On the eve of the altcoin season: How to build a suitable altcoin season investment portfolio?

Author: cyclop

Compiled by: Tim, PANews

These are the clearest bull signals I've seen in my seven years in crypto:

- BTC is approaching its all-time high

- Retail investor interest near all-time lows

- ETH/BTC exchange rate breaks out of 3-year downtrend

- Altcoin index rebounds from range lows

Each of these factors has triggered a copycat season before. Now they are all coming together to create a resonance.

Is this really the start of the next copycat season?

I can’t believe I’m actually saying this, but I truly believe we are finally about to see an altcoin boom.

In this long thread, I will explain in detail:

- How market sentiment is changing and why it's bullish

- What changes have taken place to finally make cottage season a reality?

- Important future catalyst

- Main indicators and their predictive signals

- Which altcoins may surge?

- How to build a suitable altcoin season portfolio

- How to research projects that are difficult to implement

I have been in the crypto space for 7 years and have witnessed dozens of market structures that triggered alt seasons.

Yes, the cycle has indeed changed a bit, and I have broken down the process and reasons for the changes in detail in the referenced post.

However, I believe we are at the beginning of a more sustained altcoin season, and that this trend does not require Bitcoin to surge to $150,000 to be supported.

The narrative around BTC has fundamentally shifted, from being seen as a Ponzi scheme to: a top investment asset, macro hedge, the sixth largest asset by market cap (and endorsed by S&P), a hedge against inflation, and the go-to response for countries facing isolation or high inflation.

Bitcoin rising from its current position is no longer a necessary condition for the alt season to kick off.

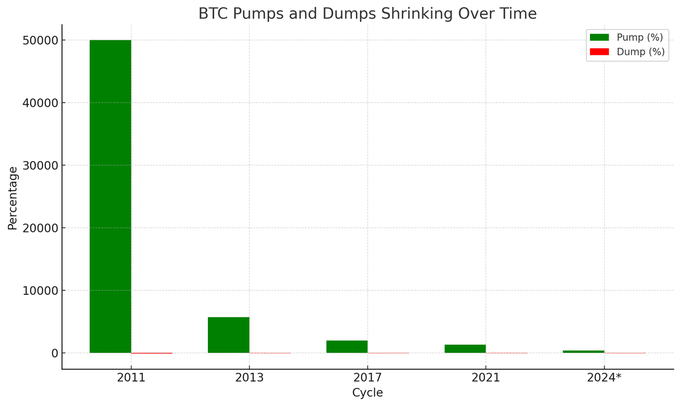

Bitcoin's surges (in percentage terms) will become smaller, as will its declines. This is how price volatility becomes when the market cap expands. Every year, it becomes more and more clear that Bitcoin is a store of value asset and less of a speculative asset.

This is where the “value” of altcoins lies.

Large-cap altcoins, especially blockchain projects, are no longer viewed as “alternatives to Bitcoin.” They are now viewed as technology companies operating within the broader Bitcoin ecosystem. Ethereum is like Nvidia, Solana is like high-performance infrastructure, and so on.

This shift in perception has occurred in past market cycles, and each time it marked the beginning of an alt season. Now, let’s talk about what actually changed to ultimately make an alt season possible.

After the Pectra upgrade, Ethereum exploded and broke the three-year downtrend in ETH/BTC. Every skeptic became a believer. Bitcoin dominance just experienced its sharpest three-day drop since November 2024. Altcoin sentiment is at rock bottom, and even after this small rally, retail participation is still at an all-time low. In my opinion, the Pectra upgrade is a game changer. It also solves the biggest obstacle facing the Ethereum-driven altseason craze: the UI and UX layer.

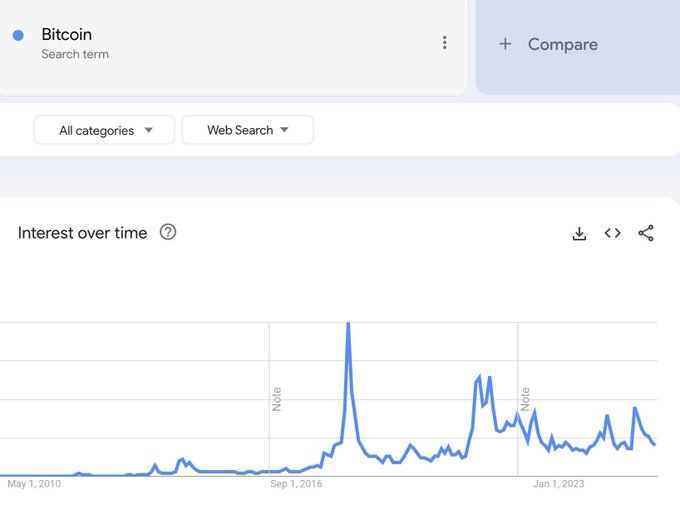

Retail Investor Index

Despite mass adoption, the retail index is currently near all-time lows. This factor has historically played a key role in the early stages of past alt seasons. Now, it is once again a positive sign. Let me elaborate:

It is important to understand a simple truth: assets peak when they are at their absolute best and bottom when they are desperate. Altcoins are still in deep trouble, but from this point on, the only way out is to climb against the trend and rebound.

Catalysts for Ethereum and other altcoins to rise? Many. Catalysts for falling? Zero, the market is extremely bearish. Even after a 2x increase from the bottom, the retail index (partial) has not yet appeared or reached the target. Finally, it has come to the point where even though the altcoin has risen 4x, it still looks like it can rise 10x again.

ETH/BTC chart

ETH/BTC has been in a downward trend for five consecutive months, which has had a negative impact on ETH. Its price and attention have both fallen, making it more difficult for altcoins to rise. After breaking through key resistance, the price of Ethereum soared, sending a strong signal for the rise of altcoins.

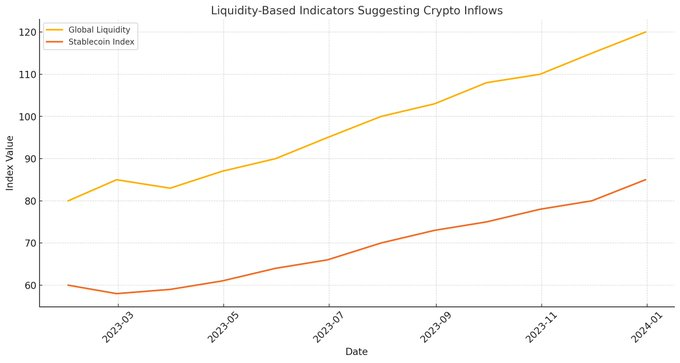

Now let’s look at some key metrics, such as:

- Global liquidity

- Stablecoin Index

- Shanzhai Season Index

All of these signals point to a potential trend reversal and an influx of liquidity into the crypto market, heralding the arrival of an alt season.

But this cottage season will be different.

In the last cycle, there were fewer altcoins, so almost all of them skyrocketed. This time, the situation is different: a severe oversupply makes it difficult for all altcoins to maintain their upward trend. It is likely that less than 10% will see a big move, and the key is how to find these potential

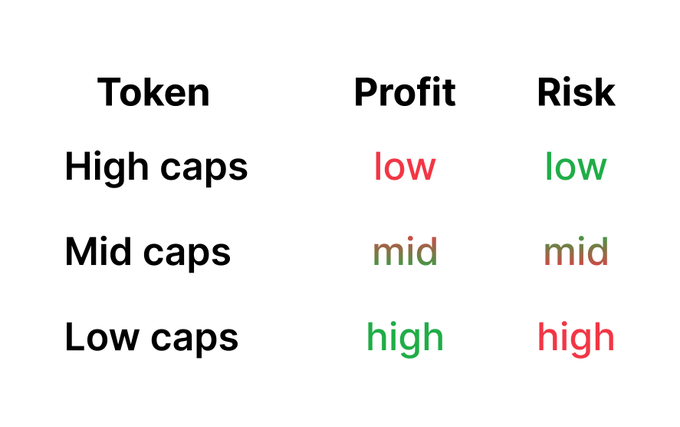

Your choice depends on the level of risk you are willing to take and the amount of profit you hope to make.

- Large-cap stocks = low profits + low risk

- Mid-cap stocks = medium profits + medium risks

- Small-cap stocks = high profits + high risks

Altcoin Research Methodology

If it is a high-market-cap utility token, rather than a newly emerged meme coin, it is best to pay attention to it, because in this case the risk of being scammed is relatively low. The token can be analyzed based on the following aspects:

- Market Cap

- Liquidity

- Trading Volume

- Listing status of centralized and decentralized exchanges

Then create a list of altcoins you like.

Follow trusted KOLs and investigate whether they follow or mention the project.

If a project is followed by many KOLs but they themselves don’t take it seriously, then it is probably garbage.

Analyze Project

Start doing detailed research on the altcoins on your list

Check the following:

1) What is the core concept of the project? Is there a market demand?

2) What is the product quality? Please check its official website and social media platforms for details.

3) Are the project team members public? Who are they? What are their backgrounds?

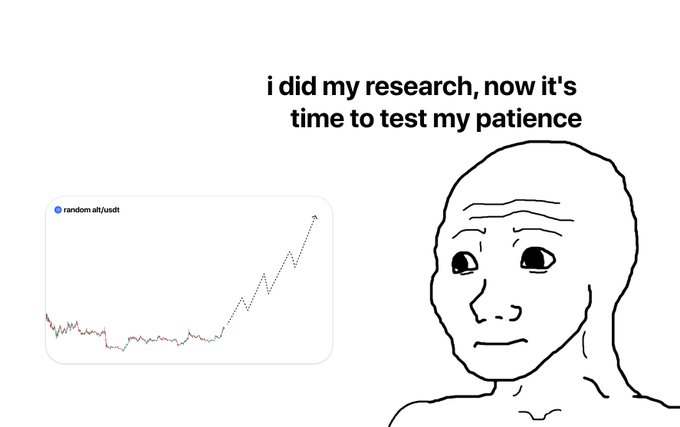

Patience + Faith = Hundredfold Return

Hundred-fold gains don’t happen in a day, a week, or even a month.

Through in-depth research of potential projects and long-term holding.

Continue to track project progress, version updates, and ecosystem activity.

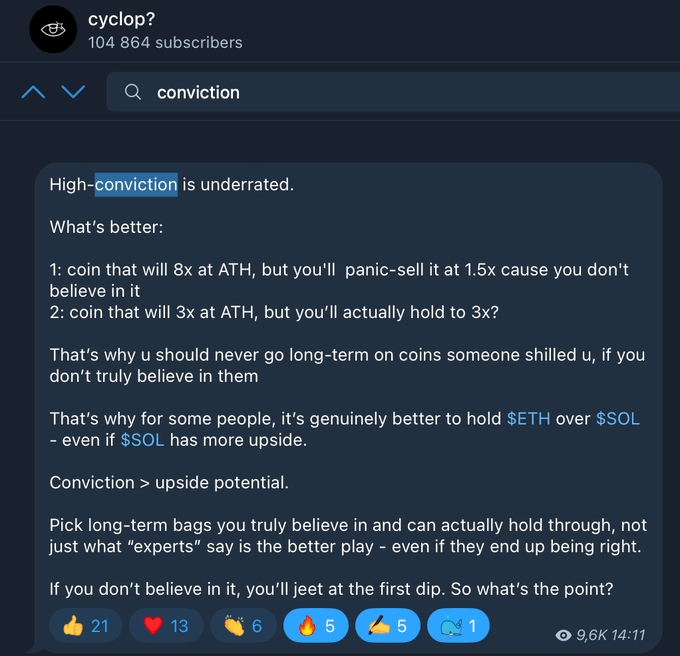

The most important principles:

Don’t over-diversify your holdings. Don’t invest based on other people’s beliefs. The screenshot below shows why.

in conclusion

Most indicators clearly indicate that the alt season is coming, and all that remains is to be fully prepared. Remember: if you believe everything, you believe nothing. Don't pick dozens of projects, pick 5 at most, and be cautious.

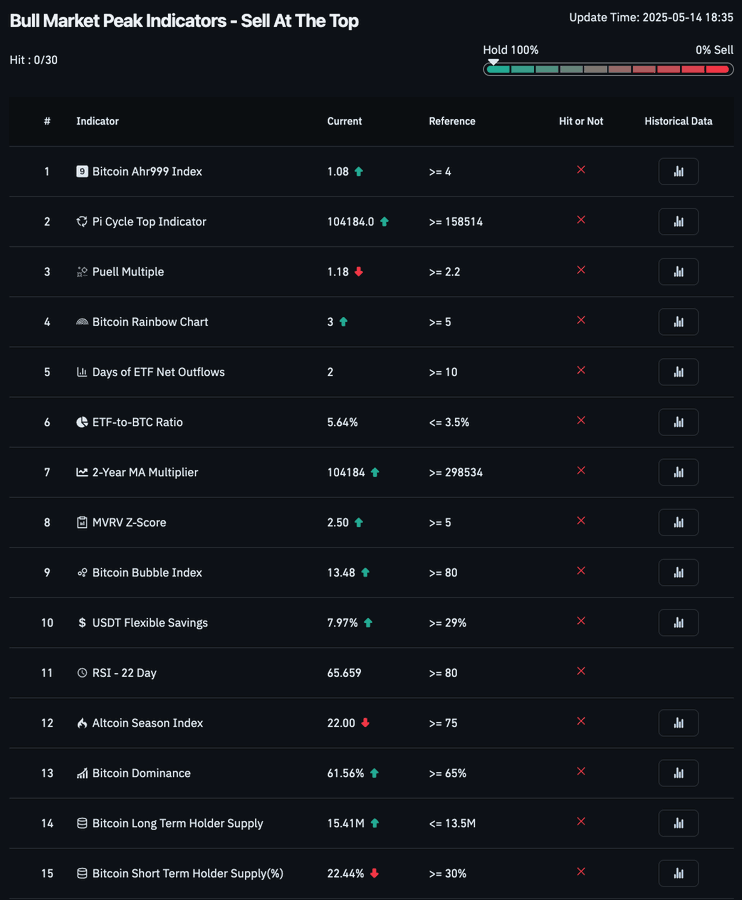

Only in this way can you capture the less than 10% of the potential altcoins, which are expected to achieve more than 100 times the return. If this is not enough, look at this picture and you will know.

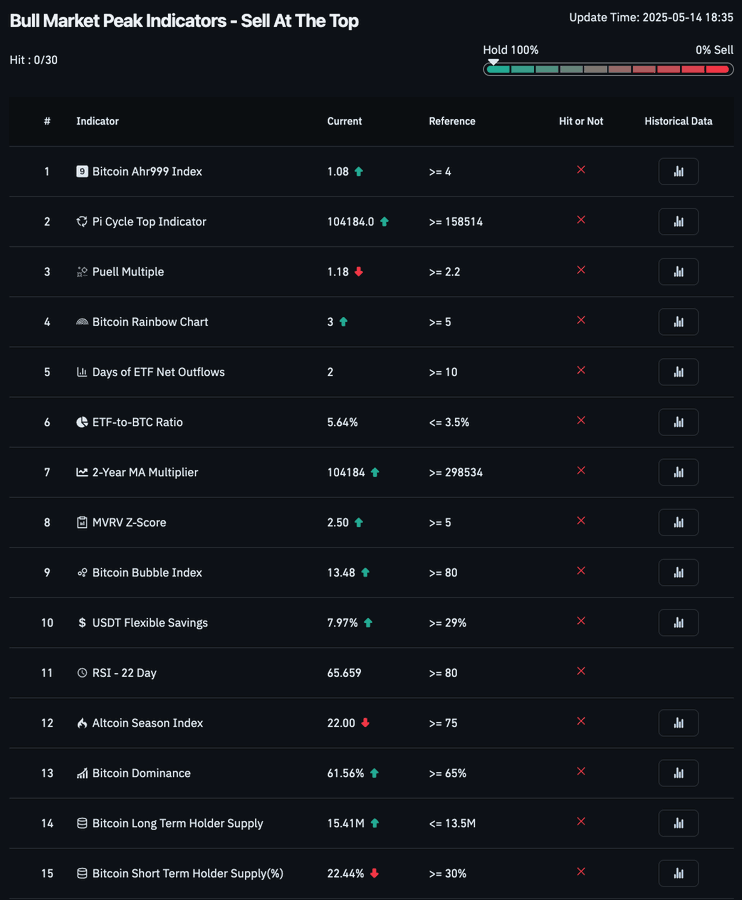

0/30 Bull Peak Indicator was triggered. Weird huh?

'

'

You May Also Like

Can Tokenization Unlock Sustainable Water? Hypercube, WaterLab, and Algorand Bet Big

Core Scientific’s Largest Active Shareholder to Vote Against CoreWeave Acquisition