Standard Chartered sees $2T in tokenized RWAs by 2028, matching stablecoins

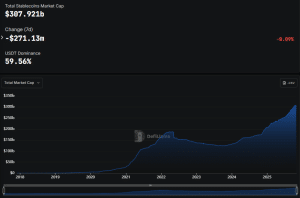

The $300 billion stablecoin market capitalization pushed DeFi into a “self-sustaining cycle” of growth, according to the investment bank’s head of research.

Tokenized real-world assets (RWAs) may reach a cumulative value of $2 trillion in the next three years as more global capital and payments migrate onto more efficient blockchain rails, according to investment bank Standard Chartered.

The bank said in a Thursday report shared with Cointelegraph that the “trustless” structure of decentralized finance (DeFi) is poised to challenge the dominance of traditional financial (TradFi) systems controlled by centralized entities.

DeFi’s growing use in payments and investments may bolster non-stablecoin tokenized RWAs to a $2 trillion market capitalization by 2028, the investment bank predicts.

Read more

You May Also Like

Coinbase Says Banks’ Stablecoin Fears ‘Ignore Reality,’ Dismisses Deposit Drain Concerns

Ethereum Name Service price prediction 2025-2031: Is ENS a good investment?