Who will win the 2028 U.S. Presidential Election? – Here are Polymarket’s top picks

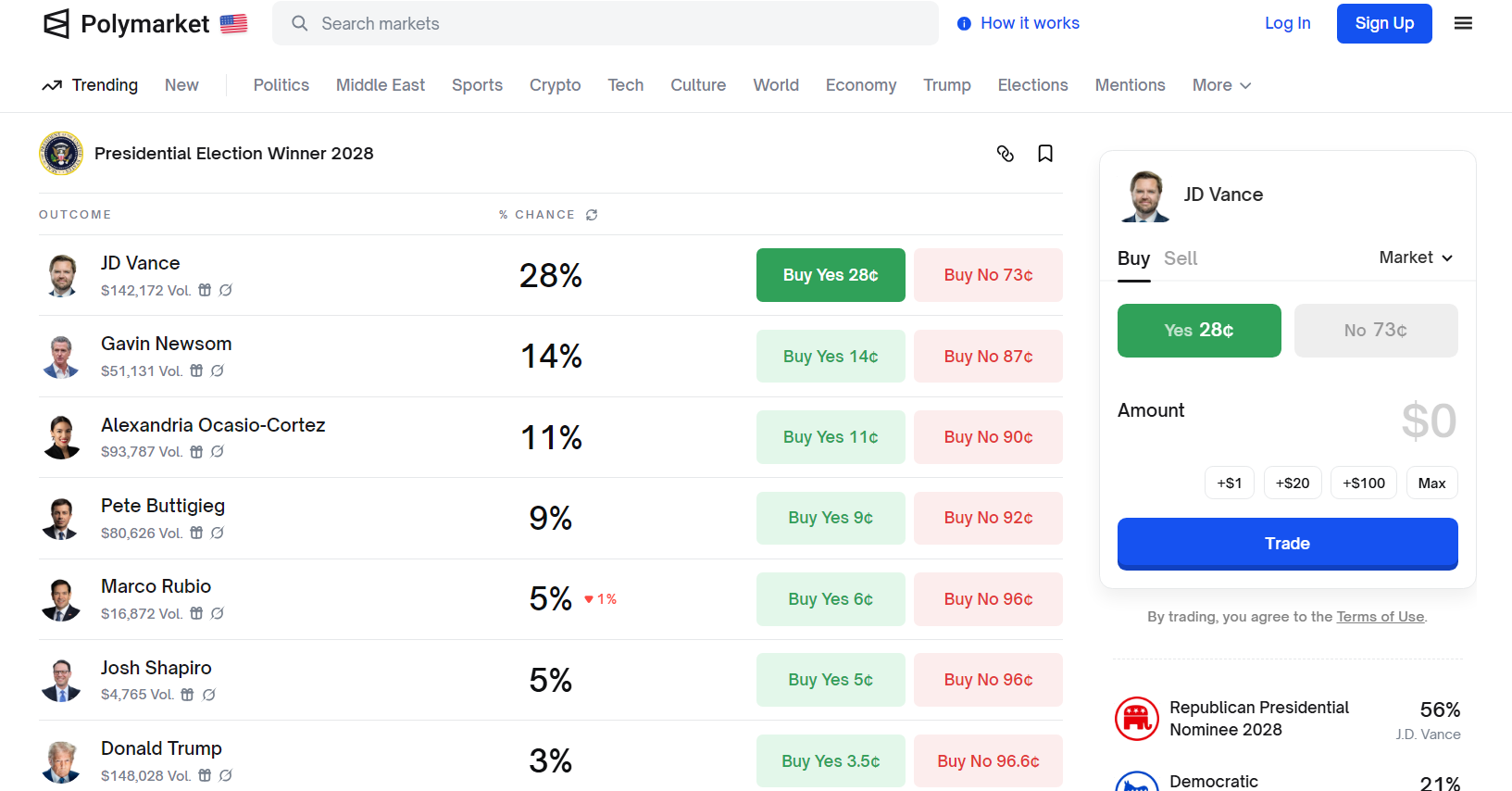

Polymarket’s betting pool on public figures that could become the next President of the United States has attracted over $1.1 million in participation. So far, J.D Vance is in the lead with 28% odds.

- J.D Vance is the most popular pick for the next U.S. President according to Polymarket bettors.

- Current President Trump only has 3% chance of winning a third term.

- In the previous election, Polymarket bets amounted to $3.6 billion in volume.

Who do you think will win the 2028 U.S. Presidential Election? As of July 23, bettors believe that the chances of Donald Trump getting voted again into office are slim. Although the current president has hinted at his ambition to extend his run as president into a third term, with him selling “Trump 2028” caps back in April, bettors are not convinced.

According to the current odds, Trump only has a 3% vote of confidence that he can secure a third term after his second run as president. This could be due to the U.S. constitution’s terms that dictate a person may only be elected into office twice.

However, this has not stopped Trump nor his supporters from aiming for another term. The release of the $50 cap comes ahead of Trump’s comments that he is “not joking” about wanting to serve a third term as U.S. president. The next U.S. Presidential Election is scheduled for November 2028, once Trump’s term ends.

Though the odds seem unlikely, Trump has gained the second largest participation volume after Vance, with $148,028 in volume.

On the other hand, Vice President J.D. Vance seems to be the popular choice for bettors who think the 40-year-old could takeover the White House after Trump steps down as President. Vance is currently in the lead with 28% odds, boasting a volume of $142,172 from investors.

Vance’s number recently dipped from 51% when the betting pool first opened on Polymarket. Since then, his numbers have dipped and remained consistent around the 25% to 28% range.

Who else is Polymarket betting on?

Aside from Trump and Vance, bettors are also setting their sights on a variety of figures from both sides of the Presidential race. In second place by total YES votes is Californian Governor and Democrat Gavin Newsom with 14% odds.

After Newsom, Alexandria Ocasio-Cortez has also become a popular pick from the Democratic side with 11% of bettors voting YES. Currently serving in the U.S. House of Representatives for New York’s 14th congressional district, Ocasio-Cortez recently received death threats and vandalism over her Israel-related vote on defense spending bill.

Other notable figures on the poll list include Former U.S. Secretary of Transportation Pete Buttigieg, Secretary of State Marco Rubio, Donald Trump Jr., and even former Trump supporter and X owner Elon Musk.

Interestingly enough, former Vice President and former 2024 Presidential candidate Kamala Harris‘ name is also in the polling. With the third largest betting volume after Trump and Vance at $117,168, Harris holds the same number of odds as her political opponent Donald Trump, at 3%.

How influential are Polymarket bets?

In the past, Polymarket bets have been used as an indicator to predict outcomes in real-world events. During the previous 2024 U.S. election, traders wagered more than $3.6 billion in betting volume alone. By the time the poll closed, Trump won the poll by a landslide vote of 99.8% and a participation volume of $1.5 billion.

In the crypto space, Polymarket has also been used to try and predict the true identity of Bitcoin (BTC) creator Satoshi Nakamoto, that traders believed would be unmasked in an HBO documentary titled “Money Electric: The Bitcoin Mystery.”

However the platform also came under fire after suffering a governance attack on their UMA oracle related to Trump’s Ukrainian mineral deal. At the time, a last-minute intervention from a whale tipped the results in their favor. This incident led to a downturn of trader trust in the platform’s final outcomes.

You May Also Like

SEC Approves Bitwise ETF, Then Immediately Reverses Decision Hours Later

Investors Rotate from Bitcoin to Ethereum and Altcoins: CryptoQuant Report