Why Peter Brandt Expects Bitcoin (BTC) to Fall

Peter Brandt, a veteran trader with decades of market experience, has taken a short position in Bitcoin futures.

Despite being a long-term holder of BTC, Brandt is trading against it in the short term based on technical signals that suggest further downside is possible.

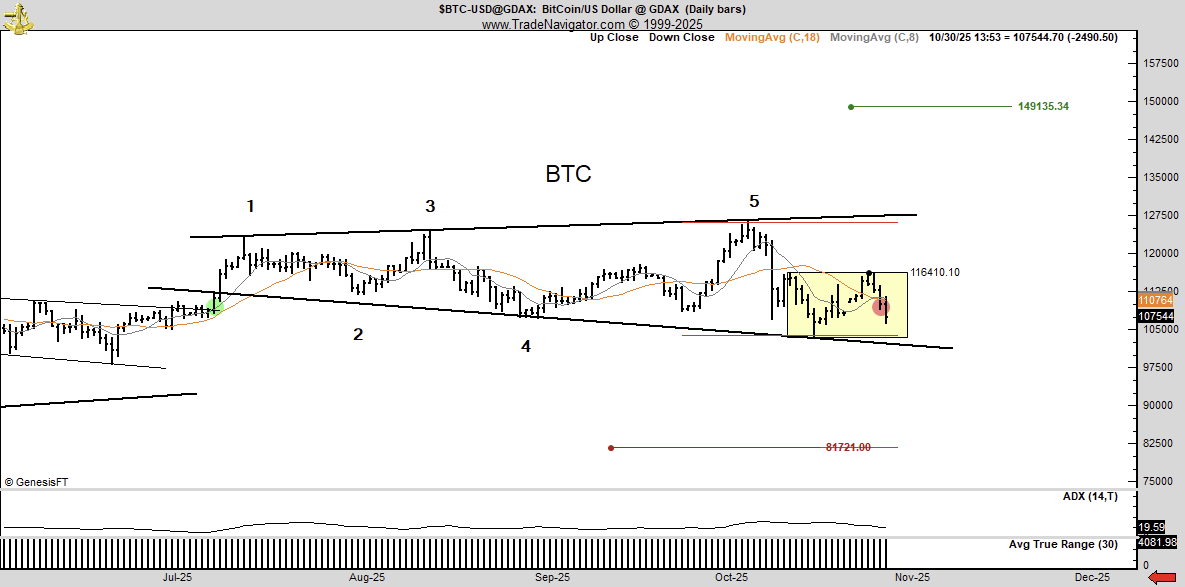

Broadening Pattern Indicates Risk

On the daily chart, Brandt identified a broadening formation, sometimes referred to as a megaphone pattern. It shows five distinct swings, with the most recent top near $126,000. After this high, Bitcoin moved into a sideways range between $106,000 and $116,000 before dipping below the south boundary.

Source: Peter Brandt/X

Source: Peter Brandt/X

Currently, the price sits near $109,500, following a 2% drop in the past day and 2% over the last week. This breakdown below the range supports Brandt’s short-term bearish setup. If the move continues, potential price levels to watch include $97,000 and $84,721.

Order Book Shows Liquidity Above Price

Market data from Coinglass shows that most of the order book liquidity sits above the current price. The $113,000 to $116,000 range contains large clusters of limit orders and stop-losses. Rekt Fencer posted,

A sudden move higher could trigger short liquidations, leading to a quick price bounce. Below current levels, there are fewer large orders, which may weaken support on the way down.

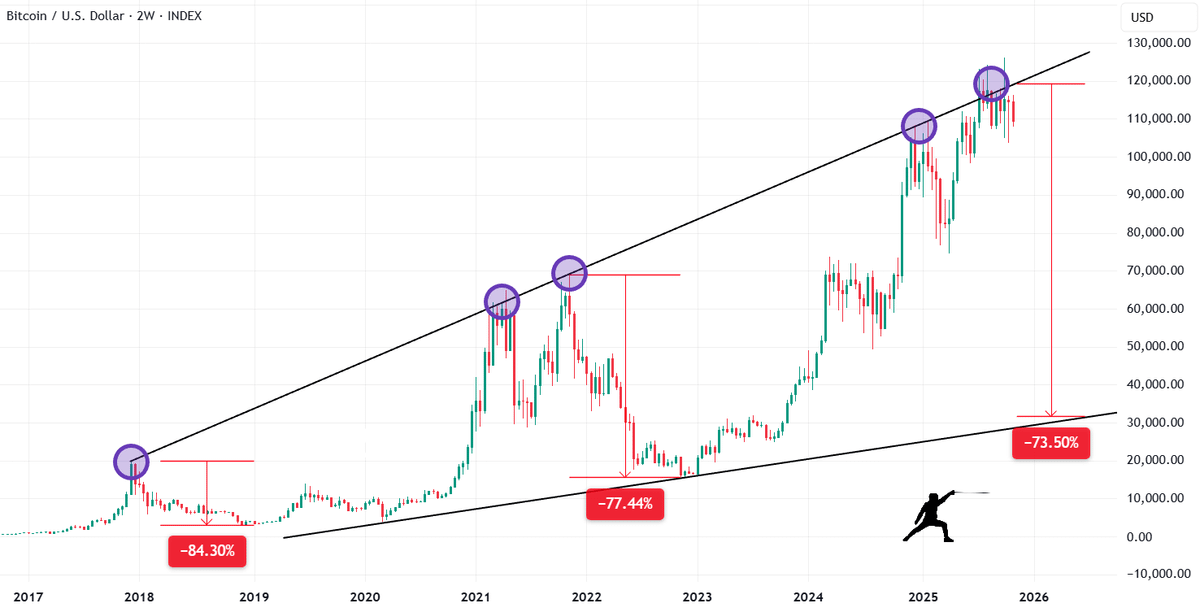

Notably, Bitcoin has a history of large drawdowns after hitting the upper boundary of its long-term trend channel. Past rejections have led to drops of 84% and 77%. The latest chart shows another rejection near this same trendline, with a potential 73% decline if the pattern holds.

Rekt Fencer added,

A move toward that zone would match the lower boundary of the multi-year channel.

Source: Rekt Fencer/X

Source: Rekt Fencer/X

Rate Cut Sparks Market Reaction

The Federal Reserve’s recent 0.25% rate cut led to volatility across markets. Bitcoin briefly fell below $108,000 after Fed Chair Jerome Powell’s comments, as traders reacted to the policy shift. Some described it as a classic “buy the rumor, sell the news” event.

Meanwhile, on-chain data shows falling BTC balances on exchanges, suggesting reduced supply. As CryptoPotato reported, large transactions above $1 million have also reached a two-month high, which points to continued interest from large holders. However, the asset remains under pressure as short-term uncertainty persists.

The post Why Peter Brandt Expects Bitcoin (BTC) to Fall appeared first on CryptoPotato.

You May Also Like

Top Old Altcoins Set to Dominance in the Next Altseason, Expert Predicts

Fed Wins Legal Battle Over Custodia Bank Master Account Denial