Bitcoin ETF Outflows Extend as Analysts Warn of a Deeper Decline Toward $50K

TL;DR

- Bitcoin ETFs saw $133M outflows as sentiment stayed in extreme fear territory.

-

BTC trades near $67K and is down 24% year-to-date amid persistent selling.

-

Standard Chartered sees a possible drop to $50K before a later rebound.

-

Solana ETFs continue to attract inflows while Bitcoin products weaken.

Bitcoin exchange-traded funds recorded another day of outflows on Wednesday as risk appetite remained weak across digital asset markets. Spot Bitcoin ETFs posted $133.3 million in net withdrawals, marking one of the most negative sessions of the month. The steady outflow came as Bitcoin briefly moved below $66,000 before stabilizing near the lower end of its weekly range.

Data from SoSoValue showed that BlackRock’s iShares Bitcoin Trust led withdrawals with more than $84 million leaving the product. ETF trading volumes stayed below $3 billion, which signaled continued caution. Market analysts said activity levels remained muted even after earlier expectations that inflows could stabilize.

The latest data brought weekly Bitcoin ETF outflows to about $238 million. If the trend continues through Friday, the asset class could post its first five-week streak of withdrawals since March of last year. Year-to-date, Bitcoin ETFs have registered about $2.5 billion in outflows. Assets under management now stand at roughly $83.6 billion.

ETF Flows Pressure Bitcoin as Fear Dominates

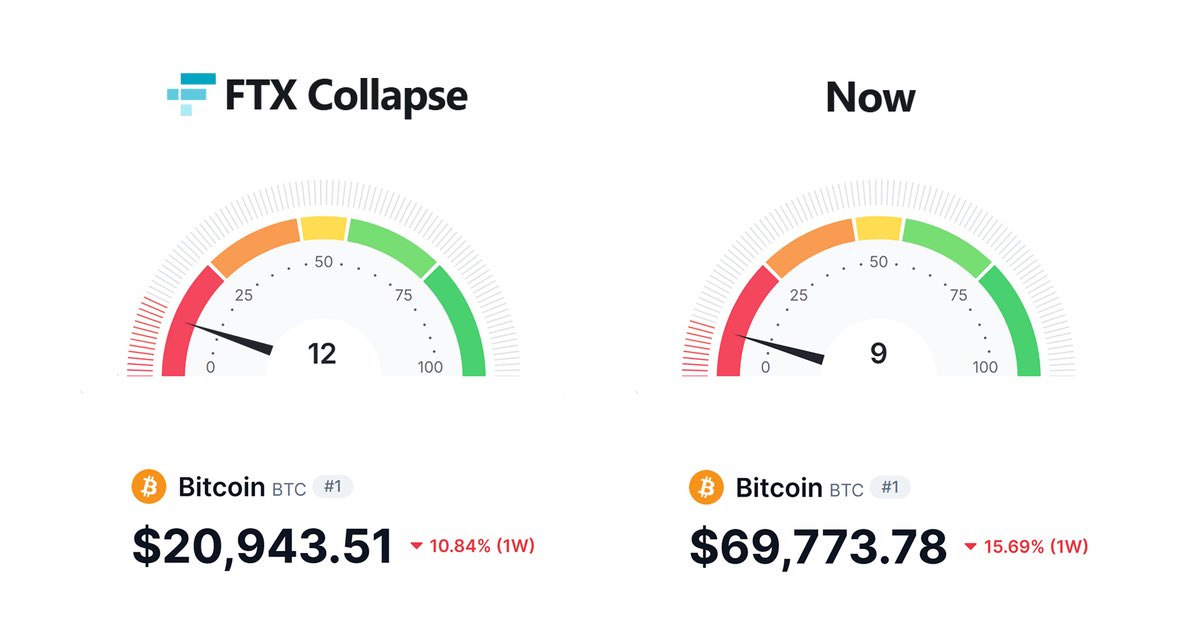

The sell-off in Bitcoin ETFs came as the Crypto Fear and Greed Index stayed in extreme fear territory. The index has held near these levels for several days, reflecting broad concern across the market. Bitcoin is down about 24% this year, and it has struggled to regain momentum after moving away from the $70,000 area.

At the time of writing, Bitcoin traded at $67,058 on Coinbase. While this level marked a small rebound from multi-month lows near $60,000 reached earlier in February, analysts said sentiment remained cautious. They pointed to weak inflows, negative positioning, and slow recovery attempts as signs of a fragile market structure.

Standard Chartered reiterated its view that Bitcoin could fall toward $50,000 before attempting a later rebound. The bank said the current decline fits a pattern where Bitcoin retests lower zones before a recovery develops. Its research team still expects Bitcoin to reach $100,000 later in 2026, but it noted that near-term pressure remains elevated.

Solana ETFs Continue to Draw Interest

While Bitcoin and Ether ETFs recorded outflows, Solana funds continued to attract new capital. Solana ETFs marked a six-day streak of inflows, bringing year-to-date gains to around $113 million. These products have accumulated nearly $700 million in assets since their October 2025 launch.

However, trading volumes for Solana ETFs have slowed. February inflows remain well below January’s pace and far lower than December’s $148 million figure. XRP ETFs also saw modest outflows, though the amounts were smaller compared with Bitcoin and Ether products.

The contrasting flows suggest that investors are still expressing interest in selective altcoin exposure even as broader market sentiment stays weak. Analysts said the trend also reflects rotation within the ETF space as traders search for relative strength.

Analysts Monitor Bitcoin’s Short-Term Metrics

CryptoQuant reported that Bitcoin’s short-term Sharpe ratio has moved into levels seen during past long-term opportunity zones. The platform said these rare readings have previously appeared near cycle lows.

According to analyst Ignacio Moreno De Vicente, “each prior extreme negative reading was followed by violent recoveries to new highs.” However, he said there is no clear timing signal for a rebound.

Market researchers said that compressed volatility between $67,000 and $68,000 shows hesitation across both directions. Support remains in the $65,000 to $67,000 range, while resistance continues near $70,000 to $72,000. Traders are watching whether ETF flows can stabilize, since persistent withdrawals typically add downward pressure in periods of low liquidity.

UAE Wealth Funds Increase Long-Term Exposure

Despite the recent drawdown, wealth funds in the United Arab Emirates increased their Bitcoin exposure at the end of 2025. Quarterly filings with the U.S. Securities and Exchange Commission showed more than $1 billion held across two major Abu Dhabi funds.

Mubadala Investment Company reported owning more than 12.7 million shares of BlackRock’s Bitcoin ETF.

The position was valued at over $630 million and marked a 46% increase from the previous quarter. Analysts said the move shows that institutional buyers with longer time horizons continue to view Bitcoin as a strategic asset.

The post Bitcoin ETF Outflows Extend as Analysts Warn of a Deeper Decline Toward $50K appeared first on CoinCentral.

You May Also Like

PENGU Token Gains 0.81% as Pudgy Penguins Cultural Momentum Drives Market Interest

Hong Kong Monetary Authority and Fed Cut Interest Rates by 25 Bps