XRP Price: Standard Chartered Cuts 2026 Target to $2.80 as Momentum Stalls

TLDR

- XRP is trading around $1.40, down over 40% from its January 2026 high of $2.40

- Standard Chartered cut its end-2026 XRP target from $8 to $2.80, but kept its 2030 target at $28

- XRP ETF assets dropped from $1.6 billion to $1.0 billion, though February inflows remain positive at $45 million

- Whales sold XRP at $1.55, pushing the price toward a likely retest of the $1.15–$1.20 range

- The December PCE inflation data (due Feb. 20) is the next major market catalyst for XRP

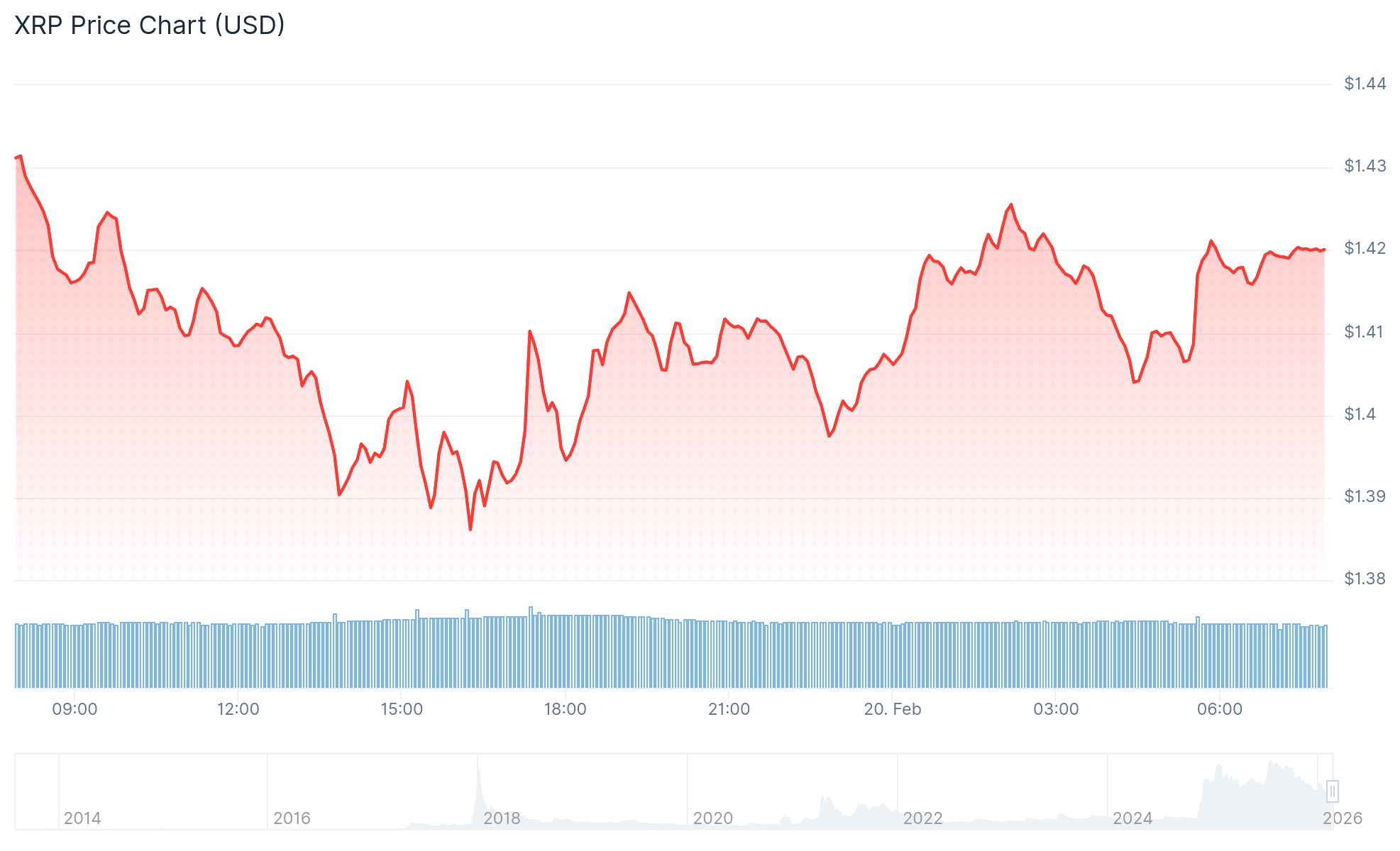

XRP is trading around $1.40, sitting more than 40% below its early-January 2026 peak of $2.40. The token has also lost around 60% from its July 2025 high near $3.40.

XRP Price

XRP Price

The drop is part of a broader crypto market selloff that has wiped close to $2 trillion in market value since October 2025.

Standard Chartered has revised its XRP price target for end-2026 from $8 down to $2.80. The bank kept its long-term 2030 target at $28. The same desk cut targets for Bitcoin, Ethereum, and Solana as part of a wider repricing across the sector.

Even at the reduced $2.80 target, that still represents roughly double XRP’s current price.

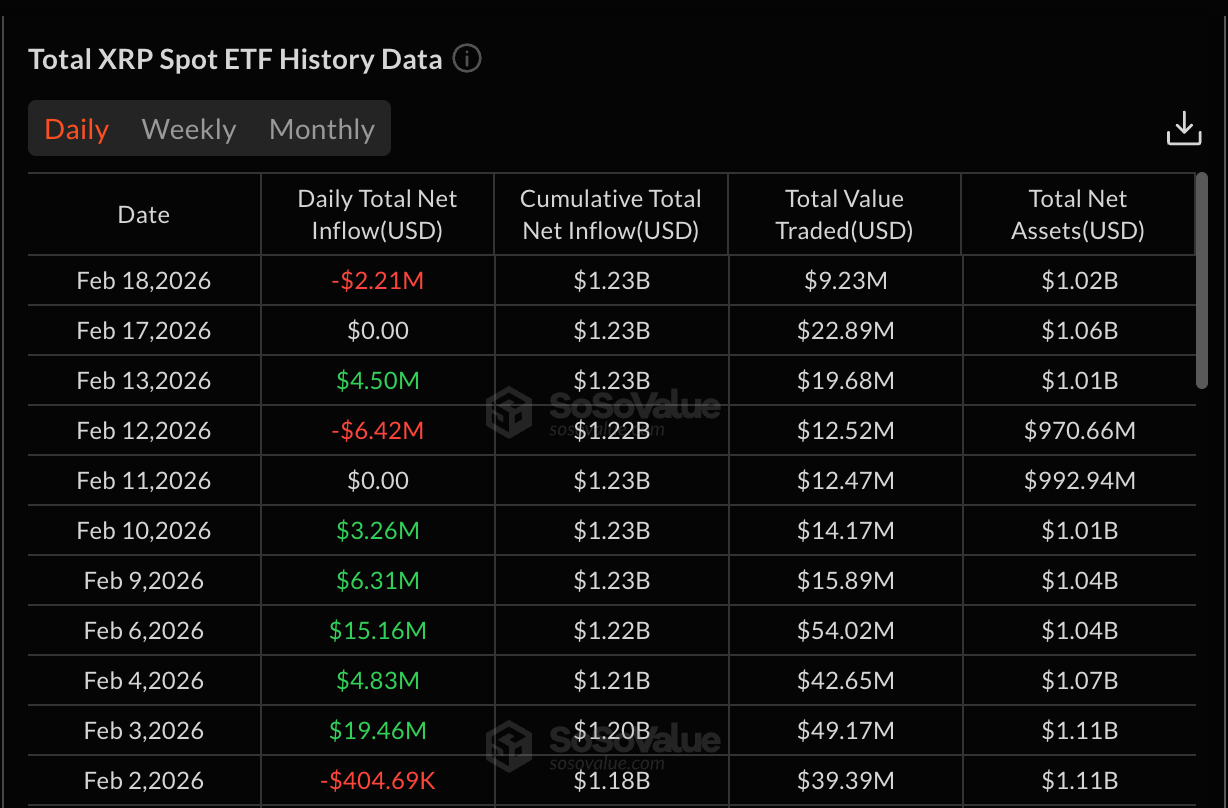

XRP ETF assets have fallen from a peak of $1.6 billion in early January to around $1.0 billion now. That 40% drop mirrors the fall in spot price. Still, February has seen net ETF inflows of around $45 million, with $7.5 million coming in last week alone.

Source: SoSoValue

Source: SoSoValue

Whale Selling Caps Recovery Attempts

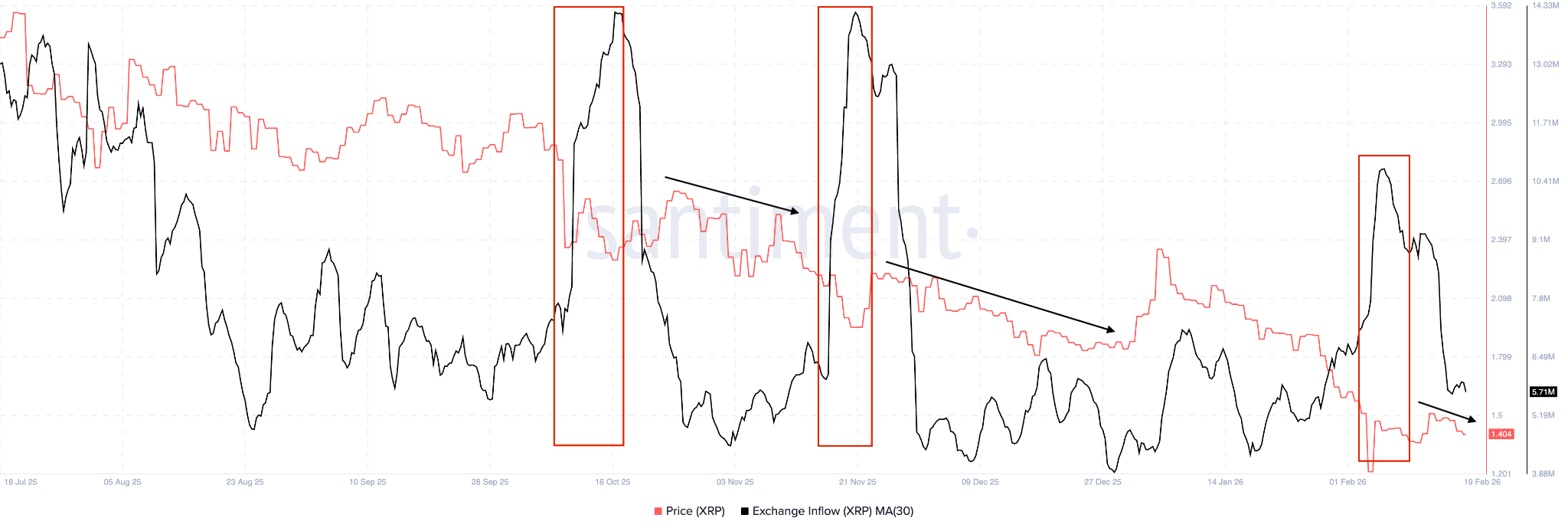

XRP exchange inflows spiked ahead of a recent move to $1.55. When the price hit that level, whales offloaded their holdings during a weekend session when liquidity was thinner. This pattern has repeated several times over recent months.

Source: Santiment

Source: Santiment

Following that rejection at $1.55, XRP has dipped to $1.40 for three straight days. Its 30-day loss now stands at 27%.

Analysts point to the $1.15–$1.20 range as the likely next destination. That zone previously acted as a strong demand area and could attract buyers again if price reaches it.

On the daily chart, a long upper wick on the February 15 candle confirmed the bearish rejection. The Relative Strength Index has moved above its signal line, but there are no clear signs of a reversal yet.

PCE Data Could Be the Next Trigger

The December PCE inflation print, due February 20, is being watched closely. November PCE came in at 2.8%, hotter than expected, which pushed investors to scale back rate-cut bets and weighed on risk assets including crypto.

Alternative inflation trackers like Truflation are showing headline PCE near 1.54% and core near 1.94%, both well below the official November reading. If official data confirms that cooling trend, it could ease pressure on risk assets.

A hot print, however, would likely push XRP back toward $1.35 and potentially reopen the stress zone near $1.20.

Key resistance sits at $1.47–$1.50, where the 21-day moving average is pressing down on price. All major daily EMAs remain pointed lower.

XRP hit a low around $1.20 during early February, which attracted buyers and triggered a short-term rebound. Analysts say $1.15 could serve as a local bottom if the token falls further, with a potential relief rally back toward $1.55 possible from that level.

The post XRP Price: Standard Chartered Cuts 2026 Target to $2.80 as Momentum Stalls appeared first on CoinCentral.

You May Also Like

Artificial Intelligence Does Not Replace Work — It Multiplies It

Adoption Leads Traders to Snorter Token