NFT

Share

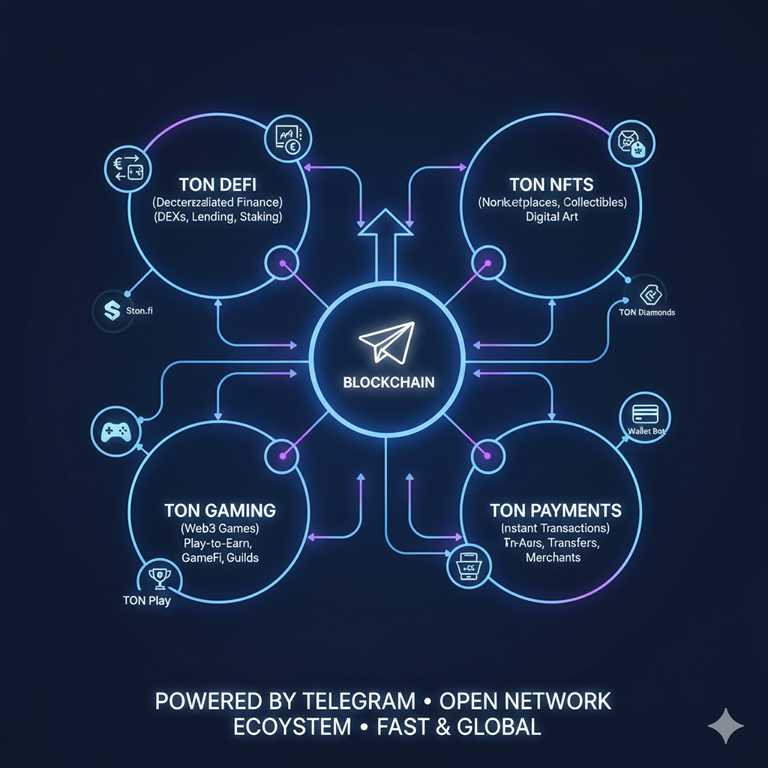

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

13053 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

US Whales Buying Bitcoin, Non-US Whales Selling – How Should This Be Interpreted? Here Are the Details

2026/02/16 02:47

Solana’s Real-World Asset Boom Explodes Past $1.66 Billion in Major Milestone for Tokenized Finance

2026/02/16 02:36

Scaramucci Says Trump Memecoins Drained Altcoin Market, Yet Sees Bitcoin Reaching $150,000 by Year-End ⋆ ZyCrypto

2026/02/16 02:02

Peso likely range-bound as market eyes BSP meet

2026/02/16 00:02

Why Spartan’s Game-Changing 33% Instant Cashback Beats BetPARX and BetRivers Promo Codes

2026/02/15 23:51