Voice Assistants: Past, Present, Future

Voice assistants used to be simple timer and weather helpers. Today they plan trips, read docs, and control your home. Tomorrow they will see the world, reason about it, and take safe actions. Here’s a quick tour.

Quick primer: types of voice assistants

Here’s a simple way to think about voice assistants. Ask four questions, then you can place almost any system on the map.

- What are they for? General helpers for everyday tasks, or purpose built bots for support lines, cars, and hotels.

- Where do they run? Cloud only, fully on device, or a hybrid that splits work across both.

- How do you talk to them? One shot commands, back and forth task completion, or agentic assistants that plan steps and call tools.

- What can they sense? Voice only, voice with a screen, or multimodal systems that combine voice with vision and direct device control.

We’ll use this simple map as we walk through the generations.

Generation 1 - Voice Assistant Pipeline Era (Past)

Think classic ASR glued to rules. You say something, the system finds speech, converts it to text, parses intent with templates, hits a hard‑coded action, then speaks back. It worked, but it was brittle and every module could fail on its own.

How it was wired

What powered it

- ASR: GMM/HMM to DNN/HMM, then CTC and RNN‑T for streaming. Plus the plumbing that matters in practice: wake word, VAD, beam search, punctuation.

- NLU: Rules and regex to statistical classifiers, then neural encoders that tolerate paraphrases. Entity resolution maps names to real contacts, products, and calendars.

- Dialog: Finite‑state flows to frame‑based, then simple learned policies. Barge‑in so users can interrupt.

- TTS: Concatenative to parametric to neural vocoders. Natural prosody, with a constant speed vs realism tradeoff.

How teams trained and served it

Why it struggled:

- Narrow intent sets. Anything off the happy path failed.

- ASR → NLU → Dialog error cascades derailed turns.

- Multiple services added hops and serialization, raising latency.

- Personalization and context lived in silos, rarely end to end.

- Multilingual and far‑field audio pushed complexity and error rates up.

- Great for timers and weather, weak for multi‑step tasks.

Generation 2 - LLM Voice Assistants with RAG and Tool Use (Present)

The center of gravity moved to large language models with strong speech frontends. Assistants now understand messy language, plan steps, call tools and APIs, and ground answers using your docs or knowledge bases.

Today’s high‑level stack

What makes it click

- Function calling: picks the right API at the right time.

- RAG: grabs fresh, relevant context so answers are grounded.

- Latency: stream ASR and TTS, prewarm tools, strict timeouts, sane fallbacks.

- Interoperability: unified home standards cut brittle adapters.

Where it still hurts:

- Long‑running and multi‑session tasks.

- Guaranteed correctness and traceability.

- Private on‑device operation for sensitive data.

- Cost and throughput at scale.

Generation 3 - Multimodal, Agentic Voice Assistants for Robotics (Future)

Next up: assistants that can see, reason, and act. Vision‑language‑action models fuse perception with planning and control. The goal is a single agent that understands a scene, checks safety, and executes steps on devices and robots.

The future architecture

What unlocks this

- Unified perception: fuse vision and audio with language for real‑world grounding.

- Skill libraries: reusable controllers for grasp, navigate, and UI/device control.

- Safety gates: simulate, check policies, then act.

- Local‑first: run core understanding on device, offload selectively.

Where it lands first: warehouses, hospitality, healthcare, and prosumer robotics. Also smarter homes that actually follow through on tasks instead of just answering questions.

Closing: the road to Jarvis

Jarvis isn’t only a brilliant voice. It is grounded perception, reliable tool use, and safe action across digital and physical spaces. We already have fast ASR, natural TTS, LLM planning, retrieval for facts, and growing device standards. What’s left is serious work on safety, evaluation, and low‑latency orchestration that scales.

Practical mindset: build assistants that do small things flawlessly, then chain them. Keep humans in the loop where stakes are high. Make privacy the default, not an afterthought. Do that, and a Jarvis‑class assistant driving a humanoid robot goes from sci‑fi to a routine launch.

You May Also Like

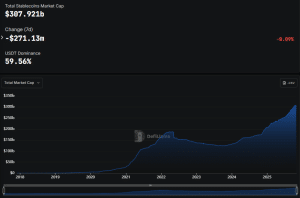

Coinbase Says Banks’ Stablecoin Fears ‘Ignore Reality,’ Dismisses Deposit Drain Concerns

Grayscale Ethereum Trusts Migrate to NYSE Arca’s Generic Listing Standards