Data interpretation of PNUT's on-chain chips: Robot 22U becomes 2.91 million, creating a 132,000-fold return, some people missed 34 million, and some people raked in 13 million

Author: Frank, PANews

The past November was destined to be a month for Bitcoin and MEME to dance together. And PNUT became the most dazzling star in the MEME track in November. It created a record of a market value from 0 to a maximum of more than 2 billion US dollars in a single month, and also created countless diamond hands and wealth myths of smart money.

Putting aside Musk's orders and the news of Binance and other mainstream exchanges going online, how did the smart money and diamond hands grab this golden project? What is the current distribution of chips on the chain? PANews conducted a large amount of data analysis on the top 1,000 holding addresses on the PNUT chain, trying to uncover the secrets of these top chips.

First, the data source and method of this analysis are explained here. This analysis uses the top 1,000 holding addresses on the chain on November 28 as the analysis object. Due to the source of transaction data, the robot addresses, exchange addresses, trading pool addresses or abnormal addresses are removed. A total of about 624 addresses were analyzed for their first purchase or transfer (price, amount), first sale or transfer (price, amount), some related addresses, some large-scale addresses, and early internal trading addresses.

Diamond Hands Faster Than Musk

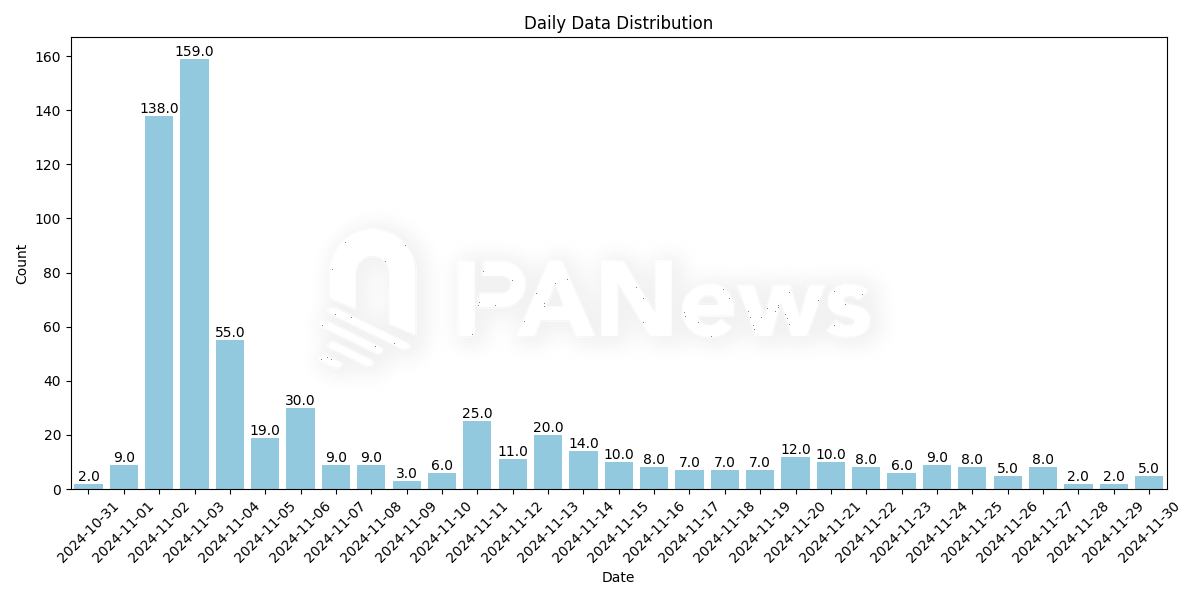

First purchase time distribution chart

Through analysis, PANews found that the initial purchase time of these large investors was mostly concentrated between November 2 and November 4. Among them, the largest number of addresses purchased on November 3, which was 159. November 2 was the second largest day, with 138 addresses buying for the first time on this day. From the timeline, Musk first mentioned the Peanut incident at around 3 a.m. on November 3.

The purchase time of these diamond hands was even earlier than this time. In fact, the incident happened on October 31, and the PNUT token was also born on October 31. On November 2, many American media began to ferment the topic of "Rat Lives Matter", which shows that many smart money's grasp of the subject matter is not limited to following Musk, but keeps a close eye on hot topics and events in the West.

But after Musk’s call, we did see that the most smart money addresses chose to intervene during this time period.

Enter when others are panicking

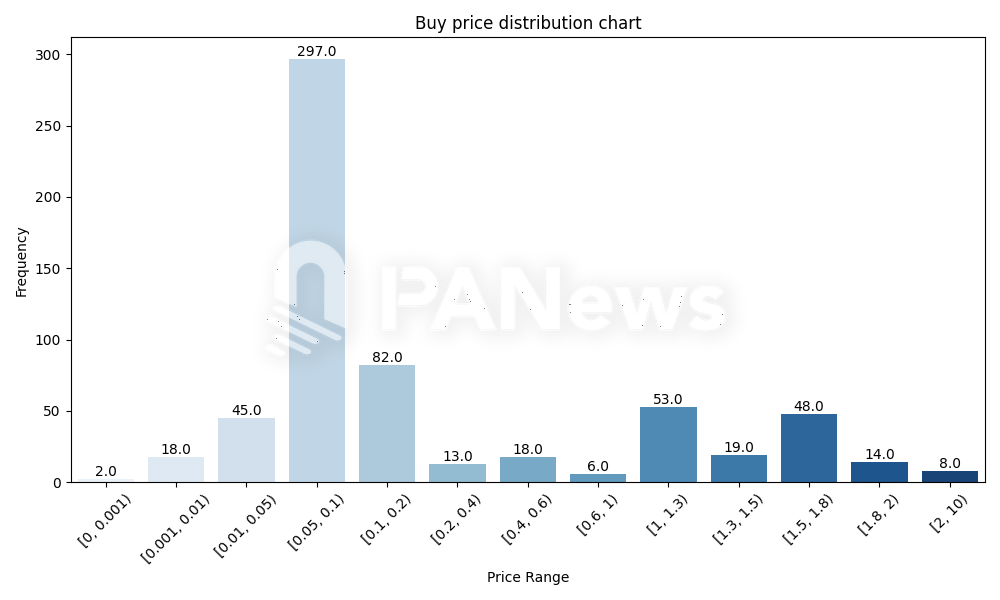

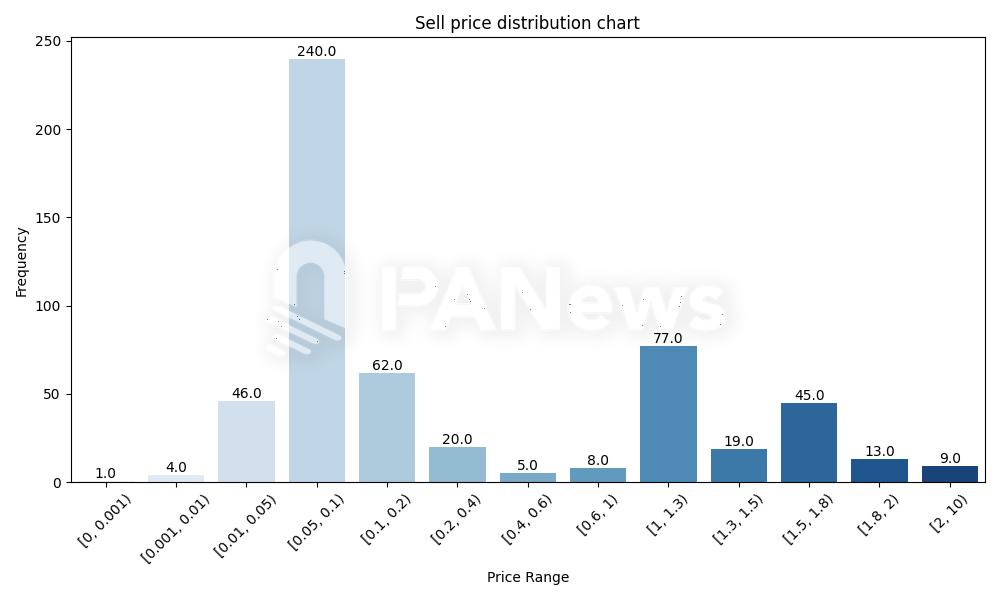

Judging from the purchase price, almost half of the smart money chose to buy PNUT for the first time in the price range between 0.05 and 0.1.

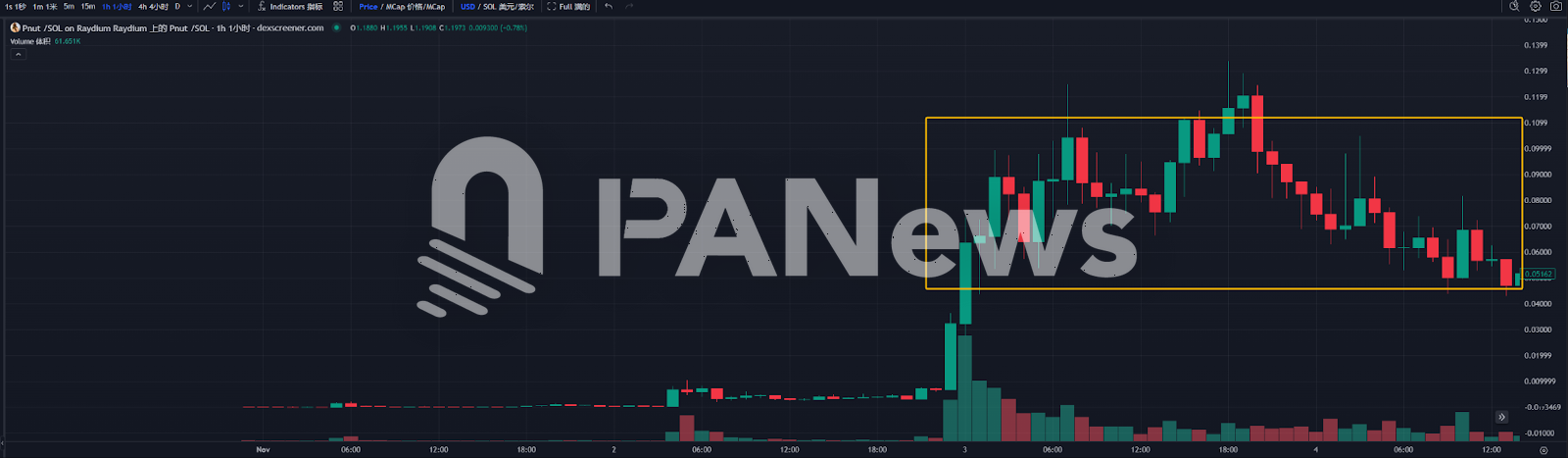

From the chart, the yellow box is basically the time and price range when the top 1,000 large holders bought the most. In fact, before this price range, PNUT had experienced two increases, and its market value also reached the range of 50 million to 100 million US dollars. Normally, a short-term increase of a MEME coin to the range of 50 million to 100 million US dollars is a good time for many people to leave the market, but it is clear that the real main force seems to choose to enter the market here. From this, it can be seen that the secret of smart money may not be to grab early chips. But to choose to enter the market when others dare not.

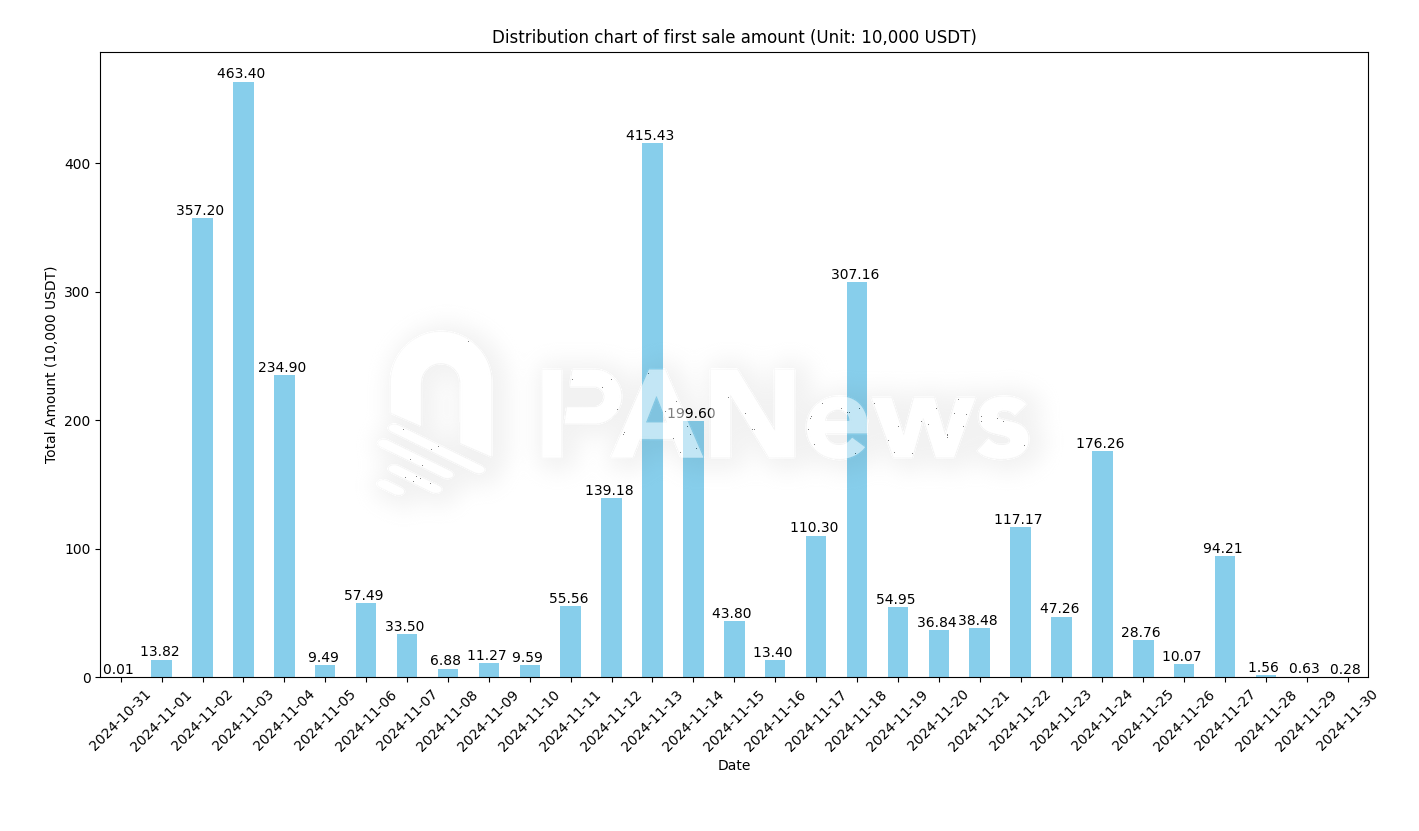

In addition, judging from the total amount of purchases on each date, the main capital inflows of the top 1,000 major players were concentrated between November 2nd and 4th, and November 11th and 14th. The first period was when PNUT just started to become popular, and most of the major funds were deployed at this stage. The second period was when Binance and other exchanges announced the launch of PNUT. At this stage, another part of the major players saw the certainty and decided to enter the market. However, since the market value of PNUT was close to 1 billion US dollars at this time, these purchases were relatively not obvious. On the contrary, it can be seen that between November 2nd and 4th was the obvious entry period for the major players.

Large investors generally hold their positions for longer periods of time

From the perspective of holding habits, the main investors hold positions longer than retail investors. Among the addresses analyzed, the average holding time is 39 hours, and the addresses that have not been sold since purchase are not counted here. If the holding time of addresses that have never sold is included, the average holding time will be higher.

Judging from the selling or transfer prices, the first selling or transfer prices are basically concentrated in the price range of 0.05~0.1 USD. However, one factor that may need to be considered here is that many large addresses here will disperse the tokens to new addresses as soon as they buy, which is not considered selling. Therefore, the selling price range is not of much reference significance here. According to further analysis of individual large addresses by PANews, several addresses holding more than 10 million USD have not sold so far.

Who is the real diamond hand? There is an address with a profit of over 10 million

During the investigation, PANews found that the tokens in multiple addresses all came from the same addresses. These addresses are basically new addresses used by these real big players to disperse funds. In this regard, PANews conducted some investigations on the real big players behind these.

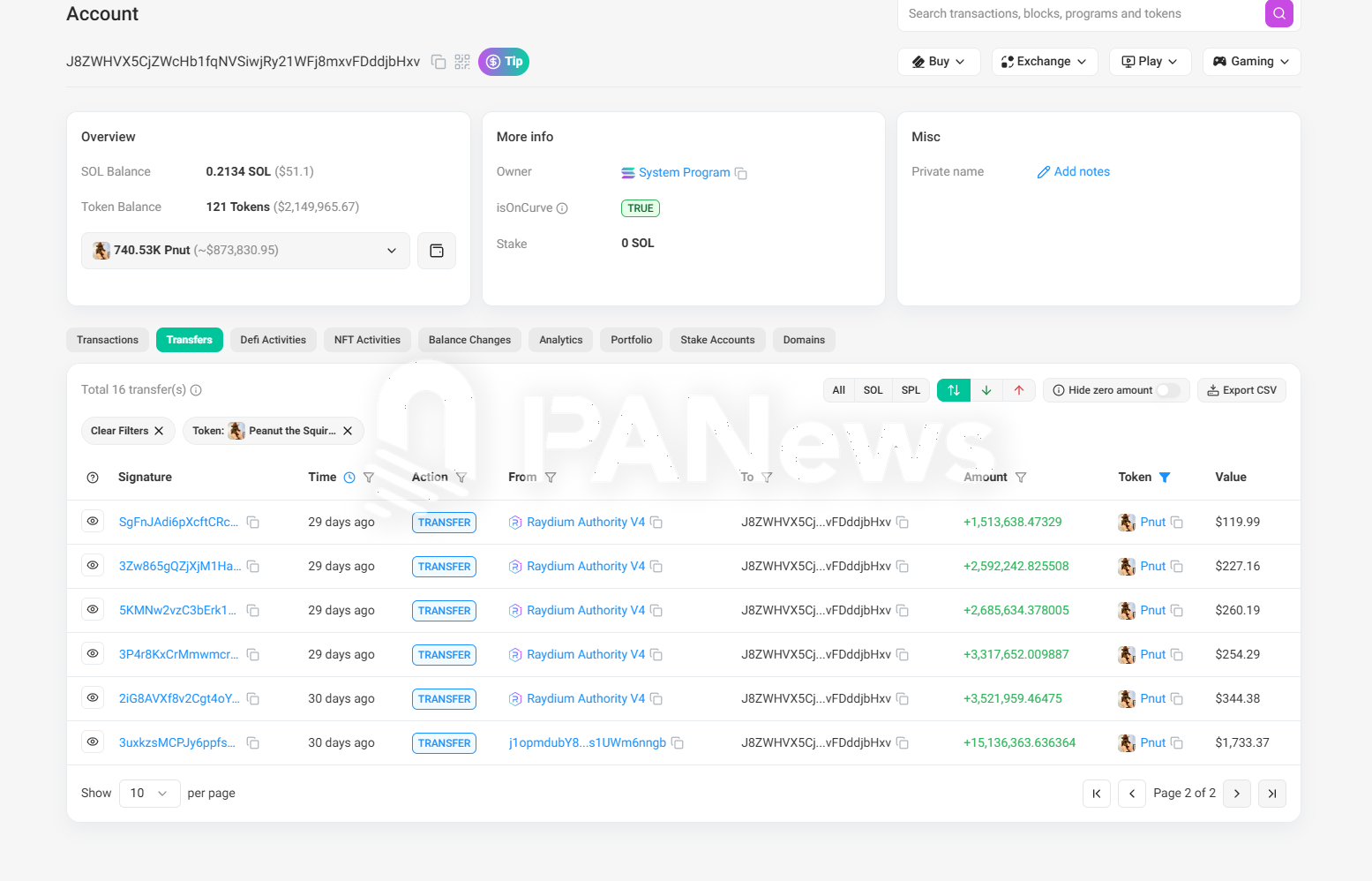

Among these large accounts, the most eye-catching one is J8ZWHVX5CjZWcHb1fqNVSiwjRy21WFj8mxvFDddjbHxv (hereinafter referred to as "J8ZWH").

The address first bought 1513,000 PNUT at 11-01-2024 01:48:12, spending 10 SOL, and then kept replenishing the position, holding up to 28 million PNUT, and his average holding price was about $0.0001. Calculated at a maximum of $2.46, his rate of return could reach 24,600 times. On November 2, 15.97 million PNUT were sold, earning $109,371. Currently, he still holds nearly $12.6 million of PNUT.

Another address 2h7s3FpSvc6v2oHke6Uqg191B5fPCeFTmMGnh5oPWhX7 (tonkadriving.sol) is also quite legendary. This address discovered PNUT on November 1 and invested madly to buy it, spending $67,000 to buy a total of 9.15 million PNUT. The market value of PNUT at that time should be only about $7.3 million. He completed the position in half an hour, and during his purchase process, he also raised the token to $0.01. Then other players began to sell, and tonkadriving.sol continued to absorb chips in the process, and finally completed the initial position at an average price of $0.007.

On November 3, tonkadriving.sol also sent 4 million PNUT to the creator of PNUT, which was worth $244,000 at the time. If tonkadriving.sol knew that these tokens were worth more than $10 million at most, would he regret the donation?

The number of early internal players has dropped to 2.91 million due to forgetting 22U

For MEME players, many people like to grab the internal market. The earlier they buy, the higher the yield. PANews analyzed the 276 internal market addresses participating in the internal market and found that only 4 addresses finally appeared within the top 1,000 in the holding ranking.

Among them, taking B8S2aupPvX3ARWgyEYS1gbHc3jTb2Ta4Q2i37HUewGnf as an example, this address used 2 addresses to purchase 13.75 million PNUT tokens at a total cost of about $280, and sold almost all of these tokens at $5,657 in the following two days. On November 16, the address spent another $148,000 to buy back 86,000 PNUT coins. According to the earliest holdings, he missed out on up to $34.1 million.

The strongest player in the inner market is gUPH84k3YhMSjXSfXrTAUzCjuqQinQMZg9TkAkoSR77, which spent $22 to buy 2.37 million PNUT in the inner market and has not traded since then. These tokens are currently worth about $2.91 million. His rate of return is as high as 132,000 times, which should be regarded as a model of 10U war gods. However, judging from the trading habits, this address is most likely a trading robot address, which is still conducting high-frequency transactions of hundreds of dollars. Perhaps the owner of the address has long forgotten that the unintentional act at that time has reaped unimaginable benefits. Another inner market address CrjPMnpDyJ16qpo1hR74iEQ2bypvAeMqxmxm42tB9ppr also bought $22, and chose to sell a fixed 5,902 each time. So far, $194,000 has been sold, and the account still holds tokens worth about $82,000.

From this point of view, the way to keep the highest profit is to forget it, but you can't forget it completely.

In the process of analyzing PNUT, we have seen many lucky stories of getting rich quickly, and also found many regrets. Many addresses had very low holding costs in the early stage, but almost all of them were sold before PNUT really rose. From the trading habits, we can see the style of these players. Many of them do not have a large amount of funds, and they will choose to clear all their positions when the amount of funds increases from tens of dollars to thousands of dollars. However, they did not know that they missed tens of millions of dollars in profits, and this is very likely the biggest opportunity in their trading career.

Those with large accounts are generally much calmer. They invest tens of thousands to millions of dollars, but choose to hold on. At most, they will choose to withdraw the principal when the profit is large. The rest is to let the bullet fly for a while. Perhaps, there is a saying that is very appropriate here: people can only earn money within their cognition.

But then again, as an ordinary person, it is not easy to earn dozens of times in one transaction. Moreover, without the release of these chips, PNUT may find it difficult to become the king of MEME in November.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%