Fed Lowers Rates By 25bps: How Bitcoin And Crypto Prices Responded And What’s Next

The Federal Reserve (Fed) announced its first interest rate cut of the year, leading to an immediate reaction in the cryptocurrency market. Bitcoin (BTC) experienced a notable decline, dropping below the $115,000 threshold shortly after the announcement.

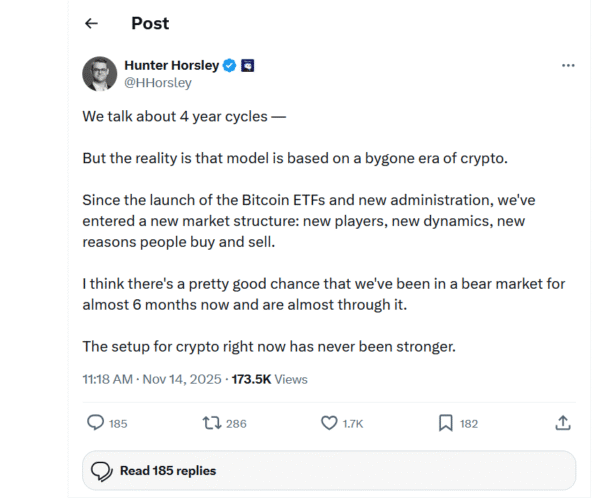

Expert Predicts Crypto Rally

Fed Chair Jerome Powell addressed the current economic landscape, noting that while inflation has eased significantly from its mid-2022 highs, it still remains elevated compared to the Fed’s long-term target of 2%.

He also pointed out that there are increasing downside risks to employment in what he described as a less dynamic labor market. Looking ahead, Powell indicated that the Fed anticipates interest rates will settle between 3.5% and 3.75% by the end of 2025, a reduction of 0.50% from current levels.

Additionally, he mentioned that the Federal Open Market Committee (FOMC) plans to implement two more rate cuts within this year.

Market expert Lark Davis took to social media platform X (formerly Twitter) to share his thoughts on the implications of the rate cuts. He stated that the easing of interest rates suggests that “the money printer is getting turned ON,” forecasting that cheaper capital would soon flow into the crypto market.

Although Davis acknowledged the possibility of short-term dips, as evidenced by Bitcoin’s performance following the rate cut decision, he remains optimistic about a medium- to long-term rally for cryptocurrencies.

Will Rate Cuts Propel Bitcoin And Ethereum To New Heights Again?

Analysts at The Bull Theory supported this outlook in a previous analysis, explaining how lower interest rates enhance liquidity. They noted that reduced borrowing costs encourage both businesses and consumers to spend more, ultimately boosting economic activity.

Drawing parallels to late 2024, after the Fed had begun its rate cuts, they highlighted how Bitcoin reached new all-time highs while Ethereum (ETH) surged past $4,000. This previous rally lasted approximately two months, suggesting that the current environment might lead to similar outcomes.

Despite the immediate volatility in the crypto markets, the analysts predict that smart money and market whales may attempt to shake out retail investors in the short term. However, they remain confident that, within a three- to six-month window, Bitcoin and other altcoins are likely to trade at much higher levels.

Featured image from DALL-E, chart from TradingView.com

You May Also Like

What is Play-to-Earn Gaming? Unlocking New Possibilities

Tether Assists Global Law Enforcement in $12M Crypto Crime Bust