PANews reported on October 31 that, according to Cryptobriefing, Nasdaq-listed SEGG Media plans to launch a $300 million digital asset initiative, allocating 80% of the funds to a multi-asset cryptocurrency reserve. Bitcoin will be the initial focus of this reserve, providing a stable foundation, while other assets such as ETH, SOL, and ZIG will also be included to enhance yields through validator operations.PANews reported on October 31 that, according to Cryptobriefing, Nasdaq-listed SEGG Media plans to launch a $300 million digital asset initiative, allocating 80% of the funds to a multi-asset cryptocurrency reserve. Bitcoin will be the initial focus of this reserve, providing a stable foundation, while other assets such as ETH, SOL, and ZIG will also be included to enhance yields through validator operations.

SEGG Media, a publicly traded company, plans to launch a $300 million digital asset program, initially focusing on Bitcoin.

2025/10/31 10:03

PANews reported on October 31 that, according to Cryptobriefing, Nasdaq-listed SEGG Media plans to launch a $300 million digital asset initiative, allocating 80% of the funds to a multi-asset cryptocurrency reserve. Bitcoin will be the initial focus of this reserve, providing a stable foundation, while other assets such as ETH, SOL, and ZIG will also be included to enhance yields through validator operations.

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

Share Insights

You May Also Like

Legacy Meme Coin vs Meme-to-Earn Innovation – Who’s Winning the 2025 War?

Dogecoin’s Enduring Popularity Faces New Competition Dogecoin (DOGE) has defined meme coins for years, evolving from a fun internet joke into a household name with a loyal fanbase and ongoing celebrity endorsements. Trading steadily around $0.10 in 2025, Dogecoin maintains a substantial market cap and active community engagement. Its ease of use for microtransactions and […] The post Legacy Meme Coin vs Meme-to-Earn Innovation – Who’s Winning the 2025 War? appeared first on Live Bitcoin News.

Share

LiveBitcoinNews2025/09/21 22:30

Aster adjusts S3 buyback and airdrop mechanism: 50% buyback and destruction, 50% return and lock airdrop address.

PANews reported on October 31 that Aster announced an optimization of its S3 buyback and airdrop model: 50% of all S2 and S3 buybacks will be directly burned to reduce supply, while the remaining 50% will flow back to locked airdrop addresses to reduce circulation and reserve quotas for future airdrops. The official statement indicated that the buyback and burn mechanism will continue to iterate to support long-term value and sustainable growth.

Share

PANews2025/10/31 18:02

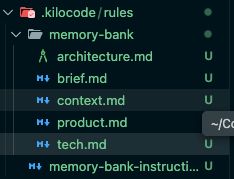

How to Understand Any Codebase in 5 Minutes Using an AI Coding Assistant

Cloned a repo with 15,000 lines of code and no docs? Don’t panic. AI coding assistants can now analyze your entire project, summarize its structure, and generate clean documentation in minutes. This guide shows how to use Kilocode’s Memory Bank to instantly understand any unfamiliar codebase — saving hours of guesswork and helping you onboard faster.

Share

Hackernoon2025/10/31 14:25