The Role of Reference Points in Achieving Equilibrium Efficiency in Fair and Socially Just Economies

Table of Links

Abstract and 1. Introduction

-

A free and fair economy: definition, existence and uniqueness

2.1 A free economy

2.2 A free and fair economy

-

Equilibrium existence in a free and fair economy

3.1 A free and fair economy as a strategic form game

3.2 Existence of an equilibrium

-

Equilibrium efficiency in a free and fair economy

-

A free economy with social justice and inclusion

5.1 Equilibrium existence and efficiency in a free economy with social justice

5.2 Choosing a reference point to achieve equilibrium efficiency

-

Some applications

6.1 Teamwork: surplus distribution in a firm

6.2 Contagion and self-enforcing lockdown in a networked economy

6.3 Bias in academic publishing

6.4 Exchange economies

-

Contributions to the closely related literature

-

Conclusion and References

Appendix

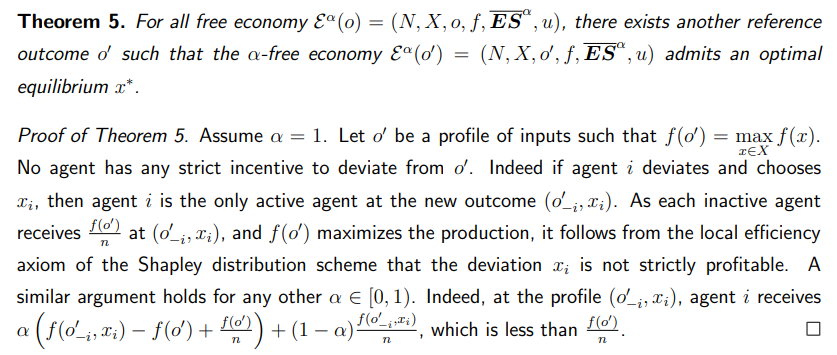

5.2 Choosing a reference point to achieve equilibrium efficiency

\

\ Remark that this result holds for any value of α, including for α = 1, which corresponds to a situation where the tax rate is zero. In that case, the entire surplus of the economy is distributed following the Shapley value. The analysis implies that if an economy can choose its reference point, it can always do so to lead to equilibrium efficiency.

\

:::info Authors:

(1) Ghislain H. Demeze-Jouatsa, Center for Mathematical Economics, University of Bielefeld (demeze jouatsa@uni-bielefeld.de);

(2) Roland Pongou, Department of Economics, University of Ottawa (rpongou@uottawa.ca);

(3) Jean-Baptiste Tondji, Department of Economics and Finance, The University of Texas Rio Grande Valley (jeanbaptiste.tondji@utrgv.edu).

:::

:::info This paper is available on arxiv under CC BY 4.0 DEED license.

:::

\

You May Also Like

The best crypto treasuries are ‘doing something hard:’ Bitwise

Investors are better off buying ETFs than buying shares in a firm that’s simply putting a crypto asset on its balance sheet, argues Bitwise’s Matt Hougan. Bitwise chief investment officer Matt Hougan says digital asset treasuries need to start taking the hard path if they want to stand out from the crowd; otherwise, investors are better off investing in crypto exchange-traded funds instead.One of the best ways to discern whether a digital asset treasury (DAT) is worth looking at is to ask the question, “Are they doing something hard?” Hougan argued in an X post on Wednesday.“Buying a crypto asset and putting it on a balance sheet today isn’t hard. It was hard at one point, but it’s not hard now. If that’s all a DAT is doing, you are better off owning an ETF. This is true even if the DAT is staking, as ETFs now stake,” he said.Read more

JANCTION Forges Alliance with AltLayer to Enhance Blockchain Interoperability