Trump Media eyes prediction boom as family crypto fortunes balloon

As Reuters tallies over $800 million in crypto income for the Trump family in six months, Trump Media is expanding into a sector flush with speculative enthusiasm backed by billions of dollars. Truth Predict could embed financial risk-taking deeper into the Trump digital ecosystem.

- Trump Media will launch regulated prediction markets on Truth Social through Crypto.com’s CFTC-registered exchange.

- The move aligns with rapid growth in the prediction market sector, where valuations for leaders like Polymarket and Kalshi continue to soar.

- The launch coincides with a dramatic surge in Trump family crypto income, exceeding $800 million in six months.

According to a press release dated Oct. 28, Trump Media and Technology Group plans to introduce regulated prediction markets directly inside Truth Social through a partnership with Crypto.com’s CFTC-registered derivatives exchange.

Trump Media said Truth Predict will allow users to trade on outcomes tied to elections, interest rate decisions, commodity prices, and major sports events, with pricing updated in real time. Beta testing is set to begin on platform in the near future ahead of a wider U.S launch.

The company argues that integrating event contracts into a social feed creates a new category of retail speculation for a politically energized audience already accustomed to reacting to breaking news.

Trump Media audience meets a booming speculation business

Trump Media is positioning the new product as a logical extension of the behavior already thriving on its networks. Users spend their time arguing over polls, inflation prints, Fed moves, and sports outcomes. Now those opinions gain a direct economic outlet. “

Technically, the event contracts will be offered through an exclusive arrangement with Crypto.com Derivatives North America (CDNA), a CFTC-regulated exchange. This provides a federally compliant structure for the wagers, which will cover politics, economics, and sports

Trump Media is also embedding its own reward economy into the launch. Truth Social and Truth+ users earn “Truth gems” for engagement and can convert those gems into Cronos (CRO) for purchasing prediction contracts. The company has spent the past several months deepening its ties to the Cronos ecosystem. It established a CRO strategy unit aimed at managing digital assets through a proposed business combination with Yorkville Acquisition Corp.

The push comes as the prediction market sector experiences explosive growth and attracts intense investor interest. Crypto.com CEO Kris Marszalek has forecast the industry is “poised to be a multi-deca-billion dollar industry.” This optimism is reflected in the soaring valuations of sector leaders. According to Bloomberg, Polymarket is currently seeking to raise funds at a valuation of up to $15 billion, while its rival Kalshi is fielding offers valuing it at over $10 billion.

Trump’s parallel financial ecosystem flourishes

This corporate development unfolds against the backdrop of a seismic shift in the Trump family’s own financial portfolio. A recent Reuters investigation estimates the Trump family raked in more than $800 million from sales of crypto assets in the first half of 2025 alone. This staggering figure, representing cash income, underscores a dramatic pivot from traditional business ventures.

The Trumps’ first-half crypto income utterly dwarfed earnings from their legacy operations. Reuters calculations show the family earned just $33 million from golf clubs and resorts and $23 million from overseas licensing deals during the same period. The vast majority of the family’s revenue, over 90%, now flows from its crypto ventures, including hundreds of millions from sales of World Liberty Financial tokens and the Trump meme coin.

You May Also Like

Privacy is ‘Constant Battle’ Between Blockchain Stakeholders and State

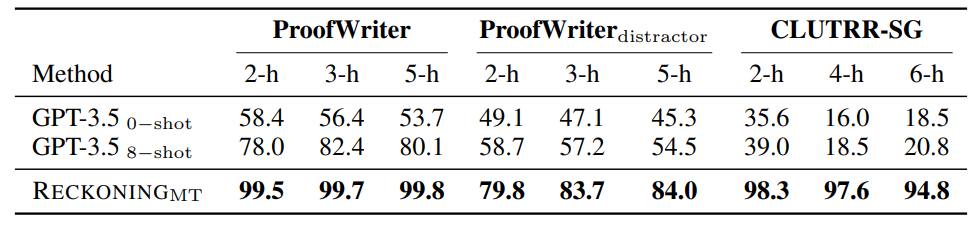

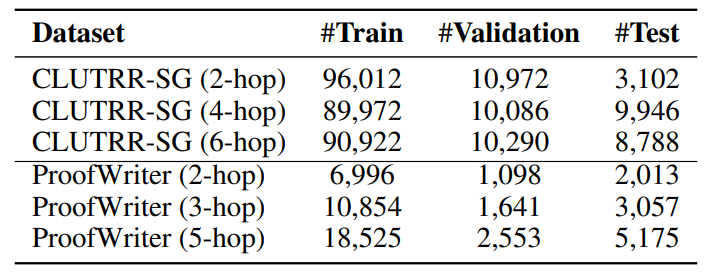

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification