Injective gains momentum as 21Shares seeks SEC approval for INJ ETF

21Shares filed for an Injective (INJ) ETF on Monday, making it the second INJ ETF under the U.S. SEC review after Canary Capital submitted its application in July. The crypto asset’s multiple ETF applications signal growing institutional interest.

In the filing, 21Shares stated that the Trust will issue common shares to track INJ’s performance, adjusted for liabilities and expenses. CF Benchmark Ltd. will calculate the Pricing Benchmark, reflecting INJ’s performance in U.S. dollars. The 21Shares team said the Trust will hold INJ to achieve its investment goals.

The team also explained that the Trust’s staking model aims to maximize the portion of its INJ available for staking while controlling for redemption and liquidity risks. It added that the model determines an equal optimal utilization rate by balancing expected yield against potential costs. However, the Staking Services Provider will have no control over the amount of INJ the Trust will stake or the timing of its staking.

21Shares aims to provide investors with direct INJ exposure

The company revealed in its October 20 filing with the U.S. SEC that the proposed INJ ETF will provide investors with direct INJ exposure. The ETF will hold physical INJ tokens in cold storage custody, and its regulated third-party custodians will be the Coinbase Custody Trust Company, LLC, and BitGo Trust Company Inc.

CoinGecko data showed that Injective’s trading volume surged 5.4% in 24 hours, hitting $79.4 million, indicating increased market activity. INJ’s price is currently $8.80, but it has ranged between $7.81 and $10.04 over the past week.

Meanwhile, staking has reportedly remained strong even after price dips, signaling steady INJ holders’ confidence in the token’s future. The crypto community has also confirmed that retail and institutional participants are closely watching the token’s development. One crypto commentator noted on X that multiple ETF filings reflect increasing trust in INJ by institutions. The ensuing discussion reveals that Injective’s ecosystem is strongly supported by its committed user base.

21Shares’ application for an INJ ETF also represents growing interest in L1 blockchains. News about the application is also boosting the token’s market visibility and sentiment. The 21Shares team believes the industry should anticipate INJ access via their INJ ETF in the coming months. However, the Trust will not invest in derivatives.

21Shares’ filing strengthens INJ’s market position

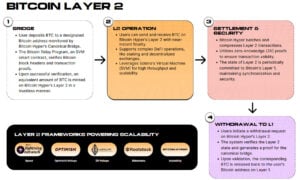

The injective blockchain is reportedly gaining attention due to its rising institutional interest and fast growth. The network’s team claims the L1 blockchain processes over 25,000 transactions per second using DPoS (delegated proof-of-stake) consensus.

The Injective Council recently held its first meeting, which focused on improving the ecosystem’s strategic goals and governance. 21Shares said its ETF filing aligns with these expansion efforts, boosting Injective’s standing among established blockchains. The ETP issuer also believes long-term demand for INJ could increase as institutions continue to explore the crypto asset.

The 21Shares team noted that investors are weighing staking opportunities as they evaluate INJ performance alongside potential ETF inflows. Meanwhile, the token’s price data and rising ETF interest signal new trading dynamics in the crypto industry. Institutional filings are also driving short-term liquidity spikes that encourage holders to increase INJ exposure or staking.

However, the team warned that no INJ exchange is immune to risks, although the Trust does not buy or sell INJ on spot markets. The closure or temporary shutdown of INJ exchanges due to business failure, fraud, government-mandated regulation, or hackers and malware can reduce confidence in the Injective network or slow down mass adoption. The failure of spot markets or any other major component of the INJ ecosystem can result in adverse effects on INJ markets and could, therefore, negatively impact the Trust’s performance.

Further, the team believes negative perceptions and customers’ manipulation of INJ spot markets may generally reduce confidence in INJ, resulting in greater INJ price volatility. The nature of the assets held at INJ spot markets also makes them appealing targets for hackers, and a few INJ spot markets have reportedly been cybercrime victims.

If you're reading this, you’re already ahead. Stay there with our newsletter.

You May Also Like

Mastercard Goes All Into Web3 Via Acquisition of Zerohash for Nearly $2B

Bitcoin Hyper Coin Review 2025 — Is it Safe to Invest in? Everything You Need to Know