DC Crypto Summit Turns Tense: Senators Confront CEOs Over Alleged Political Allegiances

On Wednesday, several crypto industry CEOs participated in a roundtable discussion with Senate Democrats. The discussion focused on the Market Structure bill and the Democratic Party’s request for specific provisions in the GENIUS Act, which has already been signed into law by President Trump.

However, sources cited by market experts indicate that tensions escalated during the meeting, leading to a heated exchange between one senator and the crypto executives.

Tensions Flare Between Senator Gallego And Crypto CEOs

According to crypto reporter Eleanor Terret, the meeting began with 30 minutes of introductions from industry leaders, where attendees shared “top-level highlights” they hoped to see reflected in the Market Structure bill.

The senators collectively expressed their commitment to advancing the legislation, emphasizing that there would be “no slow walking” and acknowledging that even Republicans have concerns regarding the current draft.

However, sources within the meeting reported that Senator Gallego representing Arizona became particularly agitated, telling the crypto CEOs:

Banking Advocates Push For Stricter Stablecoin Regulations

Adding to the discussion, Senator Kennedy remarked during a GOP lunch that lawmakers need to carefully consider the banking industry’s concerns regarding market structure changes.

“The bankers are worked up, OK? And you better take them serious as four heart attacks and a stroke,” he stated. While Kennedy did not specify the exact concerns, banking advocates have been actively pushing for stricter limits on yields and rewards for stablecoins.

In response, the crypto industry has launched a public campaign advocating for the existing laws to remain intact under the GENIUS Act.

As this situation develops, it remains to be seen how the crypto CEOs will respond and what the future holds for these bills once the government shutdown concludes.

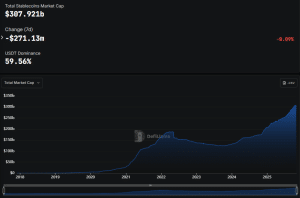

Featured image from DALL-E, chart from TradingView.com

You May Also Like

Coinbase Says Banks’ Stablecoin Fears ‘Ignore Reality,’ Dismisses Deposit Drain Concerns

Grayscale Ethereum Trusts Migrate to NYSE Arca’s Generic Listing Standards