Strategy Buys The Bitcoin Dip: Saylor Unveils New $357 Million Purchase

Michael Saylor’s Strategy has just announced a new Bitcoin purchase, suggesting the price dip hasn’t stopped the company from buying more.

Strategy Has Made A Fresh Addition To Its Bitcoin Treasury

As announced by Strategy chairman Michael Saylor in a new post on X, the company has completed a new Bitcoin acquisition involving 3,018 BTC. The firm purchased these coins for $356.9 million or an average price of $115,829 per token.

According to the filing with the US Securities and Exchange Commission (SEC), the purchase occurred between August 18th and 24th. This is the same window in which BTC faced a drawdown. Thus, it seems the company wasn’t dissuaded by the bearish price action.

In fact, the firm’s purchase this week was significantly bigger than last week’s buy, which involved an amount of 430 BTC ($51.4 million), or the one from the week before, coming at 155 BTC.

Following the latest acquisition, Strategy’s total Bitcoin holdings have grown to 632,457 BTC. At the current exchange rate, this converts to almost $71.1 billion, which is nearly 53% above the company’s cost basis of $46.5 billion.

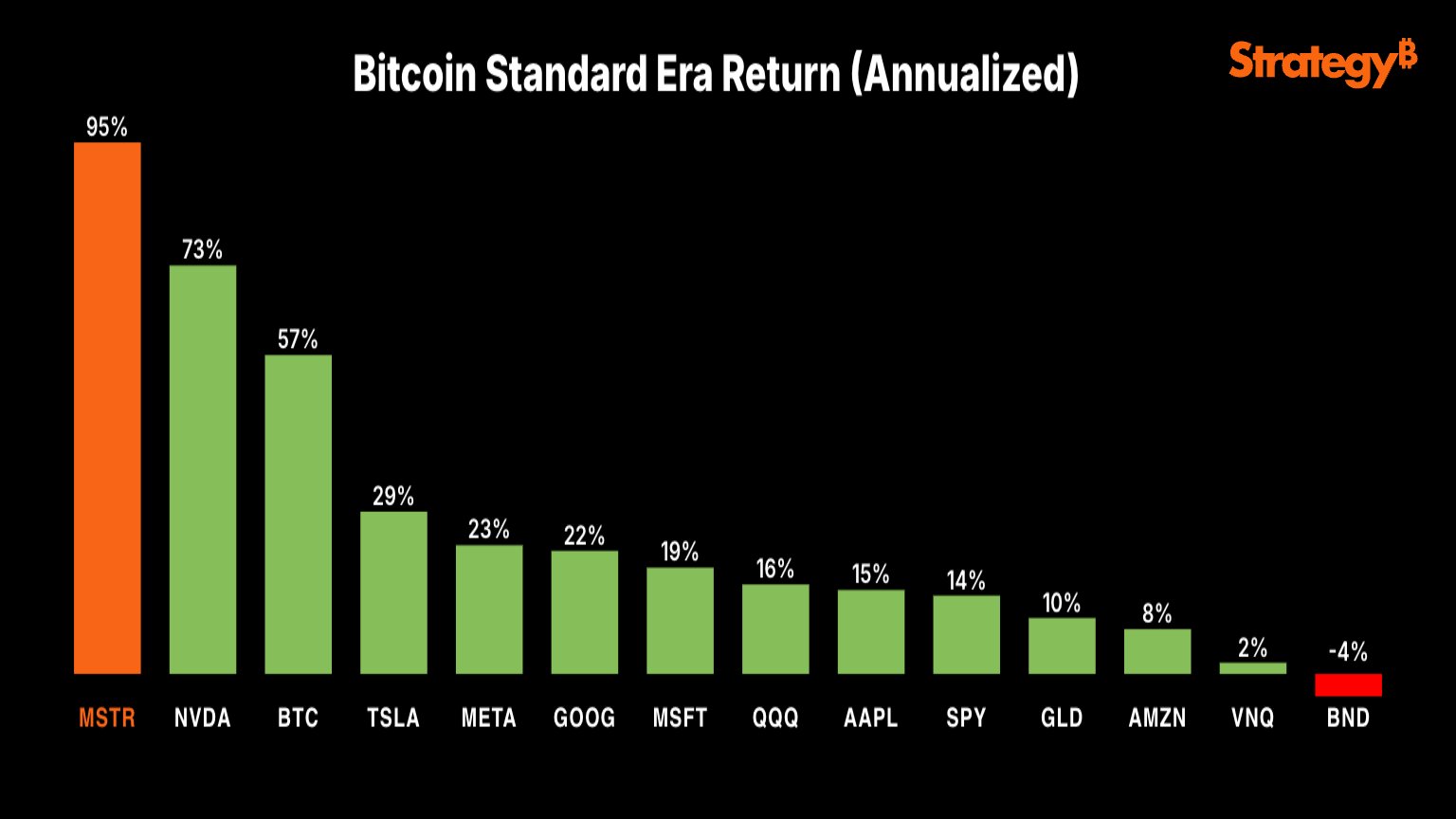

The profit-loss balance of the Bitcoin holdings isn’t the only thing the firm is doing well on. As Saylor shared in an X post, Strategy has shown an impressive stock performance as well.

“Five years ago, $MSTR adopted the Bitcoin Standard. Since then, we’ve outperformed every asset class and every Magnificent 7 stock,” explains the Strategy chairman. The success of Saylor’s firm started a trend of other companies also adopting a BTC treasury strategy.

An example of this is Japan’s Metaplanet. Led by president Simon Gerovich, the firm has consistently been buying BTC much like Strategy. On Sunday, Gerovich unveiled a fresh purchase of 103 BTC ($11.7 million), which took the company’s reserve to 18,991 BTC (acquired for a total of $1.95 billion).

The treasury strategy wave has now expanded into the altcoins, with SharpLink being a prominent example. The firm’s Ethereum holdings currently sit at 740,760 ETH. Now, news has come out that Galaxy Digital, Jump Crypto, and Multicoin Capital are planning a $1 billion Solana accumulation spree for a SOL treasury.

In some other news, the CryptoQuant Bull Score Index is currently flagging the market as entering a bearish phase, as explained in an X post by Julio Moreno, CryptoQuant’s head of research. The Bull Score Index combines different on-chain metrics to determine what part of the cycle Bitcoin is in right now.

As displayed in the above chart, the Bitcoin indicator has gone down recently. “The Bull Score Index is now at 40 and switched to the ‘Getting Bearish’ phase,” notes Moreno.

BTC Price

Bitcoin’s bearish form has continued during the past day as its price has dropped to the $110,900 level.

You May Also Like

eurosecurity.net Expands Cryptocurrency Asset Recovery Capabilities Amid Rising Investor Losses

Ethereum to boost scalability and roll out Fusaka upgrade on Dec 3