Qatar economy

Middle East economic data

Bahrain

Kuwait

Oman

Egypt

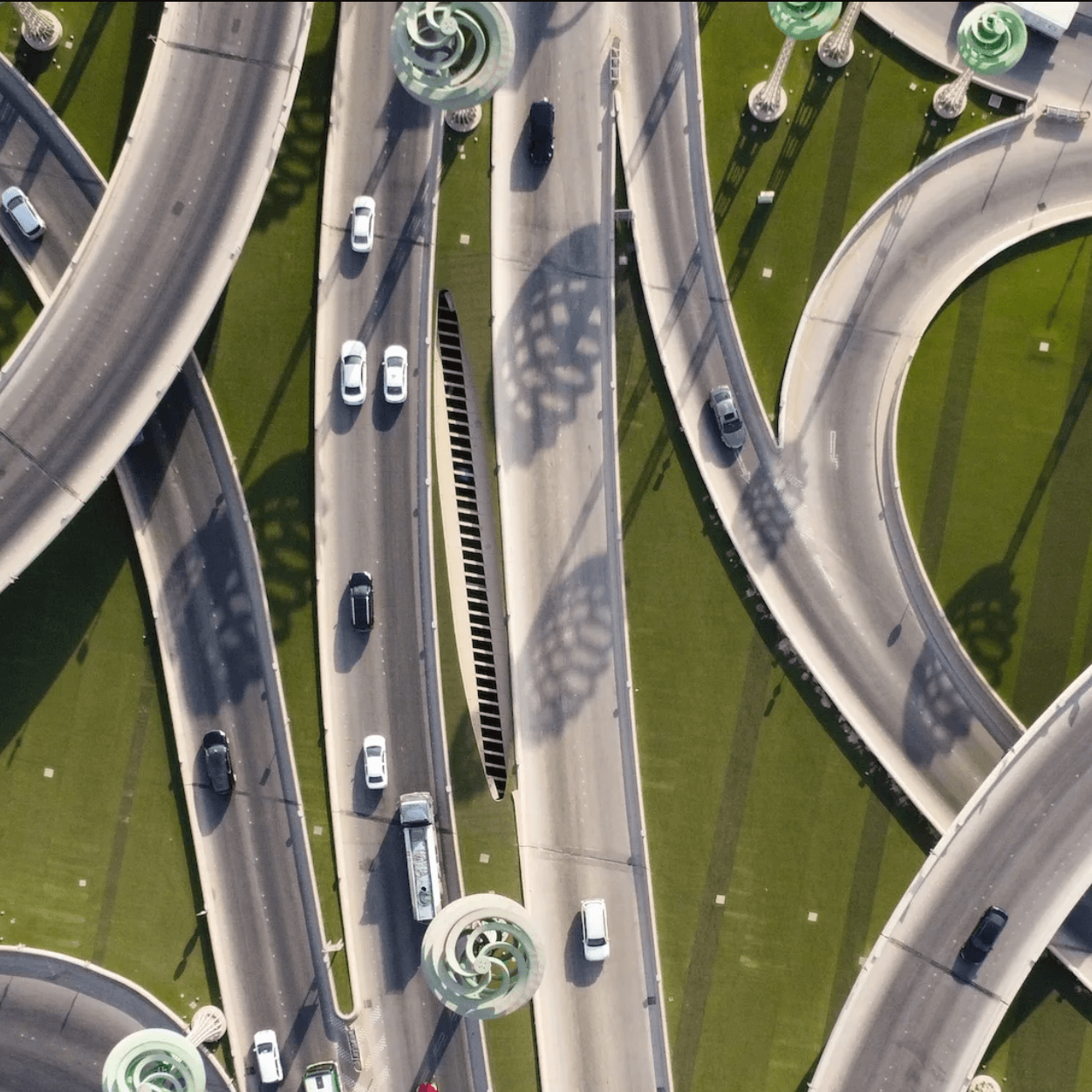

Qatar

Saudi Arabia

UAE

Turkey

For more, go to our GCC economic data and Mena economic data pages

Qatar economic indicators at a glance

Qatar nominal GDP

Qatar GDP per capita

Qatar GDP growth

Qatar oil breakeven prices

Qatar’s GDP dipped in 2020 and again in 2023, as seen in the nominal GDP and the GDP per capita charts.

The IMF is forecasting increases for the next few years. Qatar’s non-oil and oil GDP both rose in 2022 – with non-oil GDP up nearly 6 percent – but recorded much smaller increases the following year.

Qatar’s oil breakeven price hit the $50 mark in 2023 and has since fallen.

Qatar inflation

Qatar debt & current account balance

Qatar’s inflation hit 5 percent in 2022, but increases to the consumer price index have slowed since then. Government gross debt as a percentage of Qatar’s GDP is falling. Qatar’s current account balance reached $63.1 billion in 2022 and then plummeted in 2023, but is projected to inch up again.

Qatar trade

Qatar’s top 10 trade partners

Qatar’s trade picked up after the Covid pandemic but the export rate fell in 2023. The country’s imports and exports are both projected to increase from 2026. Qatar’s top exports include mineral fuels, oils, fertilisers and plastics, and its top imports include machinery, nuclear reactors, electronic equipment and vehicles.

Qatar foreign direct investment

Qatar credit ratings

Qatar governance

Qatar’s outward foreign direct investment has been volatile. Inward FDI into Qatar was steady before falling in 2018 and 2019. It is now slowly rising again.

Qatar has investment-grade ratings from Fitch, Moody’s and S&P Global. All three agencies say the outlook for Qatar is stable.

Qatar’s score in the Corruption Perceptions Index has dipped below 60 for the past four years. It was the GCC’s second best performer in the 2025 ranking.

Qatar population

Qatar life expectancy

Qatar’s population rate has fluctuated but is now slowly increasing again. More than 2 million of its 2.8 million inhabitants are male. Life expectancy in Qatar fell in 2020, but is now rising.

Expats in Qatar

Qatar expats’ country of origin

Qatar's expat population has fluctuated since 2000 – and particularly in the years it spent preparing to host the Fifa World Cup in 2022. Now about three quarters of people who live in Qatar are expats. Indians make up the biggest proportion of expat residents in Qatar, followed by migrants from Bangladesh and Nepal.

Qatar employment

Education in Qatar

Qatar has the lowest unemployment rates in the GCC. Qatar's education scores have improved over the past decade in all three Pisa subjects, but they are still far below the OECD average.

More economic indicators

The UAE

The UAE

Saudi Arabia

Saudi Arabia

All GCC countries

All GCC countries

The charts and tables on this page are for general information purposes only. AGBI aims to keep the information up-to-date and correct, but makes no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability of the information. Any reliance you place on such information is therefore strictly at your own risk. All IMF, World Bank and United Nations data on this page is publicly available. The latest IMF World Economic Outlook was published on October 14, 2025

You May Also Like

Paydax (PDP) Lending Introduces New Way To Earn With Crypto – Here’s How To Get Started

USD/JPY Analysis: Resilient Yen Finds Crucial Support in Japanese Government Bond Dynamics – MUFG Insight