Exclusive interview with Smokey The Bera, co-founder of Berachain: How the innovative PoL public chain solves the liquidity problem and may be launched in a few months

Author: Weilin, PANews

In the first half of this year, Berachain, a bear-themed, EVM-compatible high-performance L1 public chain, attracted widespread market attention. On April 12, Berachain completed a $100 million Series B financing led by Brevan Howard Digital and Framework Ventures, which was about 45% higher than the previously reported amount.

In response to the security and liquidity trade-off issue of the Proof of Stake blockchain, Berachain's Proof of Liquidity consensus incentivizes on-chain liquidity through the emission and bribery mechanism of the token BGT, avoids the liquidity ghost town dilemma faced by existing public chains, and promotes the prosperity of the on-chain DeFi ecosystem and trading activities.

Currently, Berachain’s ecosystem has more than 200 projects. Berachain plans to use the new capital raised to expand its business in Hong Kong, Singapore, Southeast Asia, Latin America and Africa. On June 13, Berachain released the testnet V2 version, introducing BeaconKit to solve the limitations brought by the CometBFT consensus.

Recently, PANews interviewed Smokey The Bera, co-founder of Berachain, to unravel the background of the establishment of this anonymous project, Berachain's PoL mechanism, the latest developments, and answered widely concerned topics such as airdrop expectations and new opportunities in the DeFi field.

An edited transcript of the conversation follows.

PANews: The establishment of Berachain can be traced back to a meme chain that originated from the Smoking Bear NFT in 2021. Can you introduce the background of the establishment of Berachain?

Smokey The Bera: The term "meme chain" may not be accurate. My co-founder Papa and I have been active in the crypto space for almost a decade. In the summer of 2021, more interesting NFT projects emerged, such as Parallel TCG and its ecosystem, which actually had the empowerment of NFTs. For fun, we decided to do a small NFT project, 100 Smokey Bear NFTs. While doing community growth, we quickly launched these NFTs in some very DeFi groups at a price of about 0.069 ETH. They are ecosystems like Frax, Olympus, Curve, Rari, and Yearn.

In this way, we built a very DeFi-native community of NFT holders. Then we had these NFTs rebase or increase the supply. If a user owned one of the first collection series NFTs, they would receive an airdrop of the second collection series NFT for free. The second batch of NFTs would have slightly more, like 10 or 15 more, for people to buy. If you owned the first NFT, or the second batch NFT, you could get an airdrop of the third batch NFT for free. We grew this community and eventually had thousands of users.

When we talked to them about the problems they were facing in the on-chain world, one of the biggest problems we realized was that there was a fundamental inconsistency in the way Proof of Stake was constructed. If you had a fund, like 32 ETH, you could choose to stake it to a validator and contribute to network security, or provide liquidity in a decentralized exchange (DEX) or lending market and contribute to on-chain liquidity. The problem in the market at the time was that liquidity and security were very opposite when building blockchains, which didn't make sense in our opinion because for an ecosystem to really thrive and for a blockchain to be useful, you need both liquidity and security.

The idea is, can we build a chain where the users and the protocol itself can align incentives between its security and the liquidity of the built-in network, and use this to help the applications on the chain. That's the overall background of Berachain. We have always tried to keep it fun and lighthearted. So some people may choose to view it as a meme chain. In fact, we view it as a very interesting economic experiment.

PANews: Why did Berachain choose to be anonymous as the underlying public chain? Why did you choose the bear as the main image (after all, no one likes the "bear market")?

Smokey The Bera: My co-founder Papa and I have all built and helped grow companies before. We were VCs and were very lucky to have done relatively well in the past. We are Canadians living in the United States, where securities laws are much stricter. On the one hand, there is the issue of legal security, as we are already public with large investors, and the same is true for exchanges. Even though everything we do is extremely compliant, it is still a place where laws are full of rapid changes.

On the other hand, when thinking about Berachain itself, we are a very crypto-native project. Most of the founding team members, as well as most of the contributors, have many years of experience in this space and have helped build some of the earliest protocols. I think the culture of anonymity is very prevalent among crypto-native users because in crypto, anonymity is fundamental. For example, if you create a wallet, no one knows who that wallet belongs to. In fact, people judge you more based on your abilities than your past achievements or lack thereof. It might be more beneficial if we were not anonymous. We hope to be able to frame it from a cultural significance perspective.

Beyond that, in the 2021 cycle, we've seen that some of the best developers we know are actually people in their 30s and 40s with wives and kids who may have day jobs at big companies like Facebook, Apple, Netflix, Google, but they spend time developing after get off work. And our choice to be anonymous actually makes it easier to provide a platform for these people to still develop great applications without having to take huge career risks, etc., which they may not be ready to face (joining Web3 full-time).

About the bear, just because this chain originated from the NFT project. The bear is for fun, and now I think it's a fun meme.

PANews: One of Berachain’s core mechanisms is Proof of Liquidity. How does it help dApps better utilize on-chain resources?

Smokey The Bera: In traditional Proof of Stake chains, validators get the majority of the block rewards, which is great. They play an important role in ensuring the security of the network. But in most cases, with the exception of maybe educational content or blog posts, etc., validators are not necessarily the ones who build applications and do the work that will attract the next 100,000, 1 million or more users to join. In most cases, it comes down to power users and applications that actually help expand the ecosystem. They are able to attract more people to join the chain.

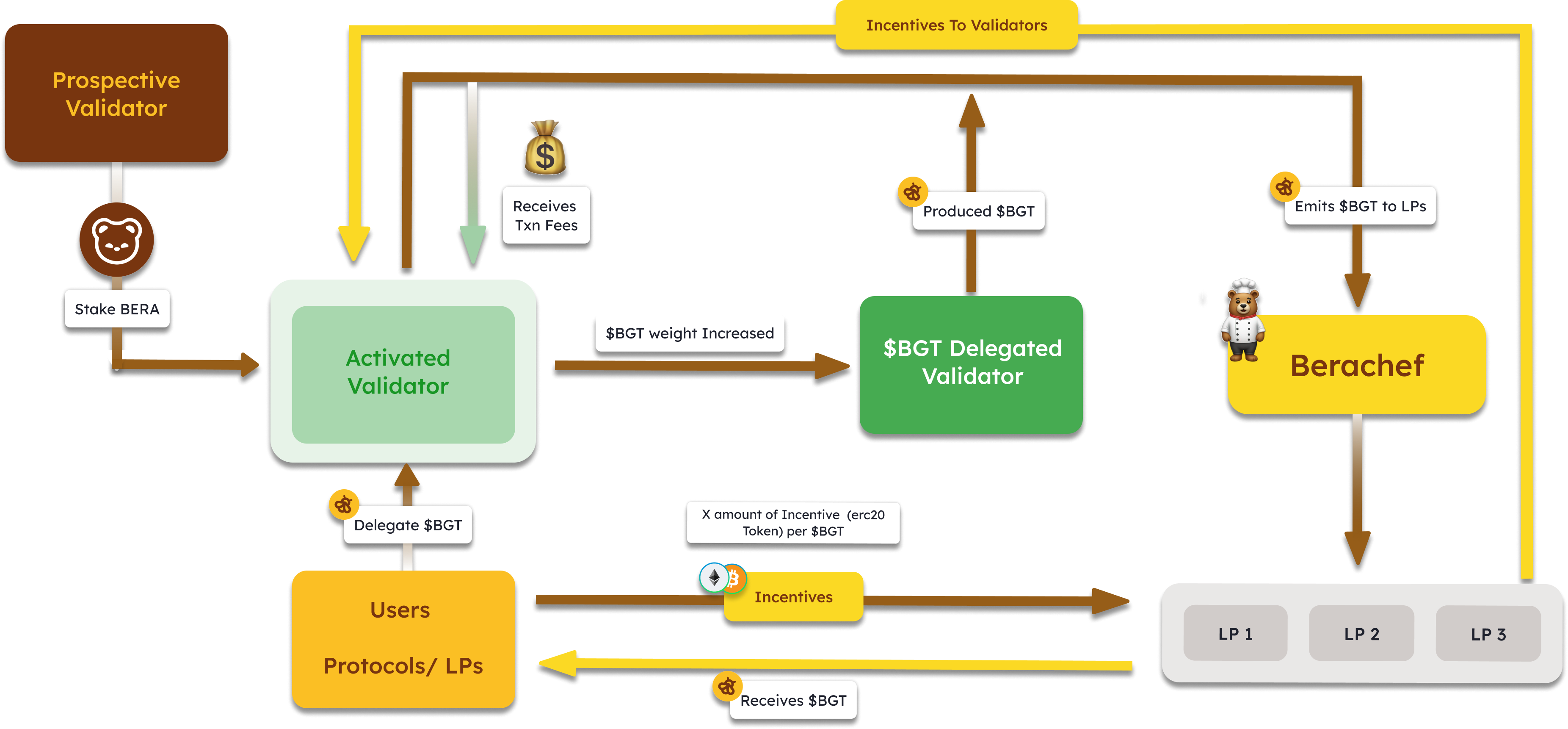

Another issue is what I mentioned before, and the fact that one of the tradeoffs we face is between liquidity and security. On Berachain, the way liquidity mining works, and the only way to get governance/issue tokens for the network, is actually to provide liquidity first. Validators on Berachain actually have a set of gauges. If you are familiar with the Curve ecosystem, this is quite similar. Each validator, after winning a block, can choose to direct or allocate the reward to a different set of protocols on the chain.

The process starts with a set of DeFi basic building blocks, including DEX, Perp Treasury, and stablecoin lending platforms. They are embedded on the chain at launch. When a validator wins a block and proposes a block, it actually pushes the vast majority of the block reward to that application. In fact, these rewards flow from validators to applications and then to users of these applications. Users can be liquidity providers (LPs) in DEX or lending markets, or do whatever they want, and get rewards in the form of network-issued tokens.

Another very interesting and important part is that users who provide liquidity are actually able to influence the reward rate in the system. Because each validator has these gauges. Depending on which validator they choose to stake with, users can actually cause more rewards to flow to pools that are already participating in liquidity mining. This means that users who provide liquidity, and therefore contribute value to the ecosystem, actually have the most say over its economic incentives in the long term. It's not just who bought the most tokens and said I bought a lot of tokens, therefore I have the most votes. It's actually the users who provide liquidity who are getting that benefit, and the entire ecosystem benefits from it.

Finally, validators actually have more economic opportunities than any other network. Validators can work with protocols to set up incentive markets where validators can say, hey, I'm going to help launch your protocol and provide X amount of issuance tokens. In exchange, you can give me and my representatives Y amount of your project tokens. So by helping the protocol get off the ground, validators actually get a call option or an investment in the protocol. The opportunity to help the protocol acquire new users at a lower cost.

PANews: On June 13, Berachain launched the testnet v2. This upgrade introduced the BeaconKit framework and increased the number of validators from 100 to 256. What are the latest developments?

Smokey The Bera: We recently launched V2, which fixes some of the issues we initially saw due to the limitations of Cosmos/CometBFT. The final form of V2 is actually more similar to the EVM structure. This makes Berachain the first project to have full EVM identical on a layer 1 blockchain. You may have heard of "EVM compatible" before, such as projects like Avalanche or Polygon. But "EVM identical" is slightly different from that. What it actually means is that you can have full execution client diversity just like you are running on mainnet. So you can choose to run Erigon, Nethermind, Reth, etc., and benefit from the performance upgrades, and actually benefit from all the research that is being done on mainnet, as well as full EIP compatibility, basically all the benefits of mainnet. And in our case, using Comet BFT consensus, supporting single slot finality at the bottom layer, which is also part of the Ethereum roadmap.

Therefore, compared to other L1s, Berachain provides the most similar environment to Ethereum itself, which means that any application, any integration, etc., that can be done on Ethereum, you can also do it on Berachain, while maintaining the liquidity proof logic and Comet BFT consensus that we mentioned. In addition, over time, we have made some changes in terms of reducing the reliance on Cosmos-style staking, and actually adopting a staking method that is more in line with Ethereum Layer 2 technical standards or the current mainnet technical standards, which also means that we can increase the value or scale of validators and become the chain with the most validators in the CometBFT chain.

PANews: Berachain recently completed a $100 million Series B round led by Brevan Howard Digital and Framework Ventures. What is Berachain's current valuation? And at what valuation do you plan to go public?

Smokey The Bera: We are not disclosing valuations at this time, and we haven’t heard about an IPO because realistically I don’t think we have full control over it, but the goal is to benefit the community that participates in the public markets.

PANews: What do you think of some controversial airdrops in the market recently, including LayerZero and Zksync? Can you reveal Berachain’s future airdrop standards?

Smokey The Bera: I wouldn’t comment too much on the upcoming airdrops. When thinking about our priorities, on one hand, I think it’s about being able to recognize the users who have helped support the growth of the ecosystem over the long term, because Berachain has been growing for about 2.5 to 3 years. For people who are testing and developing on our testnet and helping to deploy and build interesting applications, we also want to support them. In terms of distribution, think about how to attract new users into the ecosystem, but in a way that doesn’t extract value. We see a lot of teams doing random airdrops to people who are not associated with a specific ecosystem, and these people choose not to participate in it, and they would rather sell their tokens, which is not very helpful.

We are also thinking about how airdrops can bring in more liquidity and make liquidity a useful resource in the ecosystem. As for my thoughts on recent airdrops, there are pros and cons. I did not delve into the zkSync airdrop. From my general understanding, it seems that the allocations were quite generous. But I also heard some comments or rumors, and I am not sure how many tokens were distributed to internal personnel or people trying to attract projects to build on ZKsync. Now this information may not be completely accurate, please be skeptical.

As for Layerzero, they did some particularly controversial things, but they actually did a lot of things right. It’s very difficult to make an airdrop like this work well without completely destroying their own token supply or posing a major threat to the long-term security of the token.

I think there are pros and cons to mandatory claiming. Interestingly, it may act as a barrier to many people who run witch farms. Basically it means that the profit margins for these people will be reduced.

On the other hand, I can understand why this is a bit off-putting to a lot of people. In short, LayerZero did a great job of setting up a process where the team could go through a series of steps to show that we care enough to actually put in the work to prepare this RFP (Layer Zero's distribution protocol) and not just "we'll show up and expect free tokens to fall from the sky." So they did a good job on that front, but probably not as good at setting expectations and finding a way to effectively meet market needs or market expectations.

But I really think in both cases it’s almost impossible to achieve a complete win-win situation because they existed for a long time before and a lot of capital was invested before the actual token was launched.

PANews: What are the expectations for Berachain’s mainnet launch and token airdrop?

Smokey The Bera: We hope to have the mainnet launched by the end of the year, probably the end of Q3, or early Q4. We are not too far away from that goal now. For any form of token airdrop, if it happens, it will be at the same time as the launch of the project.

PANews: There are more than 200 projects in the Berachain ecosystem. Can you introduce the current development status? Which projects have performed the best? For example, The Honey Jar and Beradrome?

Smokey The Bera: It's hard to name them all. But we are very excited about the growth of the ecosystem. If I had to think about it, there are a few projects that really make sense.

Teams like Infrared, a liquidity staking protocol, play a very important role in the future development of the ecosystem, effectively allowing you to obtain the native staking token/issuing token BGT, which allows people to delegate it to a validator.

There are organizations like Kodiak, which is actually a centralized liquidity DEX, and there are also token issuers that are like Pump Dot Fun style dynamics. There are also organizations like Gummi, which is actually a novel money market that allows people to effectively leverage anything. There are also projects like Shogun, which will be built around Berachain to enable easy trading of any asset from any chain. Of the teams I mentioned, Infrared and Shogun are backed by Binance Labs, and Shogun is backed by Polychain.

For example, the Beratone team is building a very exciting game, a farming game similar to Animal Crossing and Stardew Valley, which we are very excited about. There are also teams like Puffpaw, who are building a smoking cessation/earning Depin product on Berachain. The team is very capable, has previously sold tens of millions of smart e-cigarettes to multinational companies, and has a very elegant witch defense system.

There are also groups like Overunder, who are building prediction markets on Twitch streams, which I think is going to be very exciting. There are also groups like Concrete Finance, who are effectively building a credit default swap on-chain. There are probably many more projects I could list.

PANews: What is the current competitive landscape of public chains that Berachain faces? What capabilities does Berachain have that can give it an advantage?

Smokey The Bera: Actually, we don't see much competition in the current Layer 1 space. Most of the competition actually exists in Layer 2. When I think about this, I feel that there are not many Layer 1 projects that are building new and interesting things, at least on the scale of crypto-native innovation. I don't think it's polite to criticize something directly, but what I really want to say is that apart from the mainnet, there are very few L1 projects building new things.

I'm seeing a lot more stuff on Base, a few projects on Arbitrum, the occasional bit on Blast, etc. It's definitely a bit dull right now though.

For Berachain, we have a couple of advantages. First, I think there is a huge, real, engaged native community of users who are really willing to participate in these different applications that are being built, more so than a lot of the existing ecosystems. The second point is that the structure of Berachain actually means that any application that is built on the chain for the first time can benefit from the benefits of deploying on Berachain, as opposed to deploying anywhere else. They can deploy their contract, and then they can submit a governance vote to make them an eligible gauge. In the process, they can become the destination for validators to allocate BGT.

And then they can actually lower their cost of capital and make it easier to launch liquidity for their token pairs or the protocol itself, which they can't do on any other chain. I think that's a huge advantage for the protocol.

PANews: In early May, you responded to the former Messari product manager by saying that Berachain is using the Cosmos SDK, but that does not mean it must be called the Cosmos chain. Berachain is closer to Ethereum than Cosmos. Can you explain the reason in detail?

Smokey The Bera: I think it's like how you look at a website, you wouldn't look at a website and say, this is like a website built with Webflow, or this is built with JavaScript, right? Categorizing a blockchain based on the framework it's built on is a very harmful approach. Now being seen as the Cosmos chain, the negatives far outweigh the benefits. That's why I tried to give both perspectives there.

I think there are a lot of good things about the Cosmos stack, but especially in Berachain V2, we have removed almost all of the dependencies on the Cosmos SDK. What's left now is mainly Common BFT from a consensus perspective, which is why I mentioned things like staking logic, communication layer, bank module, etc., all of which have been removed. The system is now more EVM-native. The only parts of the system that are related to Cosmos are the core validator logic, and the way that Cosmic BFT is used, and through this, we do see ourselves as a system that is more like Ethereum than Cosmos.

PANews: What do you think of the current market trend in the Defi sector? What are the opportunities for this round of bull market in this sector?

Smokey The Bera: We are still a ways off from anything really interesting, but we are getting closer. We will see more progress in the area of yield derivatives and interest rate derivatives. For example, projects like Pendle will be an example of how this will evolve. And Concrete, which I mentioned earlier, fits very well in this direction, which I am very excited about.

Also, as markets become more complex, credit DeFi swaps make more sense. I think we'll also see some interesting things in terms of volatility trading or more elegant options protocols. We'll see new forms of derivatives or more efficient ways to build existing derivatives.

For example, one team that I'm really bullish on is called Exponents. On the surface, Exponents might look like a decentralized exchange or a marketplace for perpetual swaps, but it's actually much more than that. It's actually the first platform that allows for incentivized directional trading. We've seen a lot of teams allow you to say, "Hey, as an LP, you're effectively going to earn a yield on the perpetual swap, you're going to be the provider of the perpetual swap and earn a yield when you lose money on the trade." This is similar to the style of GMX or GNX. In Exponents, you can actually bribe or incentivize a market participant to go long or short, which is very interesting because you can have someone say, "Hey, this is my competitor coin. I'm incentivizing you to short this coin."

Or someone says, "Hey, I have a ton of this coin. I want more people to go long it. I'll give you X tokens to go long this coin." So I think projects like that are going to be very exciting. And finally, I think we're going to see more interesting opportunities in things like undercollateralized lending and similar "Gearbox X" spaces, where elegant designs are used to more efficiently do things like operate credit accounts.

Finally, I think a trend we are very eager to see is that DeFi interoperability solutions will increase. I think the ability to trade any asset on any chain will become a more common thing in the future.

PANews: Berachain combines meme and DeFi and has one of the strongest communities in the crypto space. How do you view the role of the community in project development? What is the secret to success?

Smokey The Bera: First of all, we realized very early on that the way to win or have an advantage, both founding team wise and brand wise, is not by being very formal, very stately.

We actually win by leaning into cognitive dissonance or this regressive, wise-guy aesthetic, where you can be very silly but very competent at the same time. Like the extreme left curve and the extreme right curve. Our community is very emblematic of this because most of the time you'll see people who can be very playful and have fun and post all the time. At the same time, you'll see these same people who can be very focused on discussing a very interesting new primitive or market approach. So being able to foster this sense of not being serious, but being serious when necessary, is very important to us.

Time and effort also played a big role in this process. We spent a lot of time getting to know our community, communicating with them, and doing everything we could to help them succeed. It is indeed a daunting task to serve thousands of people if they want to build their own projects, meet new people, and learn new things. But our goal has always been, how can we provide the greatest help to this group of people?

When we think about the role of the community, it's very much like a guiding light or a guiding principle for us, which is, what can we do that makes sense and that the community will like and appreciate.

So whether it's a big event like Berapalooza, where we get to see tons of people in Denver, or different events that we might do in different cities, or even just videos that we do for fun, a lot of it is done with the community in mind.

Our goal is always, what did we think about when we built this? What will we enjoy? What do we find people really resonate with in these areas? How do we make sure that over time, that doesn’t lose that sense of style? I think that’s the most important thing, to still build something that’s very serious while still being humble and not too serious.

You May Also Like

Uncovering the Dark Side of Bitcoin

How to Build a Highly Profitable Crypto Casino With Stake Clone Script

Denmark is finally giving up on EU Chat Control after privacy backlash

Privacy-concerned citizens are celebrating as Denmark withdraws its proposal for the mandatory scanning of messages on platforms like Telegram, Signal and WhatsApp. Denmark, which holds the European Council presidency, has reportedly withdrawn the proposal that would have forced platforms like Telegram, WhatsApp and Signal to allow authorities to screen messages before they’re encrypted and sent. The proposed legislation, known as Chat Control, was first introduced in May 2022 as a method to combat the spread of illicit and illegal content through messaging services. A revived version of it came up this year, with critics arguing again that it would undermine encrypted messaging and people’s right to privacy.Read more