Europe’s IPO market stalls as companies turn to M&A amid volatility

Europe’s IPO engine has all but stalled. Klarna, the Swedish payments giant and one of Europe’s most valuable fintechs, isn’t even considering local stock exchanges. Instead, it’s going straight to New York.

That’s where the money is, and that’s where others are going too. So far this year, 153 companies have gone public in the U.S., raising $17.7 billion. Europe? Just 57 deals. $5.5 billion. That’s it.

According to reporting from CNBC, the gap isn’t closing anytime soon. Tommy Rueger, global co-head of Equity Capital Markets at UBS, said Asia has been “incredibly active this year” and is leading alongside North America.

Tommy said there are “pockets of strength” in Europe, but admitted the real momentum is outside the continent. Kevin Foley, global head of Capital Markets at JP Morgan, called Europe’s IPO market “muted,” while saying the U.S. already has more than 30 IPOs in the pipeline for the rest of the year.

Investors ditch long IPO timelines for faster M&A deals

Companies in Europe are tired of waiting. The IPO process takes too long, between three to twelve months, and the risks are high. Jonathan Murray, co-head of ECM for EMEA at Mizuho, said, “The IPO process is quite long, and during that process you can have market risk.”

Speaking from Tokyo, where he’s pitching European companies to Asian investors, Jonathan pointed out how quickly deals can fall apart. One bad day in the markets or a peer stock crash can nuke valuations overnight.

And the market isn’t even performing well. The MSCI France index is up only 4.5% this year. Other European indexes only started recovering in August after crashing earlier in the spring. Barclays strategist Emmanuel Cau said while the U.S., China, and Japan are hitting new highs, Europe is stuck; no AI momentum, and way too much geopolitical noise. It’s dead weight.

That’s why private equity firms are avoiding IPOs altogether. They’re choosing M&A; cleaner, faster, and more predictable. Jonathan said private equity sponsors don’t like taking a company public unless they can fully exit. If they’re still holding stock post-IPO, they’re on the hook for whatever happens next. And in this market, that’s not a bet they want to take.

IPO market slows as quality bar stays high

The public markets are picky again. Not everything gets through. Luca Erpici, co-head of ECM for EMEA at Jefferies, said things aren’t like they were in 2021. The market’s applying a “quality filter.” If a company doesn’t meet that, it stays out.

“We are in an orderly market,” Luca said. He added that while the bar is still high, some big deals could land in Q4 and a “strong pipeline is building for 2026 and 2027.”

But the filter is killing off private equity IPOs. Luca explained that most PE-backed companies can’t deliver stable returns every quarter, and public markets demand that. If a company can’t do it, it has no business being public. It’s safer to stay private.

One of the rare exceptions was Galderma, a skincare company owned by EQT. It listed successfully in 2024, and its shares have jumped over 125% since the IPO. EQT followed that up by selling another 5.3 billion Swiss francs (about $6.6 billion) worth of stock this year. So yes, good companies can still win. There just aren’t many of them ready.

Meanwhile, IPO pipelines globally were up 2% in the first half of the year compared to the same period last year, based on data from Datasite. That shows deal flow might pick up in the next six to nine months — but most of that won’t come from Europe.

Money and companies are heading to the U.S. Andrejka Bernatova, who recently took crypto firm The Ether Machine public in a $2.5 billion SPAC deal, explained why: “Liquidity is key. If you don’t have trading liquidity, being public is not as valuable.” Europe doesn’t have that. The U.S. does, and that’s what matters.

Bernatova also pointed to another issue: regulation. In the U.S., the NYSE and Nasdaq all fall under one rulebook, the SEC. In Europe, every country has its own regulator. It’s messy, slow, and investors hate it. That’s not good when future industries like AI and renewable energy need billions in capital. She said these companies have no choice but to look to the U.S. if they want to raise serious money.

But while bankers debate that, sellers are already gone. Europe’s IPO pipeline isn’t just shrinking. It’s drying up.

The smartest crypto minds already read our newsletter. Want in? Join them.

You May Also Like

Inventory of crypto reserves of five major listed companies: After Trump’s election, they accelerated their entry into the market, and Strategy’s floating loss exceeded US$4 billion

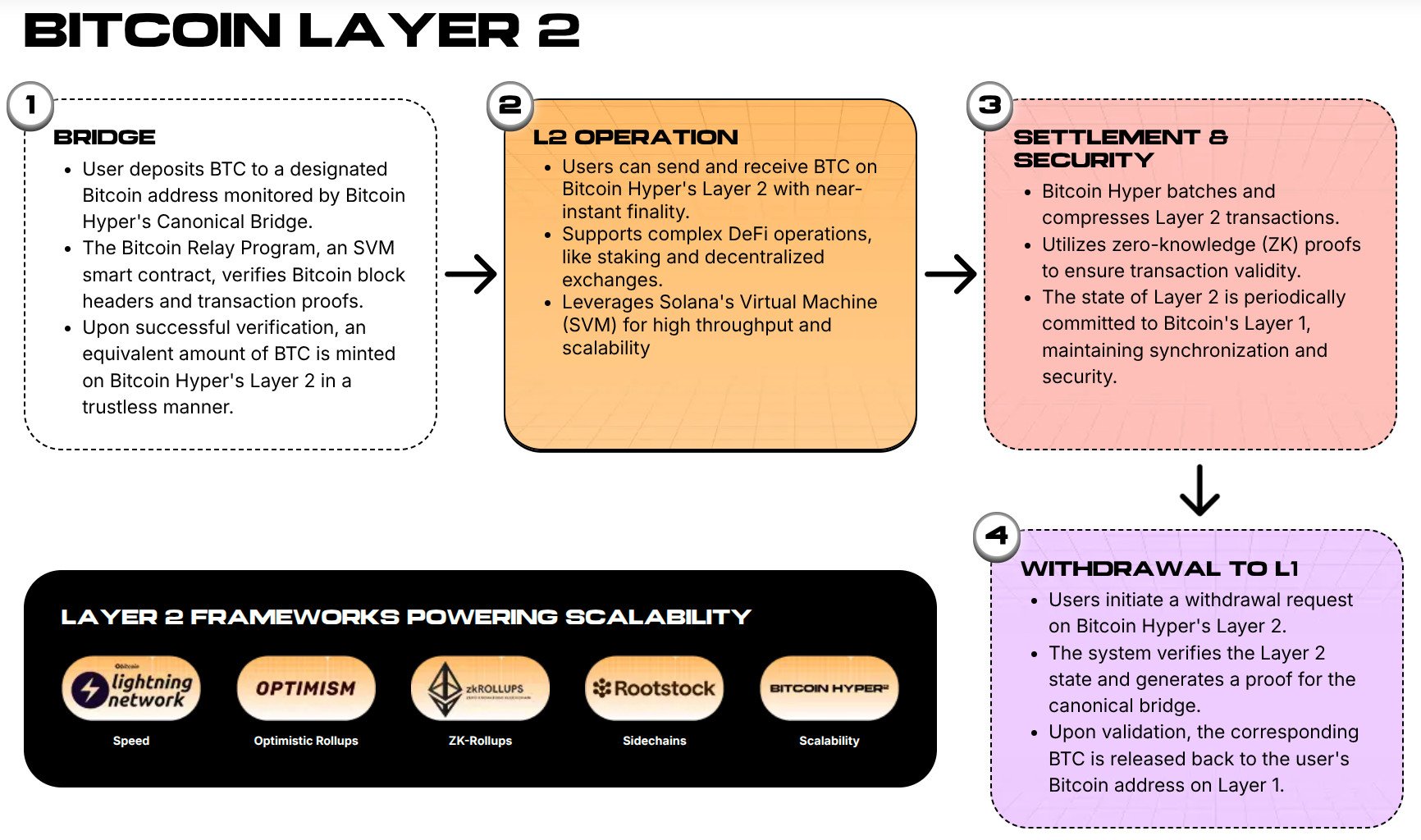

Bitcoin Hyper Presale Hits $16M As Whales Buy $64K, Is This the Next Crypto to Explode?