Top 3 Altcoins Whales Are Buying Amid This Crypto Market Crash

The post Top 3 Altcoins Whales Are Buying Amid This Crypto Market Crash appeared first on Coinpedia Fintech News

The cryptocurrency market faced a sharp sell-off over the past three days, wiping out weeks of gains and causing panic among traders. While some analysts call this a “sell the news” reaction following the Federal Reserve’s latest meeting, historical seasonal trends suggest this dip could create the perfect setup for a strong fourth-quarter crypto rally.

Bitcoin recently saw a small retracement after market liquidations, but analysts suggest this is a healthy retest before the next upward move. Fake price drops can trigger sell orders, which may help push Bitcoin higher.

This aligns with recent market moves, where Bitcoin and Ethereum are showing expected price dips as part of a broader macro trend.

Crypto Whales Are Buying These Top Altcoins Amid Market Crash

XRP

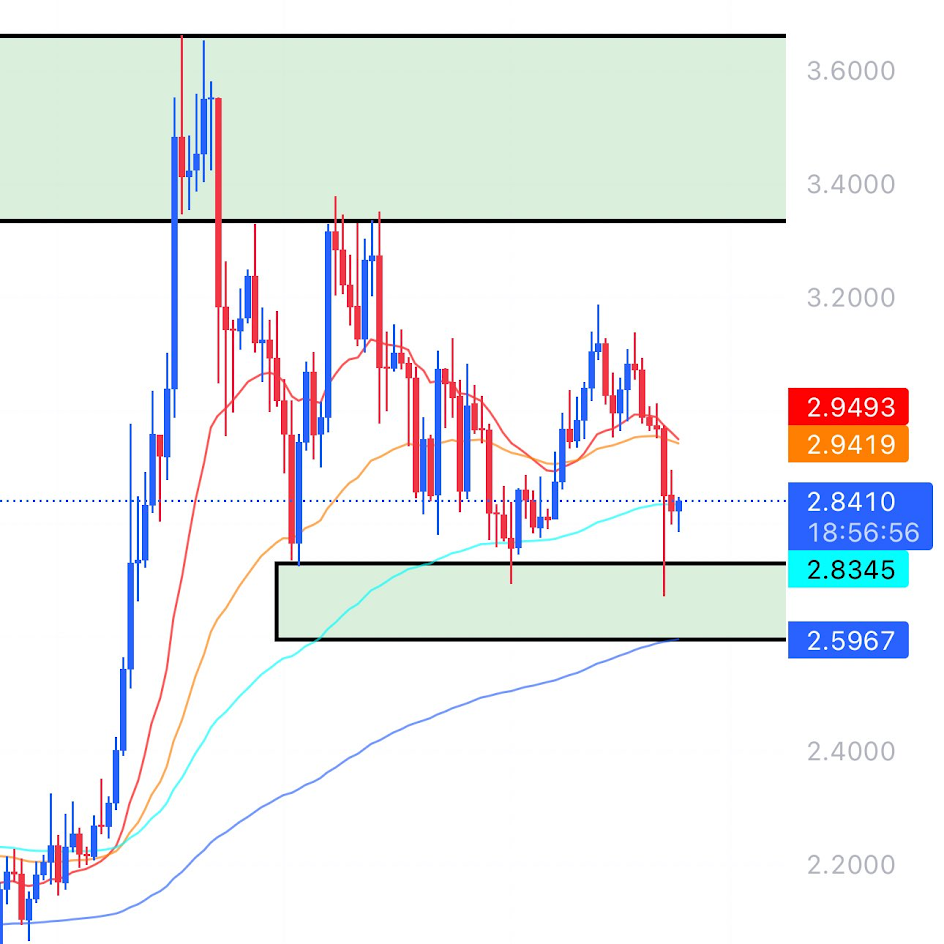

XRP has seen significant whale buying following the recent sell-off. A single 30 million XRP purchase in the last 24 hours highlights strong institutional interest in XRP. Ripple has also launched a new phase of institutional DeFi on the XRP Ledger, including over $1 billion in stablecoin volume and upcoming native lending protocols.

Traders are watching for a high-low-high pattern formation, indicating XRP could move toward $3.50 if support holds between $2.70–$2.95. XRP is emerging as a top altcoin that whales are buying after the crypto market crash, making it a key altcoin to watch in Q4 2025.

Chainlink (LINK)

Chainlink (LINK) continues to attract whales, with over 800,000 LINK purchased recently and 5.5 million LINK removed from exchanges. This shows institutional confidence in Chainlink for long-term DeFi growth.

Chainlink powers advanced DeFi applications, cross-chain compliance, and secure data connectivity. With total DeFi value locked (TVL) hitting $300 billion, LINK is positioned for further growth as more institutions integrate blockchain solutions. LINK as a must-watch altcoin for Q4 crypto gains.

Avalanche (AVAX)

Avalanche (AVAX) has shown strong performance amid recent volatility. Major corporate strategies, including Hive Miners’ $550 million AVAX investment and creation of AVAC1, indicate growing institutional adoption of Avalanche.

AVAX has surpassed Chainlink to become the 12th largest cryptocurrency, with a 30-day TVL of $417 million. AVAX could continue upward momentum, targeting around $44 after consolidating near support levels. Avalanche is now one of the top altcoins whales are accumulating after the crypto market crash.

You May Also Like

Shocking OpenVPP Partnership Claim Draws Urgent Scrutiny

SEI Technical Analysis Feb 6