Consensys Taps Aave to Launch Stablecoin Yield in MetaMask Wallets

Consensys, the Ethereum-focused software firm, has partnered with Aave to integrate a new feature into MetaMask wallets, allowing users to earn yield on stablecoins like USDC, USDT, and DAI.

In a press release shared with CryptoNews, the firm said the new feature called “Stablecoin Earn” will be powered by Aave’s lending protocol and will give MetaMask’s user base access to passive income without leaving the wallet interface.

The feature expands MetaMask’s current offering beyond staking and into DeFi lending. Stani Kulechov, founder of Aave Labs, said the move is intended to give people “more from their assets” and simplify access to decentralized finance. MetaMask, a product of Consensys, already serves more than 100 million users globally.

Aave’s Lending Power Comes to Retail Wallets

Launched in 2020, Aave has become one of the largest decentralized lending platforms in the space, with over $50 billion in total value locked.

According to the firm, the partnership gives everyday users a path to earn stablecoin yield without interacting directly with DeFi protocols or exchanges. Gal Eldar, Global Product Lead at MetaMask, describes the collaboration as a step toward “putting stablecoins to work” in a wallet that millions already use.

By embedding Aave’s lending markets into MetaMask, Consensys said it is removing barriers that may have previously kept new users out of DeFi.

The firm explains it’s not just about yield. It’s about making complex financial tools available through trusted platforms. Stablecoin Earn will likely appeal to users seeking a low-friction way to put idle assets to use, particularly during uncertain markets.

MetaMask Card Expands Use of DeFi Yield

Beyond yield accumulation, MetaMask and Aave have teamed up on MetaMask Card, which allows users to spend yield-bearing aUSDC directly in real-world transactions.

The card allows users to continue earning until the point of payment, blending traditional spending behavior with new digital finance capabilities.

In June, Consensys said it was beefing up its Web3 arsenal with the acquisition of wallet infrastructure startup Web3Auth. This move comes amid growing concerns about the usability and risks of traditional seed phrase-based wallet systems. With around 35% of users reportedly failing to back up their seed phrases, many face the looming threat of losing access to their funds.

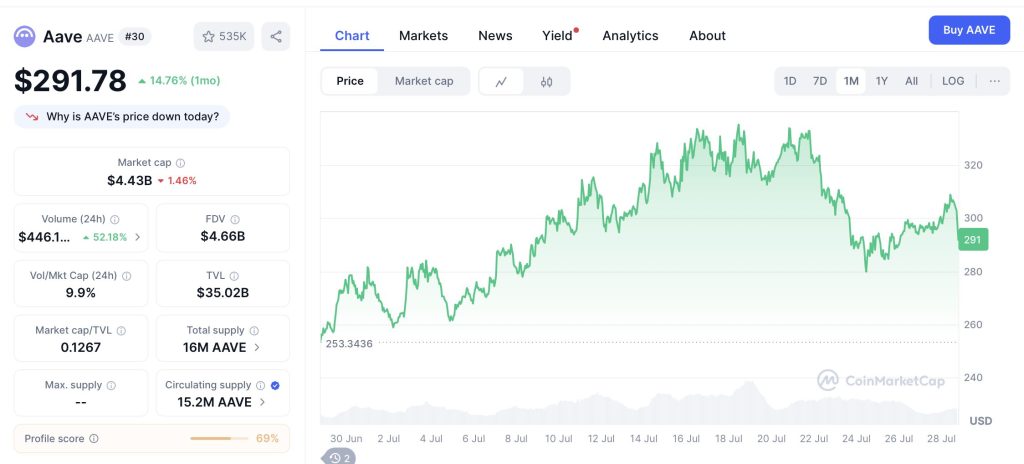

Aave Soars: 14.6% Growth Over Past Month

On July 9, Aave ($AAVE) extended its rally, testing the $300 level as the leading protocol in DeFi. With institutional interest growing and liquidity at record highs, Aave’s momentum could breach $300 resistance. Traders were watching for the next confirmation. A clean breakout may fuel the next leg of the upward trend, reports Jimmy Aki from CryptoNews.

Aave (AAVE) is currently trading at $291.78, reflecting a 14.76% gain over the past month, despite some recent volatility. The protocol maintains a strong position in the DeFi space with a $35.02 billion total value locked (TVL) and a 24-hour trading volume of $446.1 million, which has surged over 52%.

While the market cap dipped slightly to $4.43 billion, the uptick in user activity and renewed momentum—possibly influenced by its integration with MetaMask Earn—shows renewed investor confidence in Aave’s decentralized lending infrastructure.

You May Also Like

Fed Acts on Economic Signals with Rate Cut

Dogecoin (DOGE) and Shiba Inu (SHIB) Likely to Underperform as Capital Flows to New Token Set to Explode 19365%