From Ditch to Riches: Caterpillar’s Wild Ride to $1,000 Shares — Miss It at Your Peril!

From Ditch to Riches: Caterpillar’s Wild Ride to $1,000 Shares — Miss It at Your Peril!

Picture this: You’re cruising down a dusty backroad in your dream RV, windows down, playlist blasting-until a pothole the size of Texas sends you swerving into a ditch. Heart pounding, you call for a tow truck, cursing the crumbling roads that no budget ever seems to fix. Sound familiar? Now imagine turning that frustration into fortune: Caterpillar Inc. (CAT) builds the beasts that dig, haul, and pave our world back to glory. As governments pour trillions into infrastructure-from Biden’s bridges to Europe’s green grids-CAT’s not just surviving the boom; it’s engineering your next big win. Why care? Because in a market obsessed with flashy tech, this 100-year-old titan is quietly revving up 20%+ returns, turning everyday gripes into investor gold.

Operations: Built to Conquer Any Terrain

Caterpillar Inc. dominates as the world’s top maker of construction, mining equipment, engines, and locomotives, operating across three powerhouse segments: Construction Industries (think excavators for urban boom), Resource Industries (mining beasts), and Energy & Transportation (powering rails and grids).

With a global dealer network spanning every continent, CAT delivered $16.6 billion in Q2 2025 sales, fueled by end-user demand despite softer volumes. This resilience shines in volatile markets, where CAT’s tech-infused machines-like autonomous haulers-keep customers hooked, driving steady parts and service revenue that pads margins.

Financials: Solid Foundations Amid Headwinds

CAT’s Q2 2025 showed grit: revenues dipped 1% to $16.6 billion on pricing pressures, but adjusted EPS held at $4.72, with a 17.6% operating margin signaling efficiency. Key ratios tell the tale- ROE around 50%, debt-to-equity under 2.0, and enterprise cash at $5.4 billion-proving CAT converts cash flow into real muscle. Year-to-date, free cash flow tops $4 billion, underscoring a fortress balance sheet ready for growth bets.

Stock Surge: Riding the Infrastructure Wave

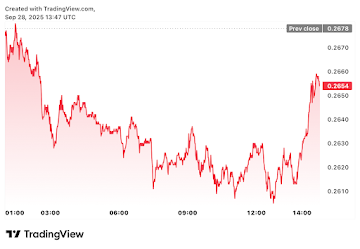

CAT shares have rocketed 29.5% YTD to $472, smashing all-time highs and outpacing the S&P 500 by double digits. This momentum stems from infrastructure tailwinds and AI-driven data center buzz, with the stock’s beta of 1.46 adding that thrilling volatility for tactical plays. At current levels, it’s trading at a forward P/E of 16 -bargain territory for a growth machine eyeing 10%+ annual returns.

The stock price has risen by more than 28 883% since the IPO.

Rivals in the Ring: CAT’s Edge Over the Pack

In the brutal arena of heavy machinery, CAT leads with a 15–20% global market share, outmuscling foes through innovation and scale. Komatsu and Volvo nip at heels in mining and construction, while Deere excels in ag-overlap gear and Cummins powers engines-yet none match CAT’s diversified empire or brand moat. CAT’s secret sauce? Superior aftermarket services, capturing 40% of revenue long-term, leaving competitors scrambling in the dust.

Competitor Comparison Table

Investment Insight

In the cutthroat world of heavy machinery, Caterpillar (CAT) stands tall, delivering robust and growing Net profitability that topped 16% in recent years. Its Gross margin, consistently strong and slightly rising, hit 36% last year, showcasing operational excellence.

Even better, as Gross profits climb, General, administrative, and commercial expenses shrink relative to Gross profit-a clear sign of disciplined resource management that creates shareholder value. For investors, CAT’s a reliable engine: steady cash flows fully fund operations, reward shareholders, and keep debt levels not just stable but declining.

Dividends are the cherry on top, with an average annual growth of 7.7% and a yield near the market average. Reinvest those dividends, and your position’s yield could outpace the market over time, making CAT a portfolio must-have. However, a word of caution: as of September 26, 2025, the stock hovers near all-time highs, with valuation metrics like P/E suggesting it’s pricey to initiate or add to positions now. Patience may unlock better entry points for this enduring powerhouse.

Investment attractiveness

Caterpillar Stock Forecast**

2025–2029 Price Targets:

*Theoretical calculation. Actual results may differ significantly due to market conditions as well as your investment strategy and tactics.

When to buy and Investment Tips

As of this writing, the stock price is hovering near its all-time high (ATH). Buying at such peaks is a no-go, even though the current price (around $464) suggests potential returns could match or exceed the stock’s historical CAGR of 23%. However, we stick to disciplined investing-avoiding overvalued highs and waiting for a correction, ideally as deep as possible, to maximize value.

Shareholder Rewards: Dividends That Dig Deep

CAT’s a Dividend Aristocrat with 31 years of hikes, boosting quarterly payouts 7% to $1.51 per share in June 2025 for a juicy 1.29% yield. Paired with aggressive buybacks-$0.8 billion in Q2 alone, from a $21.8 billion authorization -CAT returns nearly all free cash flow to owners, turning volatility into compounding gold. For yield chasers, it’s a no-brainer; for growth hunters, the EPS growth supercharges total returns.

Breaking News: Tariffs Sting, But Data Centers Sparkle

September’s spotlight hit CAT with a tariff gut-punch: CEO warnings of $1.5–1.8 billion in 2025 costs from steel/aluminum hikes, dragging shares 3.65% to $419 mid-month on inflation fears. Yet, the rebound to $472 erased it fast, turbocharged by BofA’s $517 price target upgrade, spotlighting Solar Turbines’ AI data center boom. This flip underscores CAT’s value pivot-tariffs dent short-term (subtract 2–3% EPS), but energy demand could add $2–3 billion in revenues, lifting enterprise value 10–15% by 2027.

Expert Whispers from X: The Street’s Hot Takes

Wall Street’s buzzing on X, where pros see CAT as a tariff-proof titan.

- Mohamed El-Erian (@elerianm) nailed the divergence: „Palantir monetizes AI acceleration, while Caterpillar grapples with tariffs-but this highlights dispersion favoring resilient industrials like CAT for long-haul bets.”

- BofA echo via @AIStockSavvy: „Solar Turbines is CAT’s hidden gem, powering data centers-Buy to $517.”

- Jeremy Lefebvre (@HolySmokas) adds fire: „100–200% upside in 5–10 years; revenue climbs, net income explodes-buy the dip.” These voices scream opportunity: amid noise, CAT’s fundamentals scream louder.

Conclusion

So, there you have it: Caterpillar’s not just building empires-it’s bulldozing doubts with rock-solid ops, juicy dividends, and a forecast that could make your portfolio purr like a well-oiled engine. Sure, tariffs might throw a wrench in the works, but with data centers demanding more power than a rock concert, CAT’s poised to haul in the wins. And hey, if waiting for that dip feels like watching paint dry on a backhoe, remember: patience isn’t just a virtue-it’s the turbo boost to 23% CAGR glory. Don’t get left in the dust; gear up and invest smart, or risk explaining to your grandkids why you skipped the yellow brick road to riches.

Have you already invested in this company’s stock? Leave a comment-we’re closely following this stock!

Share the article with friends and colleagues!

***

Company’s Site.

Which company’s analysis would you like to see next?

A cup of coffee from you for this excellent analysis.

Or Donate:

*Investment analysis involves scrutinizing over 50 different criteria to assess a company's ability to generate shareholder value. This comprehensive approach includes tracking revenue, profit, equity dynamics, dividend payments, cash flow, debt and financial management, stock price trends, bankruptcy risk, F-Score, and more. These metrics are consolidated into a straightforward Investment Scoreboard, which effectively helps predict future stock price movements.

**Use the price forecast to manage the risk of your investments.

Originally published at https://www.aipt.lt on September 26, 2025.

From Ditch to Riches: Caterpillar’s Wild Ride to $1,000 Shares — Miss It at Your Peril! was originally published in Coinmonks on Medium, where people are continuing the conversation by highlighting and responding to this story.

You May Also Like

Pi Network Price Prediction: Holders Are Already 85% Down As Remittix Launches New Wallet & 15% USDT Rewards

Ethereum koers toont zeldzaam dubbel koopsignaal en richt zich op $4.550