Shiba Inu Faces Utility Crisis as Shibarium TVL Remains Under $1M

TLDR

- Shibarium’s TVL has stayed below $1 million since early October 2025.

- SHIB’s total supply remains near 589 trillion tokens despite burn efforts.

- Capital is shifting from meme tokens to AI and DePIN utility projects.

- SHIB token burns surged 42,000% in 24 hours but price gains were limited.

Shiba Inu (SHIB) is struggling to recover its price due to deeper issues within its ecosystem. Despite ongoing community support, SHIB faces major challenges tied to its large token supply and weak network use. The Total Value Locked (TVL) on its layer-2 solution, Shibarium, has stayed under $1 million for weeks. Analysts say this low TVL shows that SHIB lacks utility, and without change, price goals remain out of reach.

Shibarium’s Low TVL Signals Limited Network Usage

Shibarium, SHIB’s layer-2 blockchain, was launched to bring more activity and token utility to the ecosystem. It was also designed to support token burns, helping reduce SHIB’s massive circulating supply of about 589 trillion. However, the network’s TVL has stayed below $1 million since early October 2025. According to DeFiLlama data, this is far below what is needed to create any real momentum.

A low TVL means there is very little value locked in the network’s applications, such as decentralized exchanges or lending protocols. Without strong user activity or developer interest, SHIB’s burn rate remains slow. This is creating a supply overhang that continues to weigh down the token’s price, which currently trades well below $0.0001. Analysts argue this weak burn rate is a key reason why price recovery seems unlikely in the near term.

Capital Rotation Toward Utility-Focused Sectors

The broader crypto market is now favoring projects with real-world use cases. SHIB is losing investor attention as capital flows toward utility-based sectors like artificial intelligence and decentralized physical infrastructure networks (DePIN). These sectors are offering clearer revenue paths and developer activity, drawing funds away from meme tokens.

Bitfarms and other blockchain firms have shifted toward AI-powered solutions, gaining interest from both retail and institutional investors. In contrast, SHIB’s association with its meme origins and its underused blockchain have made it harder to retain investor confidence. Analysts note that the shift in market behavior is making it more difficult for meme-based tokens to attract fresh capital unless they provide functional products.

Community Push for Token Burns Not Enough

The SHIB community remains active, continuing to support efforts to reduce token supply through burns. One recent surge in token burns reached over 42,000% in 24 hours, briefly lifting the token’s price to $0.00001062. While these events garner short-term attention, they do not address the underlying issue of weak utility.

Burn efforts tied to Shibarium rely on the network being used for real transactions, which currently is not happening at scale. The low TVL shows that the demand for network usage remains minimal, and that makes it hard to sustain meaningful deflation. Without more usage, burn rates will not rise enough to reduce the supply in a way that can move the price long-term.

Competition from Newer Projects Intensifies Pressure

Newer meme tokens are entering the market with more aggressive burn models and added features. One recent example, “Shib on Base,” gained attention for combining a 32.6% burn with AI-based functions. These projects are now viewed as more attractive by some investors seeking faster returns.

This growing competition means SHIB must adapt or risk losing more market share. Analysts stress that to remain relevant, the SHIB team needs to bring more developers and liquidity to Shibarium. Increasing the TVL is seen as the first step in proving that the chain can support real applications and become a competitive part of the Web3 space.

The post Shiba Inu Faces Utility Crisis as Shibarium TVL Remains Under $1M appeared first on CoinCentral.

You May Also Like

Privacy is ‘Constant Battle’ Between Blockchain Stakeholders and State

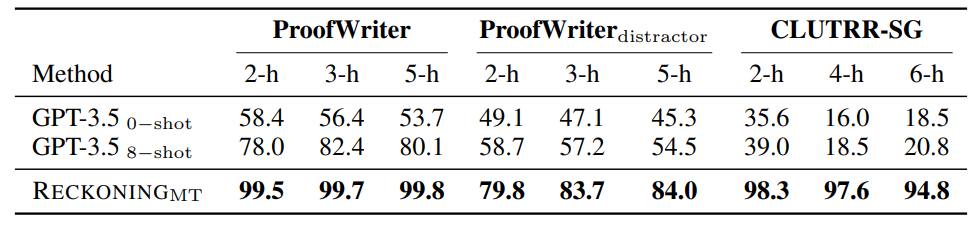

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification