Senator Claims New Bill Will Tackle Crypto ATM Scams and Market Issues

As the U.S. Senate prepares to vote on a landmark legislation to regulate the digital asset market, concerns about cryptocurrency fraud, particularly involving Bitcoin ATMs, have taken center stage. Lawmakers are now contemplating measures to curb scam activities that target vulnerable investors, especially seniors, amid ongoing debates over crypto regulation and the future of blockchain-based financial services in the United States.

- Senators Cynthia Lummis and Kirsten Gillibrand aim to address fraud associated with Bitcoin ATMs in upcoming crypto regulation laws.

- Recent reports highlight over $645,000 lost to crypto ATM scams affecting seniors, prompting calls for stricter oversight.

- The federal government has yet to implement specific laws targeting fraud at crypto kiosks, despite millions lost annually to scams.

- Legislative efforts in both the House and Senate lack comprehensive bans or regulations on crypto ATMs, though some states have enacted their own restrictions.

- Industry and local government stakeholders are actively engaging with lawmakers amid ongoing uncertainty about the final crypto regulation framework.

With the U.S. Senate expected to vote by month’s end on a significant bill aimed at clarifying digital asset regulations, attention is turning to the issue of crypto ATM fraud. Wyoming Senator Cynthia Lummis, a prominent advocate for crypto-friendly policies, recently revealed that addressing scams involving Bitcoin (BTC) ATMs is a priority within the proposed market structure legislation.

She cited a report indicating the Cheyenne police identified 50 instances of fraud, primarily victimizing seniors and totaling over $645,000. Despite these alarming figures, the federal government has yet to pass specific legislation targeting crypto kiosks. The FBI reported approximately 11,000 complaints in 2024 related to crypto ATM scams, resulting in losses exceeding $246 million.

Source: Senator Cynthia LummisThe upcoming Senate debate coincides with ongoing efforts to establish broader crypto regulation. While the House of Representatives passed the CLARITY Act in July — which notably did not address crypto kiosks and ATMs — the latest Senate draft, circulated by Republican leadership, similarly omits specific provisions on ATMs, focusing instead on standardizing the industry.

Industry experts and lawmakers continue to discuss potential regulatory measures, with some advocating for stricter oversight or outright bans on crypto kiosks to prevent fraud. Meanwhile, many states have taken independent action — with 13 enacting laws requiring transaction limits, fraud warnings, and registration of crypto ATM operators.

Though federal legislation remains in flux, these state-level regulations reflect growing concern over the menace of crypto ATM scams, especially as the crypto markets evolve and DeFi and NFTs continue to draw mainstream interest. As lawmakers deliberate, the crypto community watches closely, hopeful for clearer rules that foster responsible innovation while protecting consumers.

Not the first effort to combat crypto ATM fraud

Earlier in the year, Illinois Senator Dick Durbin introduced the Crypto ATM Fraud Prevention Act, aimed at requiring ATM operators to implement scam warnings and fraud prevention measures. Despite bipartisan support, the bill remains in committee, illustrating the ongoing challenges of crafting comprehensive federal crypto legislation.

Local governments stepping in

Absent federal regulation, several US cities have moved to restrict or ban crypto kiosks altogether. Cities like Stillwater, Minnesota, and Spokane, Washington, have implemented bans following surges in scam incidents. Others, like Grosse Pointe Farms, Michigan, have enacted daily transaction limits and required prominent warnings, even though such measures are often symbolic without overarching federal oversight.

As the debate over crypto regulation intensifies, the push for effective legal frameworks to prevent crypto ATM fraud remains a top priority for lawmakers, industry leaders, and local authorities alike.

This article was originally published as Senator Claims New Bill Will Tackle Crypto ATM Scams and Market Issues on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Ford Motor Company to Serve as Advisor to Cardano’s Decentralized Cloud Service Lagon

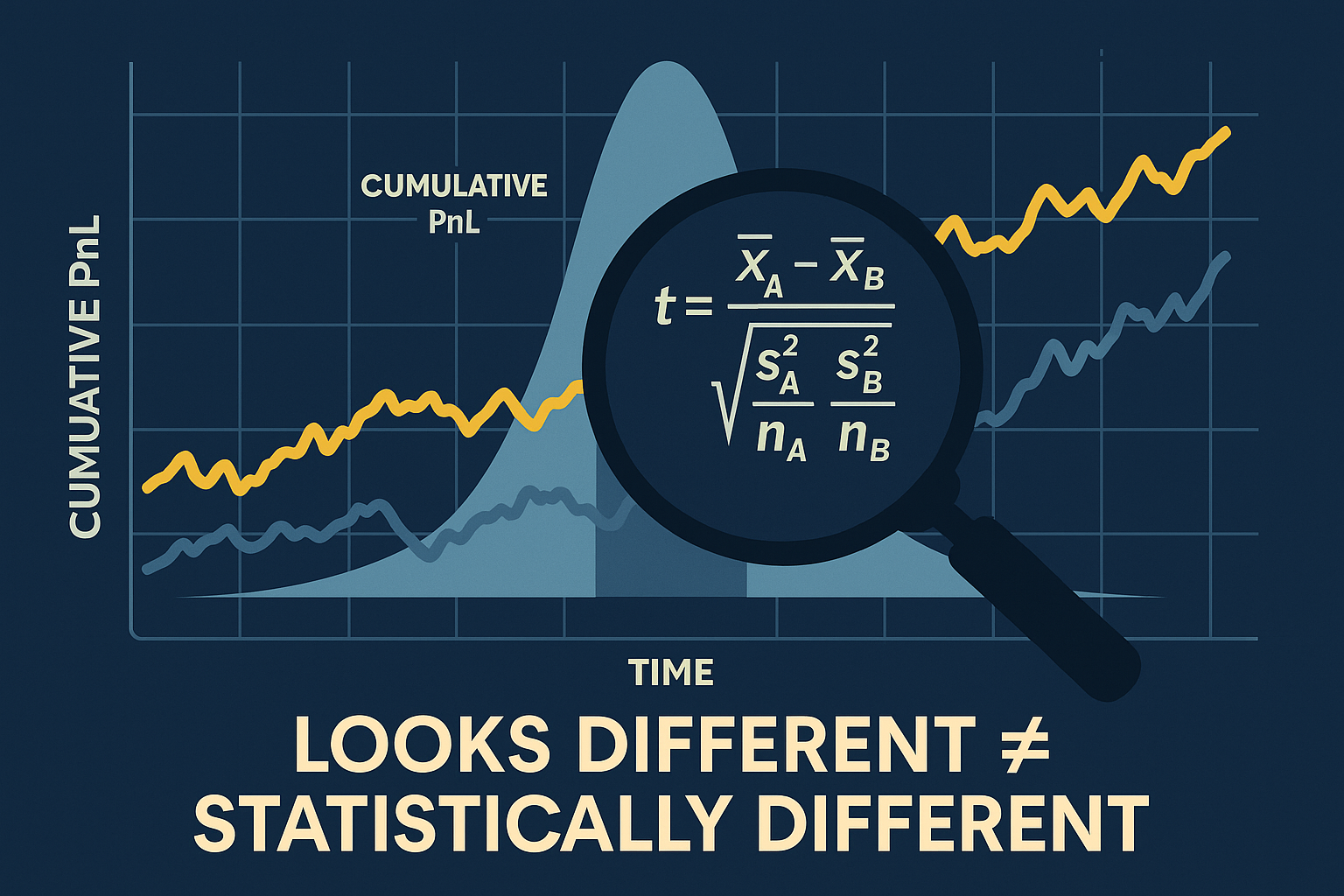

The HackerNoon Newsletter: Why You Shouldn’t Judge by PnL Alone (9/23/2025)