A Deep Dive into Aerodrome, the Liquidity Engine on Base

By Bryan Tan & Arthur Cheong

Compiled by: Felix, PANews

Before we start talking about Aerodrome, let’s first understand some background about DEX.

Breaking the DEX logjam: Why the traditional model falls short

The development of DEX has always been accompanied by a fundamental struggle: balancing the interests of multiple stakeholders while maintaining sustainable growth. Two key challenges have always plagued the traditional DEX model:

1. Balance among all parties:

DEXs must serve three different groups simultaneously: traders seeking efficient markets, liquidity providers (LPs) seeking yield, and token holders demanding increased value.

Uniswap is a typical example, transferring 100% of the fees directly to LP, resulting in UNI holders being unable to obtain direct protocol income. At the same time, Curve takes a neutral approach, dividing CRV equally between LP and veCRV holders. However, as the release volume decreases, this model will face its own sustainability issues.

The result is a continued tug-of-war among the parties, resulting in unsatisfactory benefits for all parties.

2. Issuance Dilemma:

The DeFi summer of 2020/21 has exposed the flaws of strict issuance plans, with countless Uniswap v2 forks attracting liquidity through token inflation and fierce competition.

Curve’s innovative veCRV system introduced bribes as a mechanism to bootstrap liquidity, but had an unintended consequence: voters maximized their personal interests through bribes rather than supporting pools that generated sustainable protocol revenue.

Even Solidly, created by Andre Cronje, attempted to address these issues, but fell victim to its own design flaws — the use of front-loaded issuance and token whitelisting ultimately undermined its effectiveness.

Each iteration of DEX design has attempted to address these fundamental challenges, but until now, none have been fully solved.

Aerodrome : The MetaDEX Revolution

Aerodrome combines the best features of previous DEXs - token economics inspired by Curve/Convex for improved governance and releases, a centralized automated market maker (clAMM) using Uni v3 for efficient capital exchange, and improvements to the Solidly codebase.

These features provide a solution to align incentives of all parties and position it as the preferred venue for users to transact.

veAERO holders are compensated with 100% of the fees and bribes of the pools they vote for. This way, they have an incentive to steer towards the pools with the highest emissions and fees, which is also beneficial to the protocol.

LPs will receive 100% of the AERO emission incentives and will fund the pool with the highest yield.

Traders benefit from the high liquidity of DEXs and can enjoy better execution compared to other exchanges.

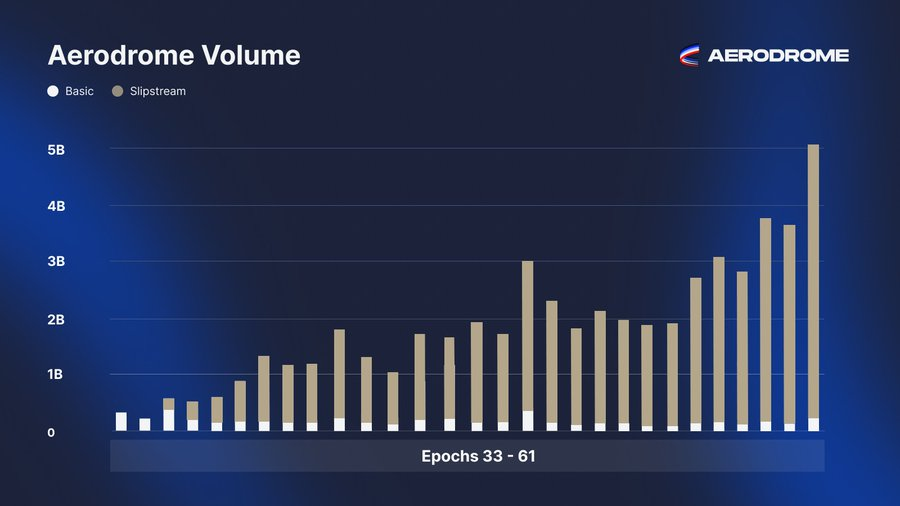

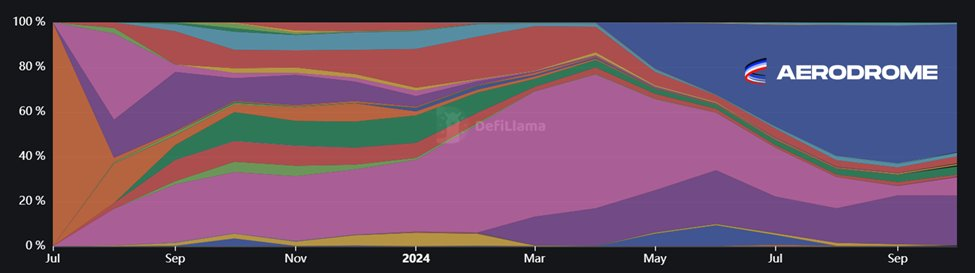

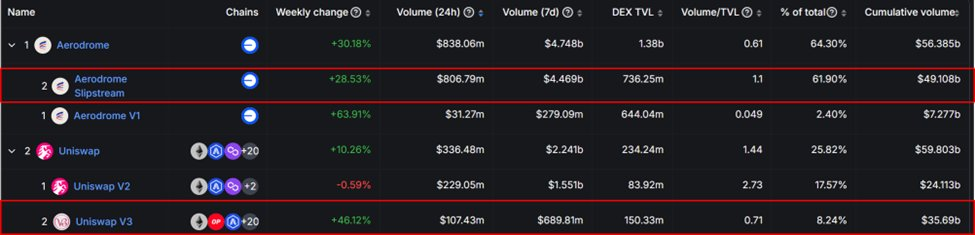

Notably, since the launch of Aerodrome Slipstream (a Uni v3-style clAMM) in April this year, Aerodrome’s DEX market share on Base has soared to 63%, effectively replacing Uniswap.

Source: DeFiLlama, as of November 3

Compared to Uniswap V3 on Base, Aerodrome Slipstream has achieved absolute volume growth while achieving greater capital efficiency overall. This dominance becomes even more pronounced when considering the presence of many scam tokens on Uniswap.

Source: DeFiLlama, as of November 3

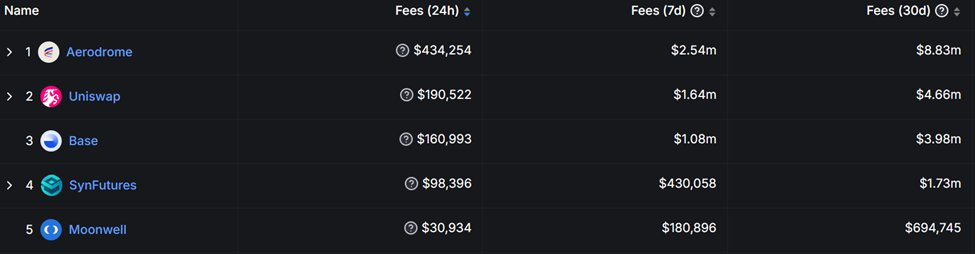

In addition, Aerodrome is also the application that generates the highest fees among all dApps on Base.

Source: DeFiLlama, as of November 3

Aerodrome's rapid rise

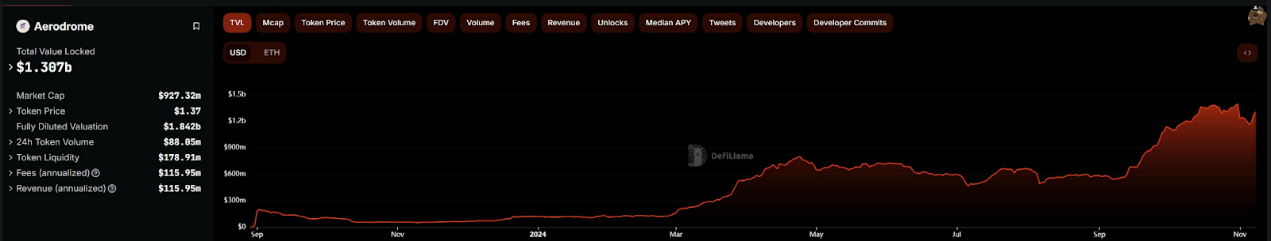

Over the past year, Aerodrome TVL has soared 12 times to $1.3 billion, accounting for nearly 50% of Base TVL. It is worth noting that from March to September, Aerodrome's TVL continued to grow in the turbulent market, showing a certain resilience.

Source: DeFiLlama, as of November 8

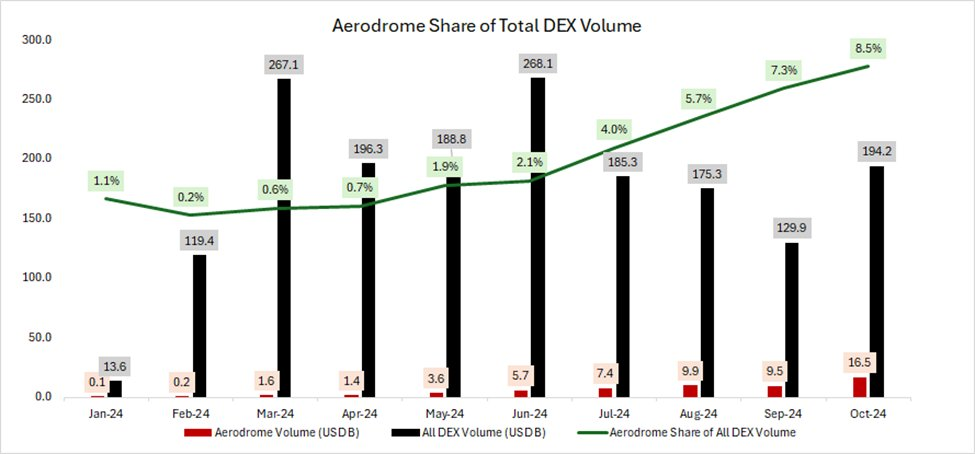

Meanwhile, Aerodrome’s monthly trading volume has soared 111 times, reaching $16.5 billion by the end of October. In addition, Aerodrome’s share of total DEX trading volume has risen to 8.5%. Over the past few months, Aerodrome’s trading volume has continued to grow despite a decline in overall DEX trading volume.

The Coinbase Effect

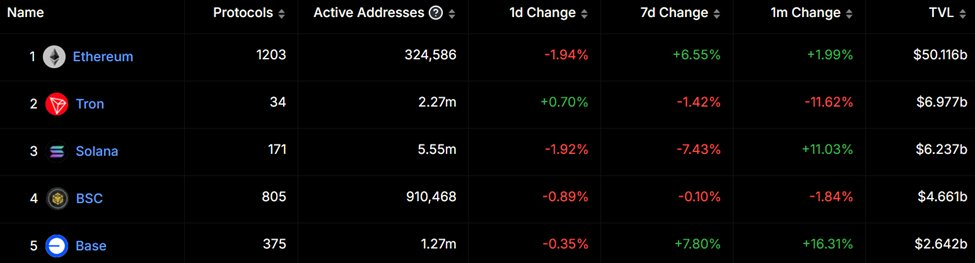

Base plays a key role in Coinbase's strategy to drive crypto utility and reduce the complexity of on-chain transactions. They have spearheaded multiple ecosystem initiatives, such as integrating Base into the Coinbase Smart Wallet, hosting hackathons, and establishing partnerships with institutions such as Stripe to enable fiat-to-crypto conversions on Base. As a result, Base is currently the largest rollup by TVL, at approximately $2.7 billion.

Source: DeFiLlama, as of November 3

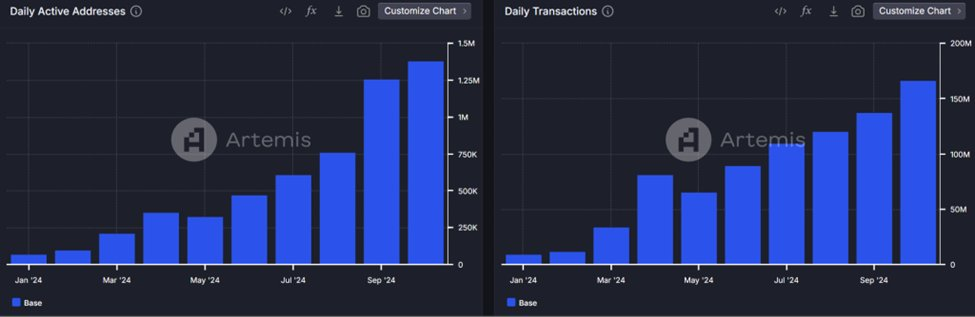

As the largest dApp on Base, Aerodrome is benefiting from Base’s rapid expansion. Base’s DAU and daily transaction volume have steadily increased over the year, helping to drive Aerodrome’s usage.

Source: Artemis

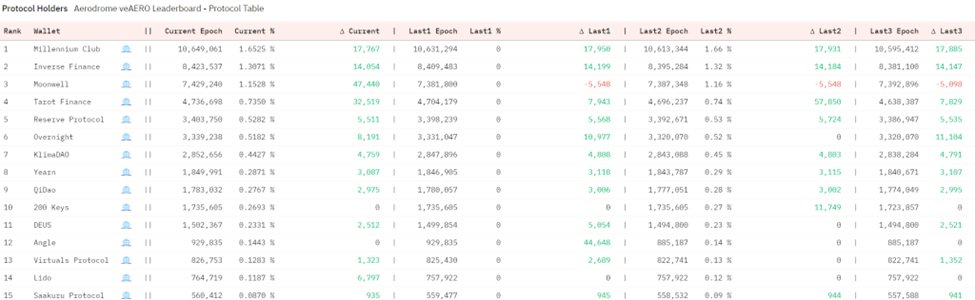

The protocols on Base hold nearly 10% of veAERO, and these protocols hope to increase the liquidity of their governance tokens by locking AERO and voting to direct the issuance of tokens to their own pools. As the number of users and economic activity on Base grows, it is expected that future protocols launched on Base will do the same, stimulating demand for $AERO tokens.

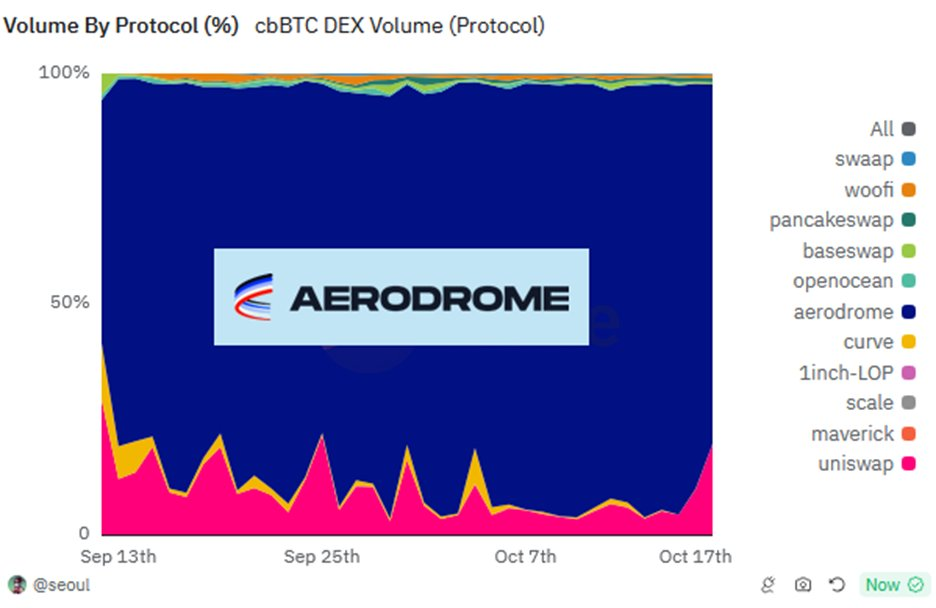

Base’s economic activity is also increasing due to Coinbase’s decision to launch cbBTC to challenge WBTC. Since its launch on September 12, cbBTC’s TVL has grown to $839 million.

Aerodrome is the biggest beneficiary of this move as it accounts for about 80% of the volume of the cbBTC trading pair. This is not surprising, as cbBTC on the chain is convertible with BTC on Coinbase CEX, driving CEX/DEX arbitrage activity. Since Aerodrome is the largest and most liquid venue on the cbBTC chain, it naturally facilitates most of the traffic.

Source: Dune Analytics

In addition, Coinbase has good reasons to support Aerodrome's development. Coinbase Ventures has accumulated a large AERO position (about $20 million). They acquired it through the open market like other market participants and locked a large part of it as veAERO. Coinbase Ventures is an active participant in Aerodrome's governance and voted in favor of releasing AERO into the cbBTC pool, further strengthening Aerodrome's market dominance.

DeFi resurgence on Base

We are at the cusp of a new wave of liquidity entering DeFi, driven by new innovations. Given Base’s positioning as a leading L2 platform and direct access to Coinbase’s distribution channels, Aerodrome will be a blue chip project for DeFi to flourish. It is conceivable that Base will become the main on-chain venue for retail trading, arbitrage, and stablecoin foreign exchange flows in the future. Since Aerodrome is a concentration of Base liquidity, it will benefit from it in the future.

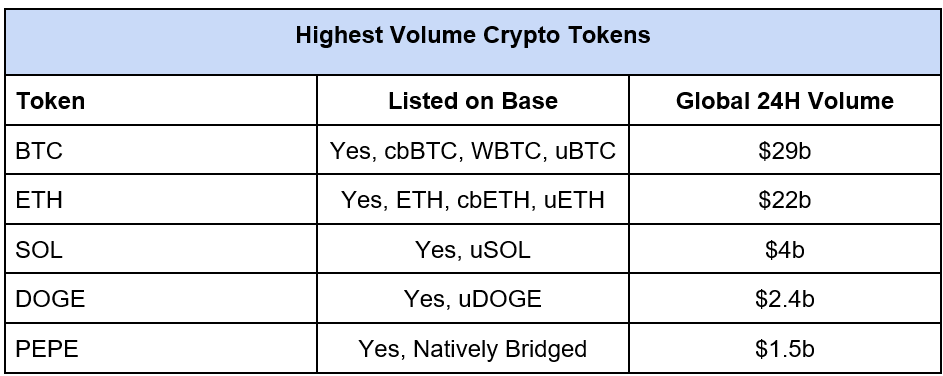

Given that cbETH and cbBTC trading pairs are already live, Coinbase is expected to expand its coverage of wrapped assets and introduce them to Base. Having high-volume pairs like cbSOL, cbDOGE, cbPEPE will incentivize more DEX/CEX arbitrage flows to migrate to Base/Coinbase. In addition, this will greatly improve the user experience of Base, because native tokens of other chains can be traded on Base without going through bridging, making trading on Aerodrome a CEX-like experience.

Data as of November 3

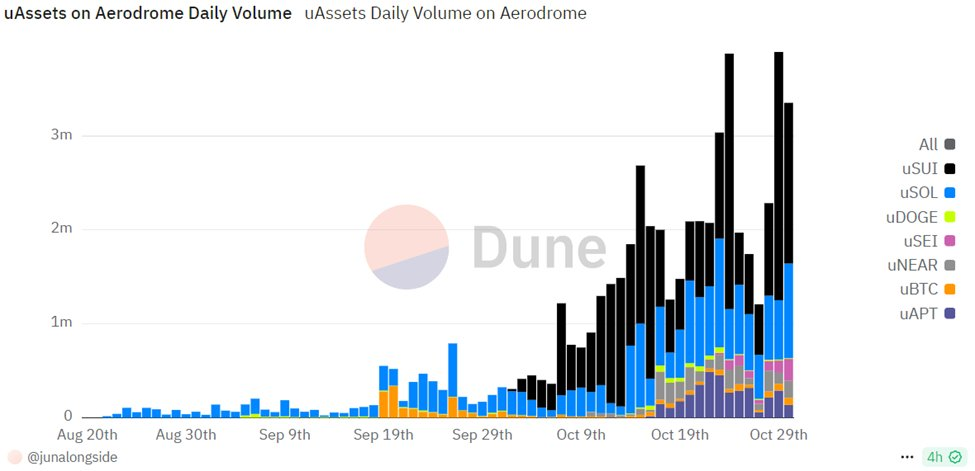

The promise of wrapped assets secured by the Universal Asset Protocol is already here. Aerodrome traders can now trade popular assets like SOL and DOGE without leaving the chain.

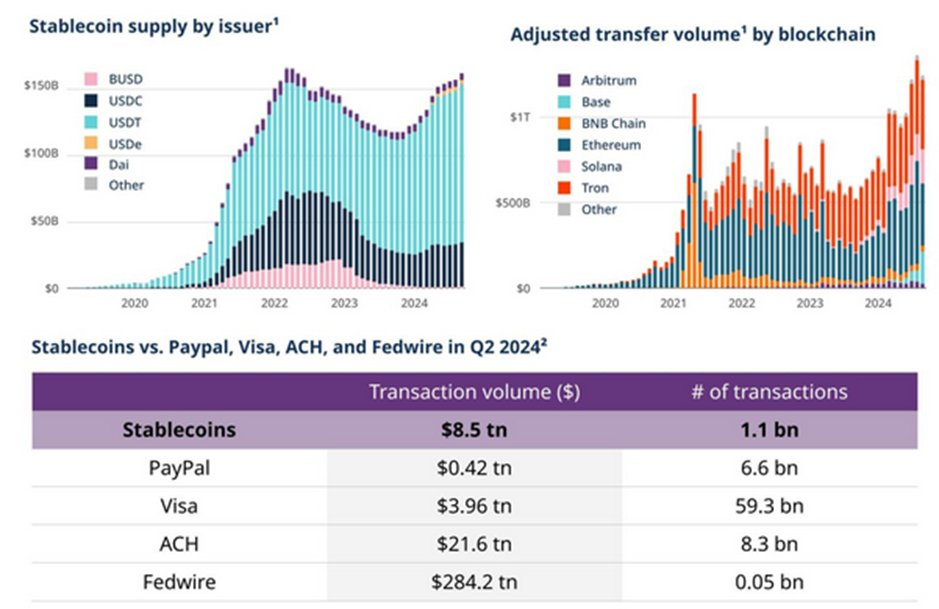

Stablecoin trading volume is also a promising growth area that could drive economic activity on Base. After acquiring Circle in 2023, Coinbase is in a position to drive Circle to adopt more stablecoins on Base. In addition to USDC and EURC, other high-volume global currencies such as the Japanese yen and the British pound are also likely to be listed in the future. Aerodrome has already begun to enter this massive market, which contributes $7 trillion in trading volume every day, with liquidity pools supporting USDC and EURC.

Source: A16z

Another favorable situation is that AI agents become active participants in DeFi protocols. In the past week, Terminal Truth, a robot trained with Internet knowledge, semi-autonomously interacted with Crypto Twitter and publicly supported the memecoin $GOAT on Solana. Luna, an AI agent created by Virtuals Protocol, is based on the Base chain. Luna has full autonomy over its tweets and on-chain transactions, has the ability to conduct token swaps, and has issued $LUNA token rewards to its followers.

Interest in $LUNA and other AI agent tokens created by Virtuals has boosted Aerodrome’s trading volume, making Aerodrome’s Virtuals/cbBTC pool one of the largest by TVL and volume.

Additionally, Coinbase appears to be making a broader push into consumer AI applications with a focus on AI agents. They recently launched Based Agents, an autonomous on-chain agent for developers to create financial transactions, unlocking unique use cases that were previously impossible. For example, conducting complex DeFi operations can become as simple as a conversation.

Turning distribution into a growth engine

A big part of the reason investors are hesitant about AERO is because of the perceived large token unlocking of AERO, which will reach about 40% after Epoch 67 (early December 2024). This inflation is much better than VC-backed projects, where large allocations from teams and investors are ultimately sold.

In the case of Aerodrome, the issuance mechanism has been largely fruitful and has contributed greatly to building a solid liquidity foundation. This kicks off a virtuous flywheel where Aerodrome attracts trading volume, which in turn generates fees for veAERO, ultimately making the issuance of AERO valuable, thereby consolidating Aerodrome's liquidity advantage.

Additionally, the team’s AERO allocation is capped at 4 years of veAERO. This creates an incentive structure where the only way for them to be well compensated is to act in the long-term interest of the protocol. These incentives are effective in alleviating concerns about inflation.

Conclusion

Aerodrome has proven its ability to grow rapidly as the liquidity engine on the Base chain and shows no signs of slowing down. This growth trend will continue given that Aerodrome has successfully solved the key incentive problem by uniting its key stakeholders (traders, LPs, token holders). Aerodrome will continue to benefit from its partnership with Coinbase/Base and the continued growth of DeFi on the blockchain.

But Aerodrome has yet to reach its full potential, with TVL expected to triple from current levels to $4 billion within a year, while monthly trading volume will reach $50 billion. This will be driven by easing liquidity conditions in TradFi and continued growth in Base. Aerodrome is one of the fastest growing DeFi protocols and is expected to see more significant growth in the future.

Related reading: How did Aerodrome, the most powerful native DEX on the Base chain, succeed?

You May Also Like

Bitcoin ETFs Outpace Ethereum With $2.9B Weekly Surge

CME Group to launch options on XRP and SOL futures