Bitcoin Price Outlook: Key Levels to Watch as BTC Tests $60K Support

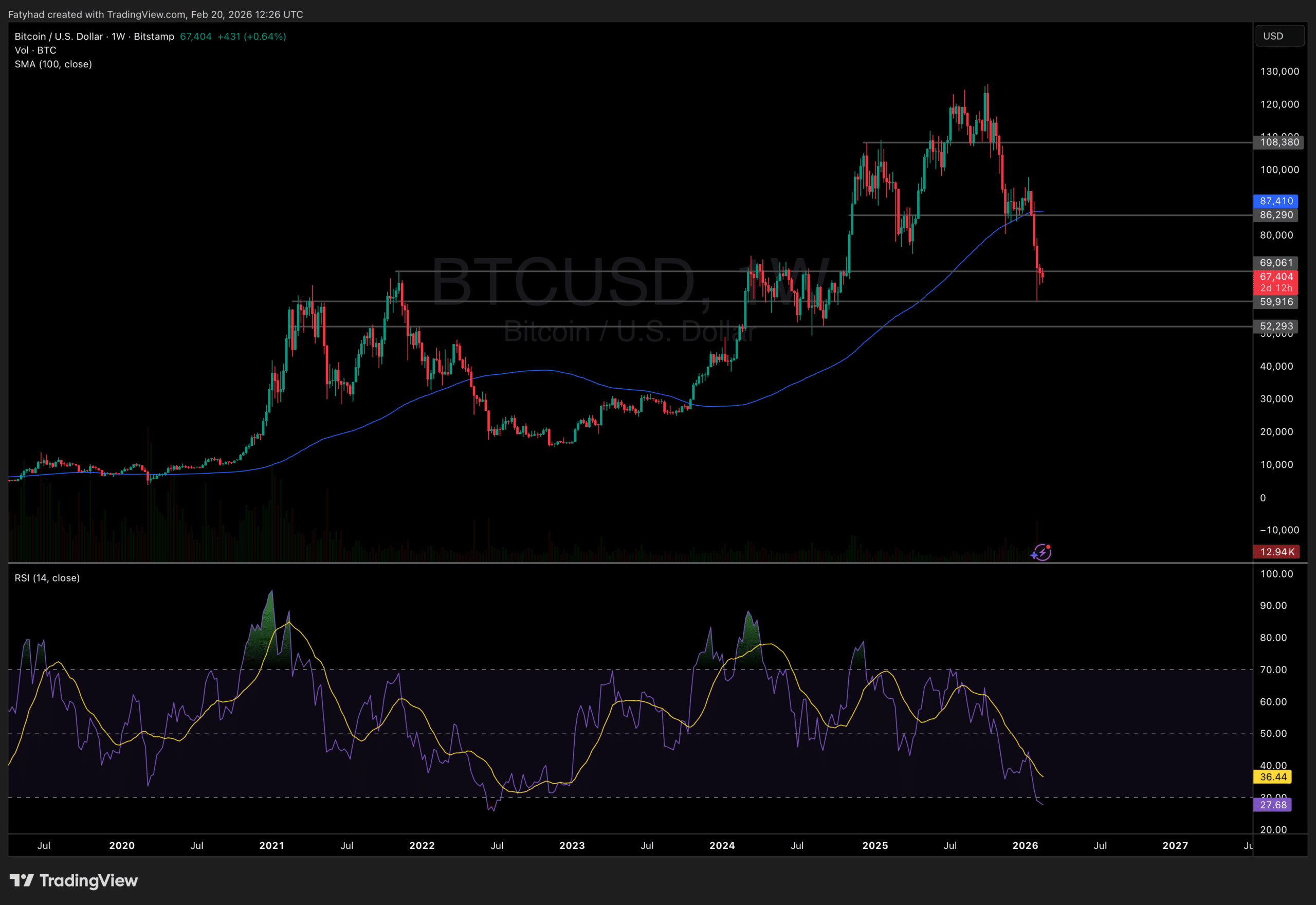

Bitcoin price action has entered a critical consolidation phase, with the leading crypto currently testing the psychological and structural floor around $60,000-$66,000. After retracing from local highs, BTC $67 052 24h volatility: 1.6% Market cap: $1.34 T Vol. 24h: $43.93 B is trading within a tightening range defined by significant support and resistance levels. Traders are closely monitoring this corridor, as technical formations suggest an imminent breakout that could dictate the market’s direction for the coming quarter.

As volatility compresses, the market awaits a decisive move to confirm whether this is a mid-cycle accumulation or a precursor to a deeper correction.

DISCOVER: Best Solana Meme Coins to Buy Now

Bitcoin Price Analysis: Key Support and Resistance Levels

Bitcoin Price Analysis Source:

Can the $60K support hold against mounting sell pressure? A decisive break below $60,000 could expose the next major demand zone between $52,000 and $55,000. On the upside, bulls face formidable obstacles. The immediate resistance lies at $69,000, followed closely by the upper boundary of the consolidation channel at $72,000.

Price is trading below the 100-week moving average (blue line), a key trend indicator that often signals broader market direction. The RSI has dropped toward oversold territory, reflecting weakening momentum but also hinting at a possible short-term bounce.

EXPLORE: What is the Next Crypto to Explode in 2026?

Fear & Greed Index Falls to Extreme Fear Levels

The bearish pressure testing these support levels is partially driven by institutional flows. Recent market activity shows that Bitcoin price drops amid ETF outflows and weakening institutional interest, creating a drag on upward momentum. Not to mention how low is the sentiment right now, with the Fear&Greed index being at 8: Extreme Fear.

Fear & Greed Index Source: Coinglass

As Bitcoin price prediction models adjust to record $133M ETF outflows and extreme fear, the psychological barrier at $60,000 becomes even more significant.

The resolution of the current consolidation will likely set the trend for the remainder of the year. If the Bitcoin price can reclaim the $72,000 level, it would invalidate the bearish thesis and reopen the path to price discovery. However, the macroeconomic backdrop remains complex.

Traders should consider broader market correlations, as Arthur Hayes recently noted the Bitcoin-Nasdaq divergence and liquidity concerns that could dampen buying pressure.

Can Bitcoin Hyper’s Layer-2 Presale Unlock the Next Growth Cycle?

Bitcoin’s price is now squeezed between key support near $60,000 and resistance around $69,000–$72,000, with momentum below the 100-week average and sentiment in extreme fear. A sustained break below $60,000 could open the door to deeper declines, while reclaiming range highs might signal renewed confidence.

While we await Bitcoin’s price trajectory, the Bitcoin Hyper (HYPER) presale presents a contrasting long-term narrative aligned with Bitcoin’s evolving ecosystem. HYPER is a Layer-2 network for Bitcoin designed to offer faster and cheaper transactions. It achieves this by integrating a high-throughput virtual machine architecture similar to Solana’s Virtual Machine (SVM) with a canonical bridge to Bitcoin’s base layer.

The presale is structured in multiple stages, with price increases at each phase and no private allocations, making the early rounds fully public.

One of Bitcoin Hyper’s standout features is its staking mechanism, which reallocates a portion of tokens for early holders to earn rewards. These incentive programs are intended to support network participation and long-term holding, with current rates reported to be attractive relative to other presales, though actual yields can vary.

HYPER is also designed for wider ecosystem roles, including governance participation, gas payments for transactions on the Layer-2, and future utility within decentralized applications that tap into Bitcoin’s security while offering broader programmability.

For investors watching Bitcoin’s price structure and sentiment, Bitcoin Hyper represents a technology-oriented approach tied to improving Bitcoin’s scalability and opening it up to new use cases beyond simple transfers. Whether Bitcoin’s consolidation resolves to the upside or downside, early access through the HYPER presale provides a way to engage with the broader narrative of Bitcoin-connected innovation.

Join the Bitcoin Hyper community on Telegram and X.

Visit Bitcoin Hyper Here

DISCOVER: How to Buy Bitcoin Hyper – 2026 ICO Guide

nextThe post Bitcoin Price Outlook: Key Levels to Watch as BTC Tests $60K Support appeared first on Coinspeaker.

You May Also Like

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

Crypto Executives Advocate for U.S. Strategic Bitcoin Reserve Legislation