The Week Ahead: Tech Earnings and August Inflation Data Take Centre Stage

TLDR

- Federal Reserve rate cut expectations and August inflation data (CPI) will be key market drivers this week

- Apple unveiling iPhone 17 at Tuesday event with new “Air” model and Pro versions expected

- Major tech presentations at Goldman Sachs conference featuring Nvidia, Meta, Microsoft, and Broadcom

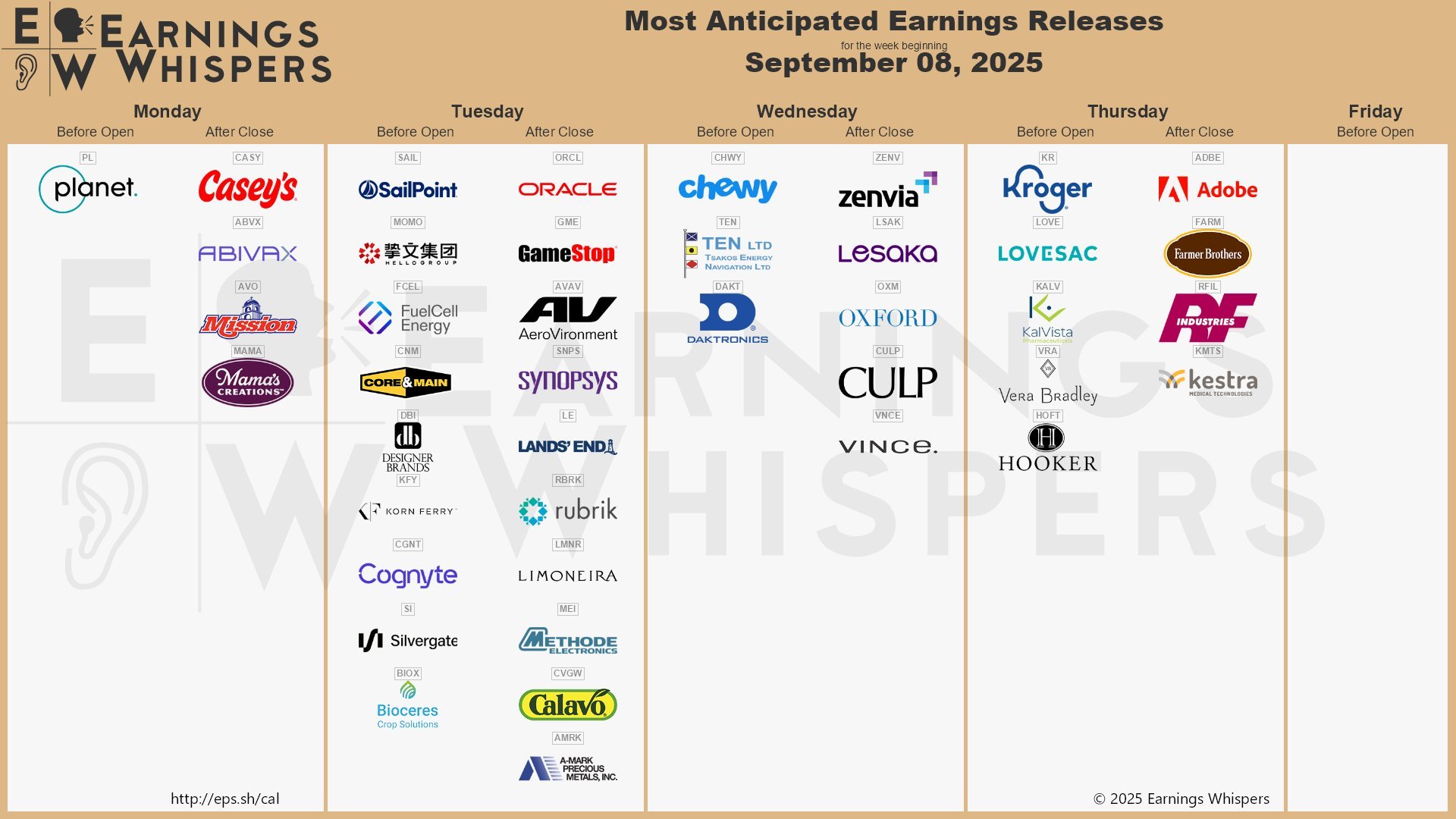

- Oracle and GameStop earnings reports highlight corporate calendar with focus on cloud deals and meme stock momentum

- Bitcoin faces historical September weakness with support levels at $100,000-$101,000 being closely watched

Financial markets prepare for a busy week as Federal Reserve rate cut speculation combines with major tech events. The Consumer Price Index report and Apple’s iPhone launch will drive investor attention across traditional and crypto markets.

The Federal Reserve faces mounting pressure to cut interest rates for the first time this year. Recent jobs data showing labor market weakness has increased expectations for monetary policy changes. The August Consumer Price Index report on Thursday will provide the final inflation data before the Fed’s September 17 decision.

July’s CPI showed prices rising less than expected, giving Fed officials room to consider rate cuts. Lower interest rates typically boost appetite for risk assets including cryptocurrencies. Bitcoin and Ethereum could benefit if the Fed follows through on expected policy changes.

Source: Forex Factory

Source: Forex Factory

Tech Giants Take Center Stage

Apple plans to unveil the iPhone 17 at Tuesday’s event. The company will showcase multiple new models including a thin “Air” version and upgraded Pro models. The launch comes as Apple continues expanding its product lineup with AI-enhanced features.

The Goldman Sachs Communacopia + Technology Conference brings together major tech leaders this week. Nvidia presents Monday, followed by Meta and Broadcom on Tuesday. Microsoft and Workday close out presentations Wednesday.

Oracle reports quarterly earnings Tuesday after CEO Safra Catz highlighted strong fiscal year momentum. The cloud provider has closed several major deals recently. Adobe’s Thursday update will reveal AI demand trends after the company boosted its full-year outlook.

Source: Earnings Whispers

Source: Earnings Whispers

GameStop delivers earnings Tuesday following a disappointing previous quarter. The meme stock reported 17% revenue decline and announced plans to raise new funding. Investor focus remains on whether momentum continues behind the original meme stock.

Crypto Markets Face September Headwinds

Bitcoin enters its historically weakest month with average September returns of -3.77% since 2013. The “Red September” effect stems from portfolio rebalancing, tax-loss harvesting, and increased institutional bond allocations.

Source: TradingView

Source: TradingView

Current Bitcoin prices hover around $108,000-$110,600 after declining from August highs. Technical analysis identifies $100,000-$101,000 as critical support levels. Lower trading volumes and dropping Fear and Greed Index readings signal cautious market sentiment.

Altcoin markets may see different patterns despite Bitcoin weakness. Some analysts predict “Altcoin Season 3.0” could begin, offering opportunities in smaller cryptocurrencies regardless of Bitcoin’s movement.

Producer Price Index data arrives Wednesday, providing additional inflation insights. Consumer sentiment readings Friday will round out the week’s economic calendar. Initial jobless claims and federal budget data provide supplementary market signals.

Rate cuts historically support speculative investments like Bitcoin and Ethereum through easier monetary conditions. However, geopolitical uncertainty and tariff escalation maintain market anxiety across asset classes.

The combination of Fed policy expectations, major tech earnings, and crypto’s seasonal patterns creates multiple volatility sources. Traders watch for sudden changes in risk appetite and positioning as economic data unfolds throughout the week.

The post The Week Ahead: Tech Earnings and August Inflation Data Take Centre Stage appeared first on CoinCentral.

You May Also Like

GCC and India to sign terms for start of free trade talks

PEPE Holders Looking For The Next 100x Crypto Set Their Sights On Layer Brett Presale