| COINOTAG recommends • Exchange signup |

| 💹 Trade with pro tools |

| Fast execution, robust charts, clean risk controls. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🚀 Smooth orders, clear control |

| Advanced order types and market depth in one view. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| 📈 Clarity in volatile markets |

| Plan entries & exits, manage positions with discipline. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| ⚡ Speed, depth, reliability |

| Execute confidently when timing matters. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🧭 A focused workflow for traders |

| Alerts, watchlists, and a repeatable process. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| ✅ Data‑driven decisions |

| Focus on process—not noise. |

| 👉 Sign up → |

Stablecoins pose minimal threat to US banks, as most demand originates from international users seeking dollar exposure rather than competing with domestic deposits. Coinbase researchers emphasize that stablecoins expand global dollar dominance without significantly impacting local banking, countering fears of customer exodus from yield-bearing stablecoins.

-

Global Demand Drives Stablecoins: Over two-thirds of transfers occur outside the US, primarily in emerging markets hedging against currency depreciation.

-

Stablecoins function as a parallel financial layer, not a direct rival to traditional bank accounts.

-

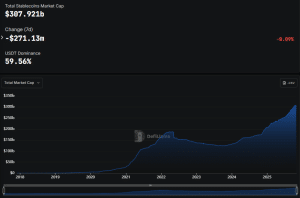

US commercial bank deposits exceed $18 trillion, with stablecoin circulation projected at $5 trillion globally, mostly foreign-held and marginal to domestic impacts (Coinbase market note).

Discover how stablecoins impact US banks without cannibalizing deposits. Learn why banking groups’ fears of yield offerings are overstated and explore global benefits in this insightful analysis. Stay ahead in crypto trends.

What is the stablecoins impact on US banks?

Stablecoins impact on US banks is often overstated, as these digital assets primarily serve international users rather than drawing funds from domestic banking customers. According to Coinbase researchers, stablecoins enhance the global reach of the US dollar without substantially competing with traditional bank deposits or lending activities. This perspective challenges narratives suggesting widespread adoption could lead to a banking customer exodus, particularly regarding yield-bearing stablecoins.

| COINOTAG recommends • Professional traders group |

| 💎 Join a professional trading community |

| Work with senior traders, research‑backed setups, and risk‑first frameworks. |

| 👉 Join the group → |

| COINOTAG recommends • Professional traders group |

| 📊 Transparent performance, real process |

| Spot strategies with documented months of triple‑digit runs during strong trends; futures plans use defined R:R and sizing. |

| 👉 Get access → |

| COINOTAG recommends • Professional traders group |

| 🧭 Research → Plan → Execute |

| Daily levels, watchlists, and post‑trade reviews to build consistency. |

| 👉 Join now → |

| COINOTAG recommends • Professional traders group |

| 🛡️ Risk comes first |

| Sizing methods, invalidation rules, and R‑multiples baked into every plan. |

| 👉 Start today → |

| COINOTAG recommends • Professional traders group |

| 🧠 Learn the “why” behind each trade |

| Live breakdowns, playbooks, and framework‑first education. |

| 👉 Join the group → |

| COINOTAG recommends • Professional traders group |

| 🚀 Insider • APEX • INNER CIRCLE |

| Choose the depth you need—tools, coaching, and member rooms. |

| 👉 Explore tiers → |

How do stablecoin yields affect banking deposits?

Yield-bearing stablecoins have sparked concerns among US banking groups, who argue to Congress that such offerings could lure deposits away from traditional accounts and undermine lending. However, Coinbase policy chief Faryar Shirzad counters that this view ignores the tokens’ real-world applications. “The ‘stablecoins will destroy bank lending’ narrative ignores reality,” Shirzad stated. Most stablecoin demand stems from outside the US, where users in emerging markets utilize them to access dollar stability amid local currency volatility. Data from blockchain analytics indicates that approximately two-thirds of stablecoin transfers occur on decentralized finance platforms or other blockchain networks, operating as a separate transactional layer parallel to the domestic banking system. This separation minimizes direct competition, with stablecoins acting more as a tool for global dollar access than a substitute for everyday US banking services. Banking groups’ push for regulatory clamps on yields overlooks these dynamics, as evidenced by historical parallels with innovations like money market funds, which initially raised similar alarms but ultimately coexisted with the banking sector.

US banking groups have urged Congress to clamp down on stablecoin yields, arguing it would trigger a US banking customer exodus. Concerns that crypto stablecoins will harm US banks by cannibalizing banking deposits are ill-placed and don’t consider the real-world uses of the tokens, according to Coinbase researchers.

| COINOTAG recommends • Exchange signup |

| 📈 Clear interface, precise orders |

| Sharp entries & exits with actionable alerts. |

| 👉 Create free account → |

| COINOTAG recommends • Exchange signup |

| 🧠 Smarter tools. Better decisions. |

| Depth analytics and risk features in one view. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🎯 Take control of entries & exits |

| Set alerts, define stops, execute consistently. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🛠️ From idea to execution |

| Turn setups into plans with practical order types. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 📋 Trade your plan |

| Watchlists and routing that support focus. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| 📊 Precision without the noise |

| Data‑first workflows for active traders. |

| 👉 Sign up → |

“Most stablecoin demand comes from outside the US, expanding dollar dominance globally, not competing with your local bank.”

Shirzad shared a market note that said the arguments over stablecoins impact on bank deposits and lending “echo familiar worries from earlier innovations like money market funds. Yet they fail to account for how and where stablecoins are actually used.”

| COINOTAG recommends • Traders club |

| ⚡ Futures with discipline |

| Defined R:R, pre‑set invalidation, execution checklists. |

| 👉 Join the club → |

| COINOTAG recommends • Traders club |

| 🎯 Spot strategies that compound |

| Momentum & accumulation frameworks managed with clear risk. |

| 👉 Get access → |

| COINOTAG recommends • Traders club |

| 🏛️ APEX tier for serious traders |

| Deep dives, analyst Q&A, and accountability sprints. |

| 👉 Explore APEX → |

| COINOTAG recommends • Traders club |

| 📈 Real‑time market structure |

| Key levels, liquidity zones, and actionable context. |

| 👉 Join now → |

| COINOTAG recommends • Traders club |

| 🔔 Smart alerts, not noise |

| Context‑rich notifications tied to plans and risk—never hype. |

| 👉 Get access → |

| COINOTAG recommends • Traders club |

| 🤝 Peer review & coaching |

| Hands‑on feedback that sharpens execution and risk control. |

| 👉 Join the club → |

US banking groups have argued that stablecoins offering yield could compete with bank accounts and trigger bank outflows, and have urged Congress to clamp down on services offering yield on stablecoins.

Source: Faryar Shirzad

Stablecoin demand is global, not US-centric

Coinbase argued in its note that the most demand for stablecoins comes from “international users seeking dollar exposure” and not from US consumers. It said emerging markets use US dollar stablecoins to hedge against local currency depreciation, and the tokens are a “practical form of dollar access” for the underbanked.

The note added that around two-thirds of stablecoin transfers happen on decentralized finance or blockchain platforms. “In that sense, they are the transactional plumbing of a new financial layer that runs parallel to, but largely outside, the domestic banking system,” Coinbase said.

“Treating stablecoins as a threat misreads the moment: they strengthen the dollar’s global role and unlock competitive advantages that the US shouldn’t constrain,” Shirzad said.

| COINOTAG recommends • Exchange signup |

| 📈 Clear control for futures |

| Sizing, stops, and scenario planning tools. |

| 👉 Open futures account → |

| COINOTAG recommends • Exchange signup |

| 🧩 Structure your futures trades |

| Define entries & exits with advanced orders. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🛡️ Control volatility |

| Automate alerts and manage positions with discipline. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| ⚙️ Execution you can rely on |

| Fast routing and meaningful depth insights. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| 📒 Plan. Execute. Review. |

| Frameworks for consistent decision‑making. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 🧩 Choose clarity over complexity |

| Actionable, pro‑grade tools—no fluff. |

| 👉 Open account → |

Community banks won’t collapse, Coinbase claims

Coinbase argued that the concerns that community banks will be hit hard by widespread stablecoin use also lack credence, explaining that the typical stablecoin user “is not the same as the typical community bank customer.”

“Community banks and stablecoin holders barely overlap,” Shirzad said, adding that banks “could improve their services with stablecoins.”

| COINOTAG recommends • Members‑only research |

| 📌 Curated setups, clearly explained |

| Entry, invalidation, targets, and R:R defined before execution. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧠 Data‑led decision making |

| Technical + flow + context synthesized into actionable plans. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 🧱 Consistency over hype |

| Repeatable rules, realistic expectations, and a calmer mindset. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🕒 Patience is an edge |

| Wait for confirmation and manage risk with checklists. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 💼 Professional mentorship |

| Guidance from seasoned traders and structured feedback loops. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧮 Track • Review • Improve |

| Documented PnL tracking and post‑mortems to accelerate learning. |

| 👉 Join now → |

Western Union picks Solana for its stablecoin and crypto network.

Coinbase also said forecasts of trillions of dollars flowing into stablecoins over the next 10 years “should be carefully scrutinized.”

| COINOTAG recommends • Exchange signup |

| 🎯 Focus on process over noise |

| Plan trades, size positions, execute consistently. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🛠️ Simplify execution |

| Keep decisions clear with practical controls. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| 📊 Make data your edge |

| Use depth and alerts to avoid guesswork. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🧭 Be prepared, not reactive |

| Turn setups into rules before you trade. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| ✍️ Plan first, then act |

| Entries, exits, and reviews that fit your routine. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 🧩 Consistency beats intensity |

| Small, repeatable steps win the long run. |

| 👉 Sign up → |

“Even if stablecoin circulation reached $5 trillion globally, a majority of that value would still be foreign-held or locked in digital settlement systems, not diverted from US checking or savings accounts,” it said.

Coinbase noted that commercial bank deposits in the US exceed $18 trillion and claimed that the impact of stablecoin on deposits would “remain marginal, while the global influence of the US dollar would significantly increase.”

| COINOTAG recommends • Premium trading community |

| 🏛️ WAGMI CAPITAL — Premium Trading Community |

| Strategic insights, exclusive opportunities, professional support. |

| 👉 Join WAGMI CAPITAL → |

| COINOTAG recommends • Premium trading community |

| 💬 Inner Circle access |

| See members share real‑time PnL and execution notes in chat. |

| 👉 Apply for Inner Circle → |

| COINOTAG recommends • Premium trading community |

| 🧩 Turn theses into trades |

| Reusable templates for entries, risk, and review—end to end. |

| 👉 Join the club → |

| COINOTAG recommends • Premium trading community |

| 💡 Long‑term mindset |

| Patience and discipline over noise; a process that compounds. |

| 👉 Get started → |

| COINOTAG recommends • Premium trading community |

| 📚 Education + execution |

| Courses, playbooks, and live market walkthroughs—learn by doing. |

| 👉 Get access → |

| COINOTAG recommends • Premium trading community |

| 🔒 Members‑only research drops |

| Curated analyses and private briefings—quality over quantity. |

| 👉 Join WAGMI CAPITAL → |

Multiple big banks and major financial institutions have launched stablecoin services or are exploring offers after the US passed the GENIUS Act earlier this year, which regulates how stablecoin service providers operate in the country.

Magazine: Bitcoin is ‘funny internet money’ during a crisis: Tezos co-founder

| COINOTAG recommends • Exchange signup |

| 🧱 Execute with discipline |

| Watchlists, alerts, and flexible order control. |

| 👉 Sign up → |

| COINOTAG recommends • Exchange signup |

| 🧩 Keep your strategy simple |

| Clear rules and repeatable steps. |

| 👉 Open account → |

| COINOTAG recommends • Exchange signup |

| 🧠 Stay objective |

| Let data—not emotion—drive actions. |

| 👉 Get started → |

| COINOTAG recommends • Exchange signup |

| ⏱️ Trade when it makes sense |

| Your plan sets the timing—not the feed. |

| 👉 Join now → |

| COINOTAG recommends • Exchange signup |

| 🌿 A calm plan for busy markets |

| Set size and stops first, then execute. |

| 👉 Create account → |

| COINOTAG recommends • Exchange signup |

| 🧱 Your framework. Your rules. |

| Design entries/exits that fit your routine. |

| 👉 Sign up → |

Frequently Asked Questions

Will stablecoin yields cause a mass exodus from US bank accounts?

No, stablecoin yields are unlikely to cause significant outflows from US bank accounts, as primary demand originates from international markets. Coinbase data shows that even at $5 trillion in global circulation, most funds remain outside domestic banking, preserving the stability of US deposits exceeding $18 trillion.

How are stablecoins used in emerging markets?

In emerging markets, stablecoins provide reliable access to the US dollar, helping users protect savings from local inflation and depreciation. They serve as an essential tool for the underbanked, facilitating cross-border transactions on blockchain platforms without relying on traditional financial infrastructure.

Key Takeaways

- Global Focus of Stablecoins: Demand is predominantly international, bolstering US dollar hegemony rather than eroding domestic bank deposits.

- Parallel Financial System: Stablecoins operate in a distinct layer via DeFi and blockchains, minimizing overlap with community banking customers.

- Regulatory Balance: Policymakers should view stablecoins as an opportunity to enhance competitiveness, integrating them thoughtfully without overly restrictive measures on yields.

Conclusion

The debate surrounding stablecoins impact on US banks highlights a tension between innovation and caution, with banking groups advocating for curbs on stablecoin yields to prevent deposit flight. Yet, insights from Coinbase researchers and policy chief Faryar Shirzad underscore that these tokens primarily drive global dollar adoption, offering underbanked populations in emerging markets a vital hedge against economic instability. As the US navigates the GENIUS Act’s framework for stablecoin regulation, embracing their role could amplify economic advantages. Financial institutions are encouraged to explore stablecoin integrations to modernize services and stay competitive in an evolving landscape.

| COINOTAG recommends • Members‑only research |

| 📌 Curated setups, clearly explained |

| Entry, invalidation, targets, and R:R defined before execution. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧠 Data‑led decision making |

| Technical + flow + context synthesized into actionable plans. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 🧱 Consistency over hype |

| Repeatable rules, realistic expectations, and a calmer mindset. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🕒 Patience is an edge |

| Wait for confirmation and manage risk with checklists. |

| 👉 Join now → |

| COINOTAG recommends • Members‑only research |

| 💼 Professional mentorship |

| Guidance from seasoned traders and structured feedback loops. |

| 👉 Get access → |

| COINOTAG recommends • Members‑only research |

| 🧮 Track • Review • Improve |

| Documented PnL tracking and post‑mortems to accelerate learning. |

| 👉 Join now → |

Source: https://en.coinotag.com/coinbase-stablecoins-may-bolster-dollar-globally-without-harming-us-banks/