China Pauses Real-World Asset Tokenization in Hong Kong

China directs brokerages in Hong Kong to cease tokenizing RWA, indicating regulatory risk in digital asset mania.

According to Reuters, China has told brokerages to halt real-world asset (RWA) tokenization in Hong Kong.

This is a move that indicates the carefulness of Beijing towards the fast-increasing offshore digital asset market.

RWA tokenization transforms the legacy (traditional) assets, such as stocks, bonds, and real estate, into digital tokens in the blockchain that can be more efficiently traded.

Within the past few months, there has been an active activity with launch of these tokens by a number of Chinese firms in Hong Kong.

China’s Warning Shakes Digital Asset Plans

The China Securities Regulatory Commission (CSRC) had issued informal notices to at least two major brokerages to stop RWA business offshore.

This guideline is expected to enhance risk management and validate the validity of business assertions regarding tokenization.

Hong Kong has been establishing itself as an asset center of digital prosperity. It has implemented programs in the areas of virtual asset trading, investment advisory services, and digital asset management.

Such developments have brought about the attraction of numerous Chinese companies, which are willing to increase their activities in the city in relation to digital assets.

Beijing’s Tightening Grip Raises Stakes

The firm stance of China is in contrast to the receptiveness of Hong Kong. Having prohibited crypto mining and trading on financial grounds in 2021.

China is still cautious of lax regulations. Recent measures have been a ban on the endorsement of stablecoins by brokers to limit domestic investor risks.

There has been a rapid expansion of the Digital Assets Market in Hong Kong, and a legal review is currently being undertaken by the Financial Services and the Treasury Bureau and the Hong Kong Monetary Authority (HKMA).

Although according to market forecasts, RWA tokenization has the potential to expand to more than 2 trillion dollars by 2030, Beijing has stunted the momentum.

RWA token products had been introduced or were to be introduced in Hong Kong by Chinese companies such as GF Securities and China Merchant Bank International.

This informal CSRC guidance is applicable irrespective of these plans and it is an indication of the willingness of the regulators to maintain keen thoughts on the offshore ventures of digital assets.

The move was given serious market consideration. Stocks of Chinese companies dealing with virtual assets in Hong Kong have surged tremendously in the recent past.

The stock of state-supported Guotai Junan International had increased by more than 400 percent following the approval of the regulation to provide crypto trading services.

The situation highlights how control and mitigation of risks are more important to China than the rapid offshore growth of digital assets. The unofficial advice fails to state the duration of the halt, and future events remain unpredictable.

The post China Pauses Real-World Asset Tokenization in Hong Kong appeared first on Live Bitcoin News.

You May Also Like

Ford Motor Company to Serve as Advisor to Cardano’s Decentralized Cloud Service Lagon

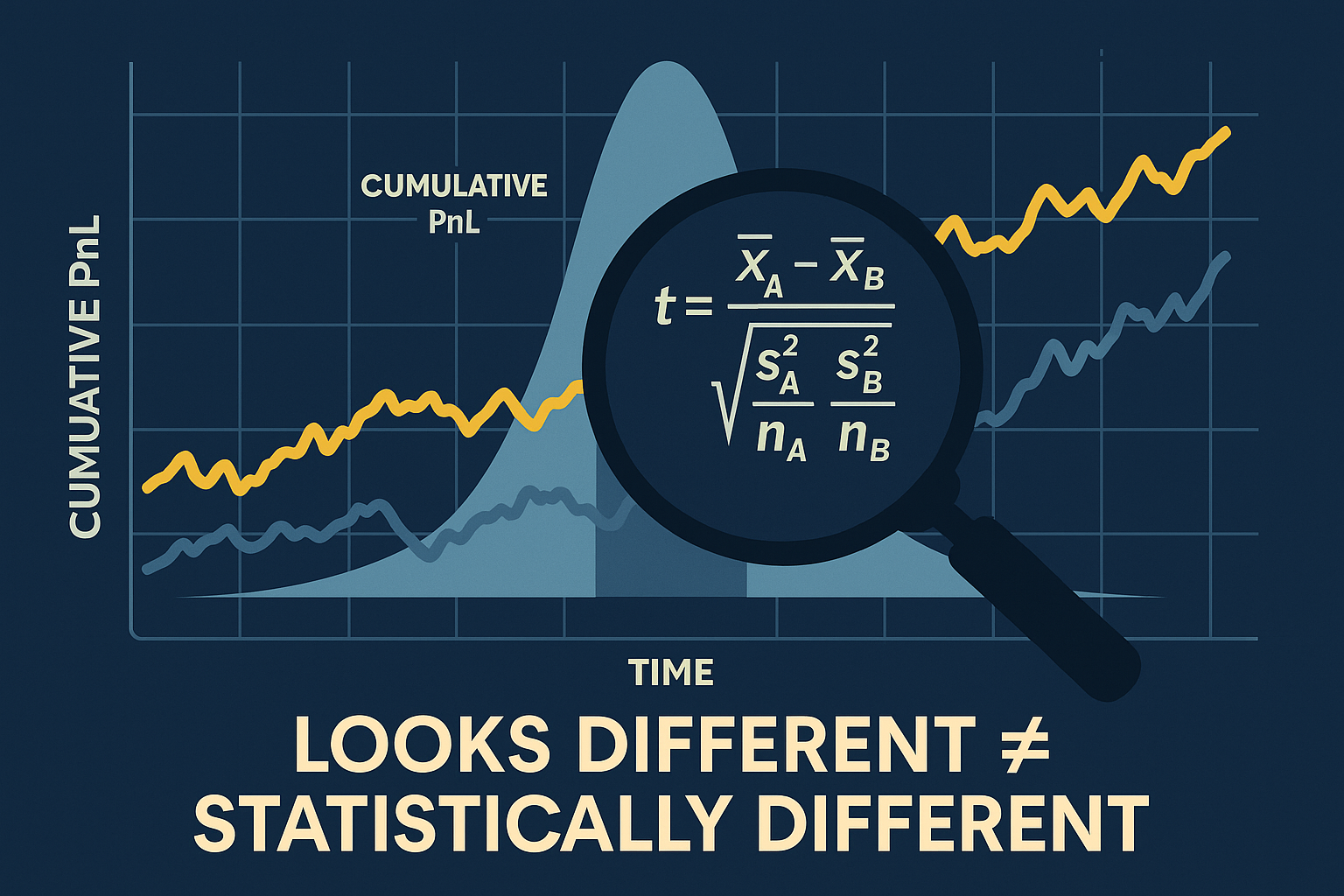

The HackerNoon Newsletter: Why You Shouldn’t Judge by PnL Alone (9/23/2025)