Saylor Stays Bullish as Google Searches for “Bitcoin Going to Zero” Hit Record High

Highlights:

- Michael Saylor insists Bitcoin accumulation is vital, even during steep market downturns.

- As panic grows, searches for “Bitcoin going to zero” surge to record highs.

- Meanwhile, Hugh Hendry positions long and predicts BTC could eventually climb toward $1 million.

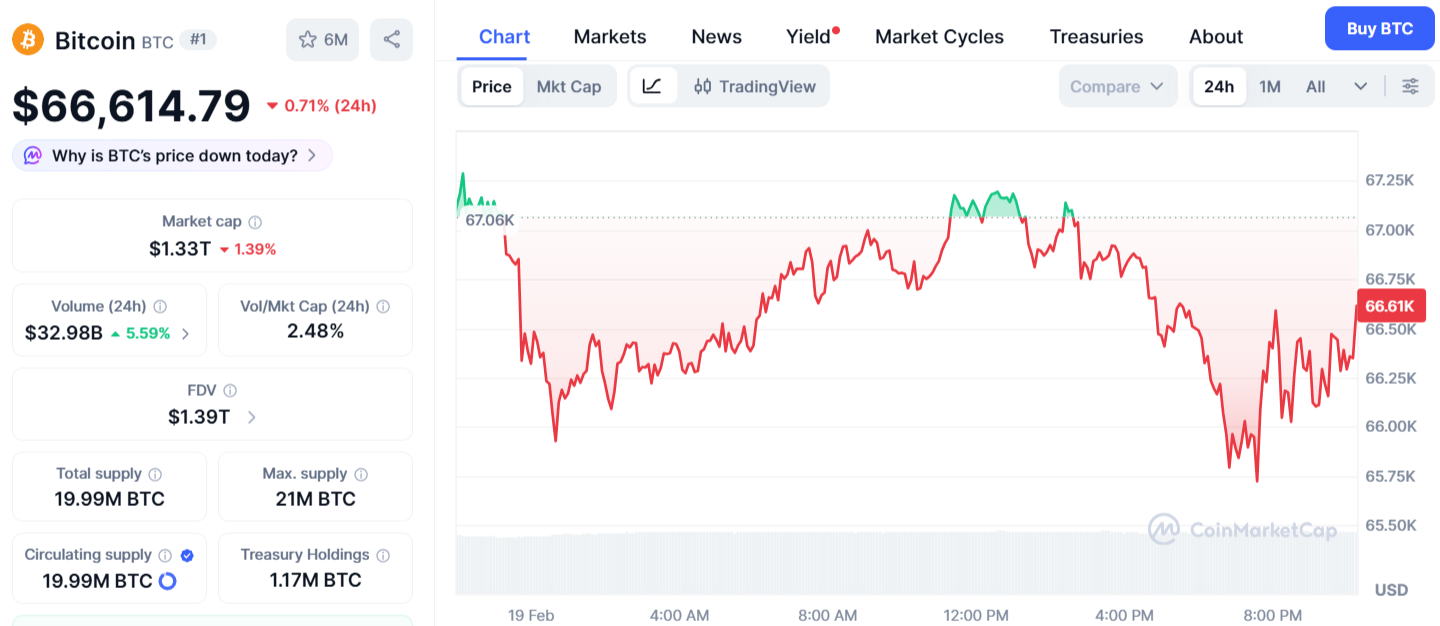

Bitcoin has experienced one of the most significant drops in its recent history. From a high valuation of $2.52 trillion in October, when the price peaked at $126,000, the asset has lost $1.2 trillion in value. Currently, its valuation stands at $1.33 trillion, with the asset trading at $66,000. This significant drop in value means that Strategy, a firm headed by Michael Saylor, has an unrealized loss of $7.2 billion, compared to the $32 billion gain it previously experienced.

BTC Price Chart: CoinMarketCap

BTC Price Chart: CoinMarketCap

Saylor Remains Bullish Despite 47% Bitcoin Drop

Despite the steep decline, Michael Saylor remains firm in his stance. He recently declared on X that he has “never been more bullish” on Bitcoin. His optimism comes at a time when the asset has dropped 47% from its all-time high, and analysts warn of further declines.

Michael Saylor kept urging investors to “go Bitcoin today,” saying money will not fix itself. His remarks showed strong support for Bitcoin accumulation, even during market dips. This optimism matched Eric Trump’s views at American Bitcoin. Speaking at an event at Mar-a-Lago, Trump predicted Bitcoin could hit $1 million. Saylor reposted this statement on X, reinforcing his own conviction.

Strategy has also remained aggressive. The company invested $4.093 billion in Bitcoin acquisitions this year alone, despite the asset depreciating by 24% during the same period. In February, it announced three distinct acquisitions. On February 17, the company acquired 2,486 BTC at a cost of $168.33 million. Prior to that, it acquired 1,142 BTC at $90.01 million and 855 BTC at $75.22 million.

Searches for Bitcoin Going to Zero Reach Record High

Whereas institutional investors are accumulating, retail market sentiment is a different story altogether. Google Trends data reveals that the search term “Bitcoin going to zero” reached a record high of 100 on February 13.

The current Crypto Fear & Greed Index is at 11, indicating extreme fear. While the market is certainly a cause for concern, some seasoned investors are going the opposite way. Hugh Hendry, a Scottish hedge fund manager who posted a 31.2% return during the 2008 financial crisis, has placed a long bet on Bitcoin.

In May last year, he sold other holdings and put $10 million into Bitcoin. He now follows what he calls a barbell strategy. In simple terms, he is balancing Bitcoin exposure with the expectation that central banks could cut rates in the future. Hendry thinks Bitcoin could eventually climb to $1 million. At the same time, he admits the road will not be smooth. The price could still drop by half before any strong and lasting rally begins.

He also compares Bitcoin’s peak valuation of about $2 trillion with gold’s roughly $20 trillion market size. In his view, if Bitcoin keeps gaining adoption, there is still significant room for growth over the long term.

Bitcoin is at an important psychological level. Retail investors are worried about further losses, while corporate buyers and hedge funds are accumulating. This mix of panic and conviction is driving the current cycle. Prices could reverse if fear dissipates, or decline if risk markets deteriorate. Nevertheless, deep-rooted conviction in Bitcoin has not been affected. Volatility is intense, but history suggests that intense fear tends to emerge around important turning points.

eToro Platform

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

You May Also Like

And the Big Day Has Arrived: The Anticipated News for XRP and Dogecoin Tomorrow

Non-Opioid Painkillers Have Struggled–Cannabis Drugs Might Be The Solution

Rising Altcoin Inflows Signal Potential Market Sell-Off: CryptoQuant

Highlights: Inflows of altcoins in exchanges have surged by 22% in early 2026. An increase in deposits indicates a growing sell-side pressure. The