Pi Network’s Latest Update Explained – And Why It’s a Big Deal

TL;DR

- The team behind Pi Network introduced a new update just a few days ago that many users had wanted for years – support for Linux.

- Here’s why the Core Team believes it could be a game-changer, at least for those opting to use the alternative OS.

Why the Linux Addition Matters?

As CryptoPotato reported at the end of last week, the Pi ecosystem has expanded its OS capabilities beyond Windows and Mac with the release of its Linux Node software. The move aims to enhance the project’s decentralized backbone, as the team is also preparing for a major protocol upgrade from version 19 to 23.

Obviously, the introduction of a third OS alternative allows for greater flexibility for developers and partners. Until now, many of them had to rely on custom node builds to work with Pi’s infrastructure. Now, they can migrate to standardized node software, which should ensure faster maintenance, smoother protocol updates, and overall network consistency.

For the tech-savvy, the Linux Node allows greater participation in the ecosystem, even though it’s not directly linked to mining rewards. It still provides broader accessibility for devs and open-source contributors who prefer such environments.

The aforementioned upgrade from version 19 to 23 is considered the most ambitious one for the protocol yet. It’s influenced by Stellar and aims to bring expanded functionality and improved control layers. Its rollout will be staged in a few steps to minimize disruption:

- Testnet1 upgrades begin this week, with minor outages possible as the new community node container is deployed.

- Testnet2 and Mainnet will follow in the coming weeks, bringing the full ecosystem to protocol version 23.

- Short outages may also affect centralized exchanges (CEXs) as they adapt to the upgrade.

This upgrade also aims to address some of the KYC issues with the project, but we will dedicate a separate article on this, as there has already been community backlash or doubts, to say the least.

PI Token Reacts

Perhaps driven by these positive developments within the broader Pi ecosystem, the protocol’s native token is among the few that ended the week in the green. Unlike most of its altcoin brethren, PI has jumped by over 5% since this time last week and trades close to $0.37 as of press time.

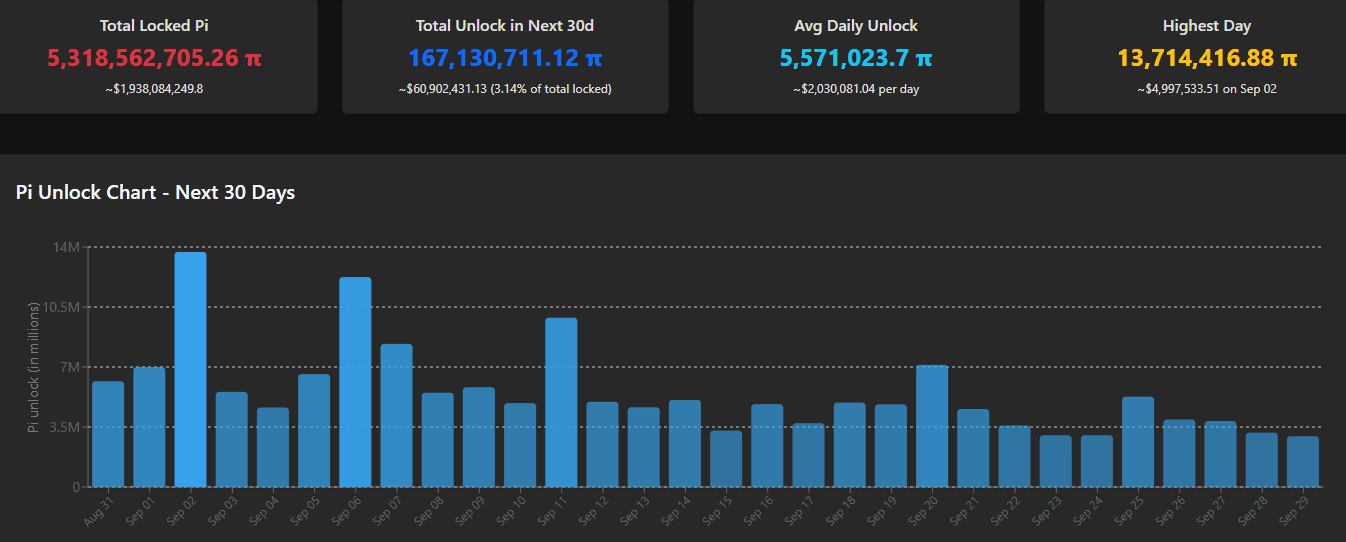

Recall that the asset plunged to a new all-time low on August 26 of $0.33 (on CoinGecko) but has recovered 10% of value since then. However, it could face some enhanced selling pressure in the following days due to the large number of token unlocks scheduled for September 2 and September 6. After that, though, the unlocks should reduce the pressure, at least in theory.

PI Token Unlock Schedule. Source: Piscan

PI Token Unlock Schedule. Source: Piscan

The post Pi Network’s Latest Update Explained – And Why It’s a Big Deal appeared first on CryptoPotato.

You May Also Like

BFX Presale Raises $7.5M as Solana Holds $243 and Avalanche Eyes $1B Treasury — Best Cryptos to Buy in 2025

Moonshot MAGAX vs Shiba Inu: The AI-Powered Meme-to-Earn Revolution Challenging a Meme Coin Giant