Senator Cynthia Lummis Pushes New Crypto Bill to Clarify SEC and CFTC Roles

The post Senator Cynthia Lummis Pushes New Crypto Bill to Clarify SEC and CFTC Roles appeared first on Coinpedia Fintech News

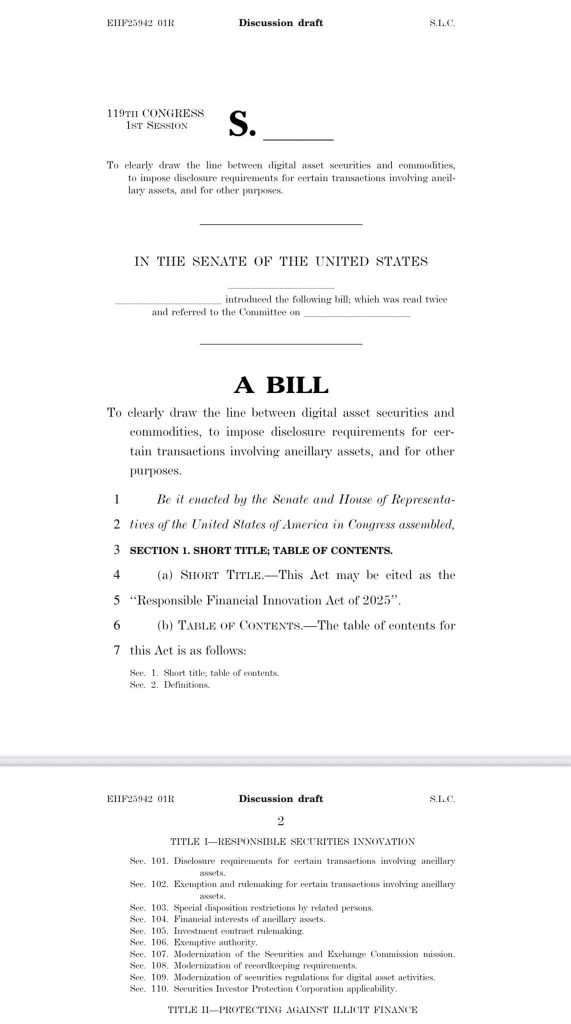

U.S. Senators introduced an updated draft of the market structure bill on Friday, aiming to bring more clarity to digital assets and cryptocurrencies.

One of the most notable changes is that stocks and securities will not be treated as commodities if they are tokenized. The bill also excludes certain crypto activities, such as DePIN, staking, and airdrops, from securities law.

Under Section 101, the bill blocks the SEC and private firms from bringing lawsuits against existing tokens unless fraud is involved. This provision is designed to stop regulators from overreaching into the crypto market.

It also clearly states that NFT transactions will not be treated as securities, meaning buying, selling, or transferring an NFT is not the same as trading stocks. This approach was missing in the earlier House version.

SEC and CFTC Coordination

Crypto journalist Eleanor Terrett reported that the bill creates a joint advisory committee under Section 701, requiring the SEC and CFTC to coordinate on crypto oversight.

In addition, Section 702 directs the agencies to resolve disputes together, preventing regulatory turf wars.

Protection for Developers and DeFi

The updated draft includes strong protections for software developers and DeFi platforms.

- Section 505, the “Blockchain Regulatory Certainty Act,” makes sure developers are not treated as money transmitters simply for writing or publishing code.

- DeFi platforms get exemptions so they are not forced to follow the same rules as centralized companies.

- The bill also protects self-custody wallets, ensuring users can safely hold their own crypto.

As one senator put it, the goal is to make sure “developers and innovators aren’t punished for building.”

When Will the Bill Pass?

The House passed its version in July, but the Senate is still reviewing its draft. The two versions must eventually be combined before reaching President Trump’s desk.

Senator Cynthia Lummis told CNBC:

“We want this on the president’s desk before the end of the year.”

She expects the Senate Banking Committee to vote this month on the SEC provisions, while the Senate Agriculture Committee will review the CFTC sections in October. A full Senate floor vote could happen as early as November.

You May Also Like

Water150 Unveils Historical Satra Brunn Well: The Original Source of 150 Years of Premium Quality Spring Water Hydration

Amazon signs AI and cloud partnership to accelerate growth