NFT

Share

NFTs are unique digital identifiers recorded on a blockchain that certify ownership and authenticity of a specific asset. Moving past the "PFP" craze, 2026 NFTs emphasize utility, representing everything from IP rights and digital fashion to RWA titles and event ticketing. This tag explores the technical standards of digital ownership, the growth of NFT marketplaces, and the integration of non-fungible tech into the broader Creator Economy and enterprise solutions.

12621 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

Quantum Computing Crypto Threat Is Exaggerated: CoinShares Reveals Sobering Reality

2026/02/09 06:25

Platinum Near $2,100 as Gold and Silver Face Speculative Exodus

2026/02/09 06:15

Tom Lee Says Ethereum’s 40% Crash Fits a Classic V-Shaped Recovery Pattern

2026/02/09 06:03

Top Crypto Presales for February Include Pepepawn and OPZ, but the Upcoming Crypto That Looks Like a True 100x Thunder Is DeepSnitch AI

2026/02/09 06:00

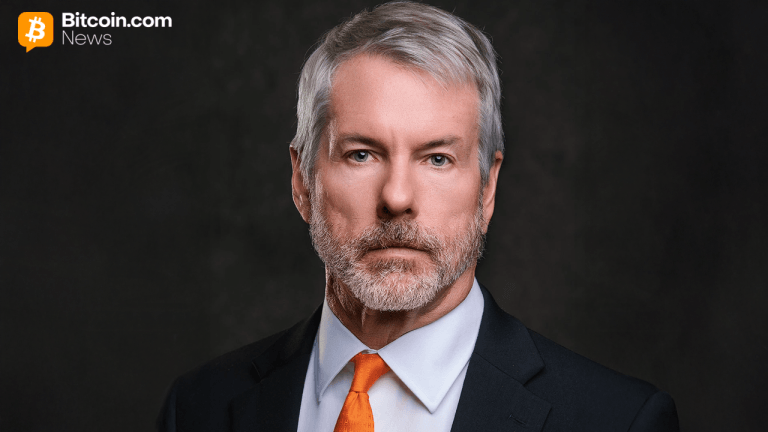

Strategy’s Boss Hints at New Bitcoin Accumulation as Unrealized Loss Tops $3.4 Billion

2026/02/09 05:30