Crypto prices today (Oct. 30): BTC, ETH, XRP, SOL dip as Fed rate cut sparks profit-taking

The crypto market traded lower on Thursday, Oct. 30, with investors taking profits after the Federal Reserve’s widely anticipated 25-basis-point rate cut.

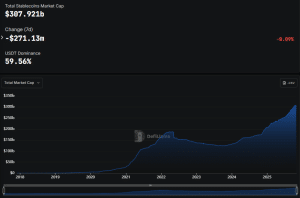

- Crypto prices today are on the decline, with the total market cap falling 1.5% after the Fed’s rate cut.

- Powell’s hawkish tone triggered “sell-the-news” event with $812M in liquidations and weaker sentiment.

- DeFi Technologies’ Andrew Forson said lower rates remain positive for crypto.

The total crypto market capitalization is down 1.5% to $3.9 trillion as traders reacted to Fed Chair Jerome Powell’s cautious tone. Bitcoin fell 3.5% to $113,315, Ethereum declined 3.7% to $3,846, XRP dropped 4.1% to $2.51, and Solana slid 2.2% to $191 at press time.

Market sentiment has shifted sharply, with the Crypto Fear & Greed Index down 17 points to 34, marking a move from neutral to fear. CoinGlass data shows $812 million in liquidations over the past 24 hours, up 46% from the previous day, while open interest dropped 1.28% to $161 billion. The average relative strength index across top assets fell to 38, now in “weak” territory.

Market turns risk-off after expected Fed rate cut

The Fed’s Oct. 29 decision lowered the benchmark rate to a 3.75%–4.00% range, marking its second cut since September and the lowest level since 2022. While lower rates typically benefit risk assets, Powell’s remarks dampened expectations for another cut in December, describing it as “not a foregone conclusion.”

Markets had priced in a 97% probability of the move, according to CME’s FedWatch Tool, which left little room for surprise. The result was a classic “sell-the-news” event, extending the October correction that began after the last Federal Open Market Committee meeting.

In a commentary shared with crypto.news, Andrew Forson, President of DeFi Technologies (Nasdaq: DEFT), said the rate cut came at a sensitive time:

Forson added that earnings season may shape short-term sentiment:

Geopolitical tension adds to volatility

Traders also weighed uncertainty after a meeting between President Trump and China’s Xi Jinping ended without a joint statement, reviving concerns of renewed trade frictions. Earlier tariff threats in October erased nearly $500 billion from crypto’s total market cap and led to over $19 billion in liquidations.

Powell avoided direct comments on trade, though he warned tariffs could “add to inflationary pressures,” complicating monetary policy in the months ahead.

Analysts see room for both caution and opportunity. If December rate-cut odds fall below 50%, Bitcoin could revisit the $100,000–$104,000 support zone. Others view the drop as a healthy reset following leveraged washout.

You May Also Like

Coinbase Says Banks’ Stablecoin Fears ‘Ignore Reality,’ Dismisses Deposit Drain Concerns

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council