Liquidation

Share

Liquidation occurs when a trader’s collateral is no longer sufficient to cover their leveraged position’s losses, triggering an automated forced closure by the exchange's liquidation engine. It is a critical risk-management mechanism that ensures the solvency of lending protocols and derivative platforms. In 2026, the focus has moved toward MEV-resistant liquidation models that protect users from predatory "cascades." This tag provides essential information on maintenance margins, health factors, and how to avoid liquidation in high-volatility environments.

14837 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

Recommended by active authors

Latest Articles

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

2026/02/06 17:24

The $1 Billion Liquidation: Bitcoin’s Brutal Moves

2026/02/06 17:18

PA Daily News | Bitcoin plunges 15.48% in a single day, marking the largest drop since the FTX crash; MSTR reports a net loss of $12.4 billion in Q4 2025.

2026/02/06 17:15

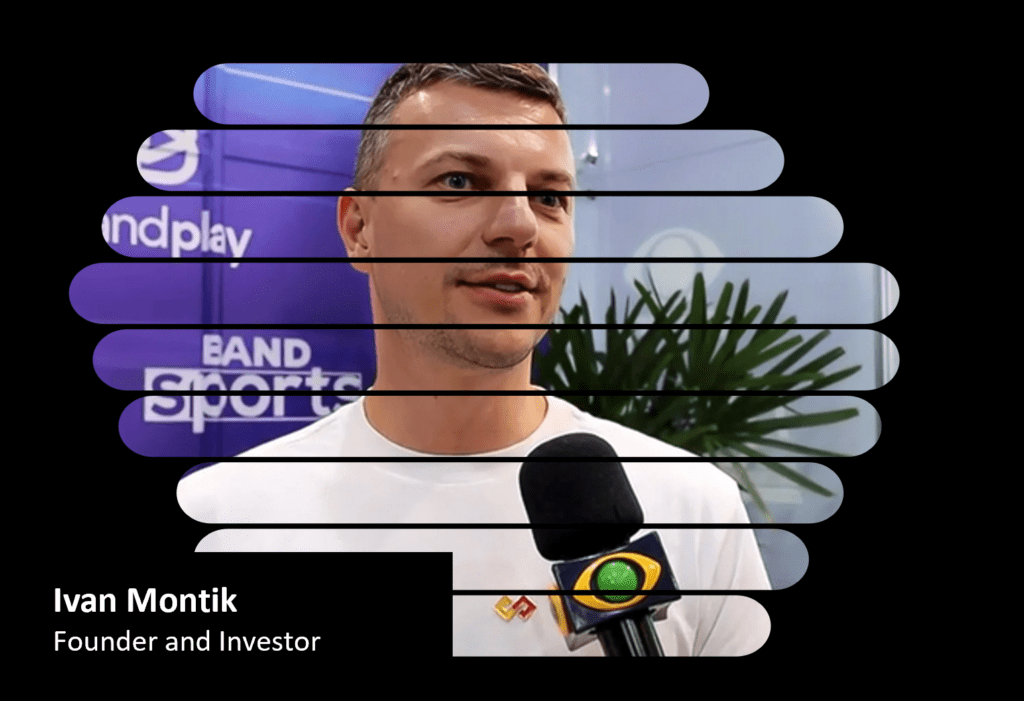

THE WIRECARD SMOKING GUN: SoftSwiss Founder Ivan Montik Unmasked in Munich Court as Judge Flattens PSP Denials

2026/02/06 17:04

What Triggered the Latest Bitcoin and Altcoin Crash?

2026/02/06 16:45