Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

14968 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

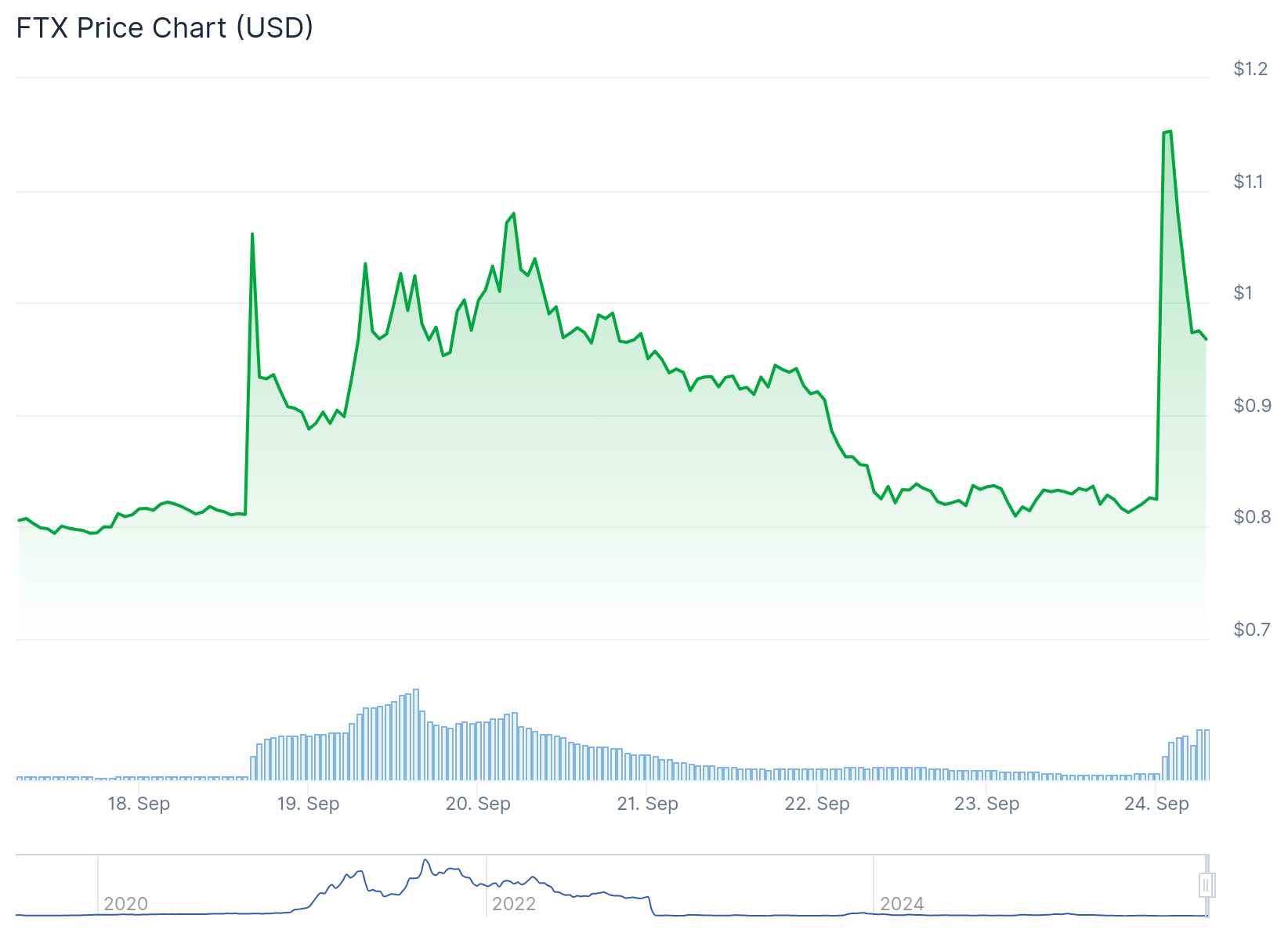

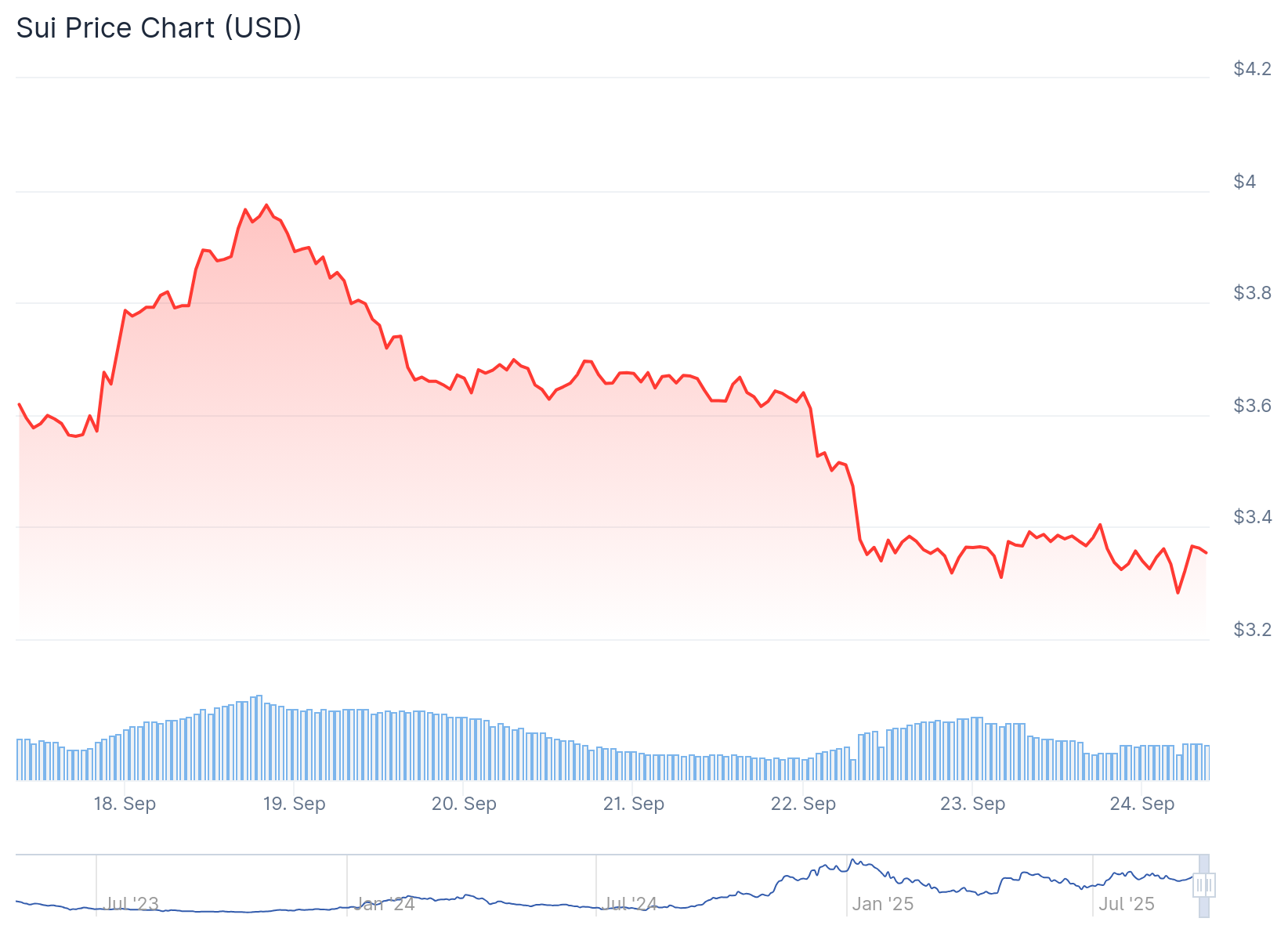

$102 Million Wiped Out In An Hour

Author: BitcoinEthereumNews

2025/09/24

Share

Recommended by active authors

Latest Articles

Unmasking the Icon: Who is Unspeakable and Inside His Million-Dollar Lifestyle

2026/02/07 00:28

Why your phone number shows as private and how to remove it

2026/02/07 00:23

What to Expect When Financing a Major Roofing Upgrade

2026/02/07 00:00

Why The Market Cap Argument For XRP Price Not Reaching $10,000 Is ‘Flawed’

2026/02/07 00:00

Zano Price Prediction: Can ZANO Coin Reach $100?

2026/02/06 23:50