Paul Atkins rolls back tough enforcement to target ‘real’ fraud

Paul Atkins, the new man leading the SEC under President Donald Trump, says the agency is done hunting for technical violations and is turning its attention to actual criminals.

Speaking to the Financial Times in Paris, Atkins said the SEC would no longer treat businesses like criminals for paperwork mistakes, ripping up the aggressive approach used under Joe Biden’s pick, Gary Gensler.

“If you lie, cheat or steal your investors and steal their money like Bernie Madoff, we’ll leave you naked, homeless and without wheels,” Atkins said, quoting a sign he saw under his first SEC boss, Richard Breeden.

But that kind of firepower, he said, won’t be used on companies that just crossed some line on a technicality. “You can’t just suddenly come and bash down their door and say ‘uh-uh we caught you, you’re doing something and it’s a technical violation’.”

SEC drops crypto cases, pushes deregulation

Since January, Paul has moved fast. The SEC has been closing investigations into crypto platforms, many of which gave money to Trump’s inauguration. Trump himself is openly promoting crypto, raking in nearly $60 million from one of his ventures and blasting out memes of his $TRUMP token on social media.

Paul didn’t comment directly on the dropped cases, but he’s clearly following the president’s playbook. The change from Gary to Paul is hard to miss. Gary spent his time at the SEC chasing down violations, rolling out new rules, and dropping massive fines on firms for failing to keep proper records.

Paul sees that entire playbook as broken. “I think a lot of people rightly criticized the SEC,” he said. “Especially in more recent years it was not grounded in precedent [or] predictability. It would shoot first and then ask questions later.”

Paul wants the public to know the SEC isn’t a trapdoor anymore. “What I am trying to address is a market perception that there was a lack of due process, a lack of notice, a lack of rule of law.”

Under Gary’s watch, billions in fines hit Wall Street firms, mostly over how they handled messaging and records. Paul said that whole strategy felt like a math equation. “It became a formula: what’s your revenue, here’s your invoice.” He wants something closer to a classroom warning: “Back in school days, the teacher flapping the ruler on the table, saying ‘class, you’re out of order … you have six months to clear this up’.”

Record-keeping rules aren’t the same for everyone (brokers, advisers, others) and Paul says the SEC needs to fix that. “It’s high time that we have this systematized.”

Paul rewrites SEC crypto policy from scratch

Crypto’s where Paul is breaking hardest from the past. Gary refused to write any crypto-specific rules. He said securities law already covered tokens, and he used that to sue a long list of crypto players, calling it the “wild west.” Paul sees it differently.

He says most tokens aren’t securities and wants to write new rules that actually make sense for the tech. He’s talking about tokenized stocks and bonds that trade 24/7 on the blockchain; same rights, but faster.

“We want people not to be doing this offshore,” Paul said, pointing to the blowup of FTX in 2022. A lot of investors lost money with the Bahamas-based exchange, but the U.S.-regulated part that handled derivatives got customer money back. “It’s a really powerful example of how a good regulatory scheme can help to protect investors while something else offshore is not going to be adequate.”

Still, not everyone’s buying it. Critics say FTX showed just how reckless the crypto scene can get when no one’s watching.

Paul isn’t calling for a free-for-all. He says the SEC still needs rules to cover things like smart contracts, which settle trades instantly on-chain. He also warned the platforms already offering tokenized U.S. stock trading that they need to tread carefully. “The securities laws do apply if they’re trading securities.”

If you're reading this, you’re already ahead. Stay there with our newsletter.

You May Also Like

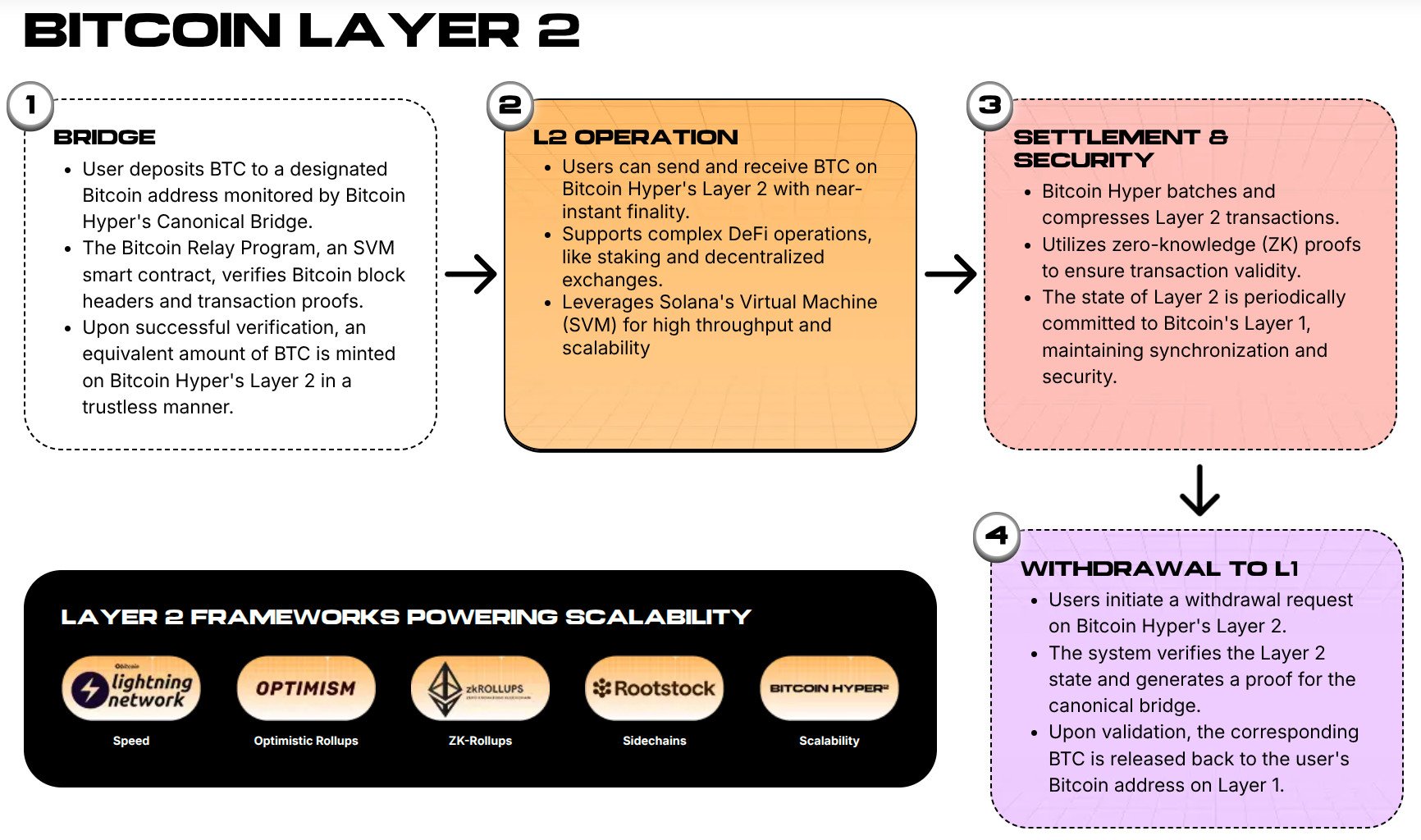

Bitcoin Hyper Presale Hits $16M As Whales Buy $64K, Is This the Next Crypto to Explode?

Recession Cancelled? Experts Weigh In