French startup Mistral AI set to double valuation to $14B with new funding

French AI startup Mistral AI is on the verge of closing $2.7 billion in funding, which would value the company at $14 billion. The financing would position the firm among the most valuable AI startups, doubling its June valuation of $7.8 billion.

Former DeepMind and Meta researchers founded the two-year-old French AI firm. It develops open-source large language models (LLMs) and Le Chat, an AI chatbot designed for the European market.

Mistral AI emerges as Europe’s fast-growing startup

Bloomberg reported that the current round of financing positions Mistral as one of Europe’s most valuable tech startups. In June, Mistral AI partnered with Nvidia to build AI data centers in France. The collaboration aimed to utilize Nvidia’s GPUs to develop the data center and expand into cloud services. Cryptopolitan reported that the French AI startup will build an AI cloud platform powered by 18,000 Nvidia GPUs and utilize its LLMs. Nvidia’s CEO Jensen Huang announced the deal during his keynote at the GTC event in Paris. He emphasized the importance of AI data centers to Europe’s technology future.

The latest funding round marks Mistral’s most significant raise since mid-last year, following a growing trend of multiple investments in European AI startups. In Q1 of 2025, European AI funding increased by 55% compared to last year. Also, during the same quarter, 12 startups graduated to unicorn companies worth over $1 billion.

AI Magazine featured the top ten startups in Europe in April. The list reflected the region’s growing AI ecosystem. It highlighted Aleph Alpha of Germany, which develops multilingual LLMs, and TechWolf of Belgium, which focuses on AI-powered HR solutions. It also listed Mistral’s AI model, Mistral Large, available on Snowflake Data Cloud for customers to use with their enterprise data to build applications quickly.

Apple held internal talks with Mistral AI and Perplexity about acquiring the technology to strengthen its Siri AI platform. CEO Tim Cook pointed out the firm plans a sizable acquisition to accelerate the development of on-device and cloud AI.

Mistral AI rises from $2.7B to $14B in just two years

Mistral’s value has grown fast over the past two years. In 2023, they received funding valued at $2.7 billion. Last month, Mistral AI sought to raise $1 billion in fresh financing, aiming for a $10 billion valuation. Abu Dhabi’s MGX backed the funding round to support the commercial rollout of its AI chatbot Le Chat and build new LLMs. Now, the new $14 billion valuation shows how much interest and demand there is for Mistral’s AI technology on a global scale.

The French AI startup has built its AI models around an open-source approach, setting it apart from many industry rivals. The firm releases its LLMs to everyone. Developers and businesses worldwide can explore and build upon the technology without restrictive licensing requirements. The firm aims to democratize access to AI tools and ensure companies can integrate the system to local needs.

Rival Chinese firm DeepSeeK adopted a similar mechanism, releasing its models open to the public. Mistral’s CEO, Arthur Mensch, acknowledged DeepSeek’s decision to open-source in February. In his interview with Business Insider, Mensch mentioned that he views DeepSeek as the Mistral of China. He added that it is a great moment to open-source their models and allow participation to build on top of each other.

If you're reading this, you’re already ahead. Stay there with our newsletter.

You May Also Like

Mastercard Goes All Into Web3 Via Acquisition of Zerohash for Nearly $2B

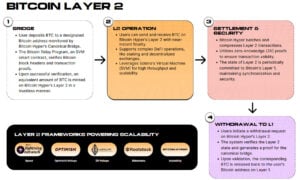

Bitcoin Hyper Coin Review 2025 — Is it Safe to Invest in? Everything You Need to Know