Flora Growth Unveils $401M Treasury to Power 0G AI Blockchain Innovation

Nasdaq-listed cannabis company Flora Growth has announced a significant $401 million treasury initiative aimed at bolstering its involvement in blockchain and AI innovation. The move centers around a private placement deal that combines $35 million in cash with $366 million in digital assets, primarily issued in Zero Gravity (0G) tokens. As part of this strategic shift, Flora plans to rebrand itself as ZeroStack, while maintaining its NASDAQ ticker symbol, FLGC, according to an official statement.

The deal was led by Solana (SOL) treasury firm DeFi Development Corp. (DFDV), with participation from Hexstone Capital, Carlsberg SE Asia PTE Ltd., Dao5, Abstract Ventures, and Dispersion Capital. DFDV’s CEO, Joseph Onorati, expressed enthusiasm about the collaboration, highlighting the potential to innovate within decentralized AI infrastructure by integrating 0G and Solana’s blockchain ecosystem. Flora will also hold a segment of its treasury assets in SOL tokens, reinforcing its strategic partnership within the Solana network.

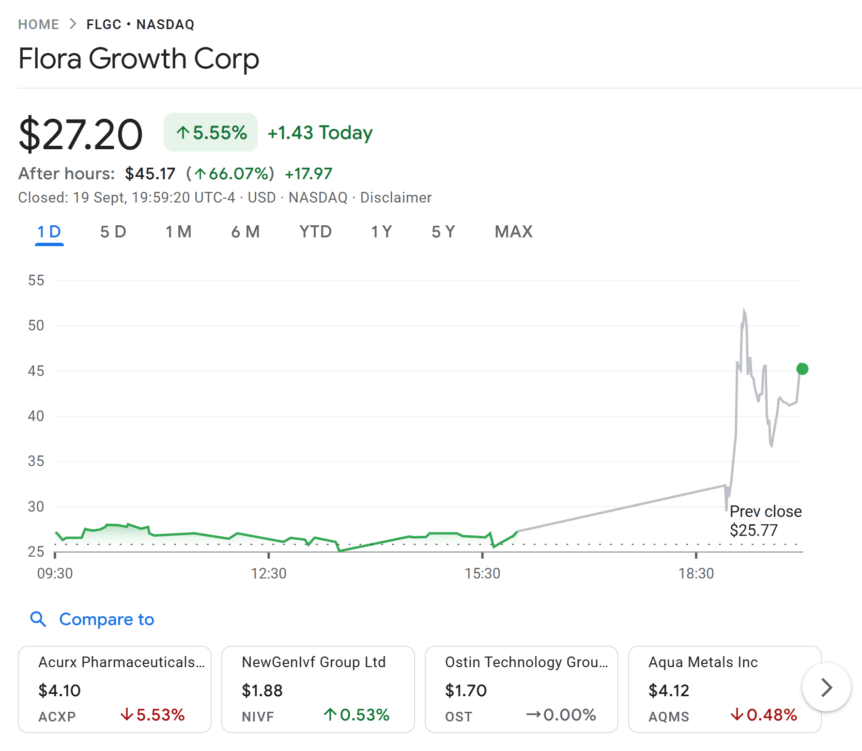

Flora Growth shares surged 5% after the announcement. Source: Google Finance

Flora Growth shares surged 5% after the announcement. Source: Google Finance

Zero Gravity leads a groundbreaking AI endeavor

The funds aim to expand 0G’s advanced AI infrastructure, which has demonstrated the capability to train a 107-billion-parameter model using distributed clusters—surpassing benchmarks set by industry giants like Google. The project claims an efficiency improvement of 357 times over conventional distributed AI frameworks, marking a significant technological breakthrough.

Daniel Reis-Faria, incoming CEO of 0G, emphasized that this treasury infusion provides institutional investors an opportunity to gain exposure to a transparent, privacy-focused AI infrastructure that is both verifiable and innovative. The transaction is expected to close by September 26, subject to shareholder approval, with some investors receiving pre-funded warrants linked to their holdings of 0G tokens.

Market insights: Challenges for digital asset treasuries

In related news, Standard Chartered warned of mounting risks within the digital asset treasury sector, citing a sharp decline in market net asset values (mNAVs). Once buoyed by successful Bitcoin accumulation strategies, many firms now face reduced valuations, limiting their ability to issue new shares or expand crypto holdings. As mNAVs fall below the critical threshold of 1, access to low-cost capital diminishes, stalling growth and leading to potential sector consolidation.

The bank forecasts that larger, well-capitalized players such as Strategy and Bitmine are positioned to emerge stronger from this shakeout, while smaller firms with depressed valuations may become acquisition targets, reshaping the landscape of crypto markets and DeFi investments.

This article was originally published as Flora Growth Unveils $401M Treasury to Power 0G AI Blockchain Innovation on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Polygon Tops RWA Rankings With $1.1B in Tokenized Assets

AVAX, SUI & ZX: Q4 Outlook for September’s Fastest Growing Altcoins