Rising Short Bets on Bitcoin Put $68K Support in Focus

A rising number of investors are deliberately taking short bets on the main cryptocurrency as a result of its recent price decrease.

Recent research suggests that with financing rates at record lows, a major short squeeze would soon be upon us. According to the latest onchain statistics, this short squeeze happened and progressed at a rate not seen in years.

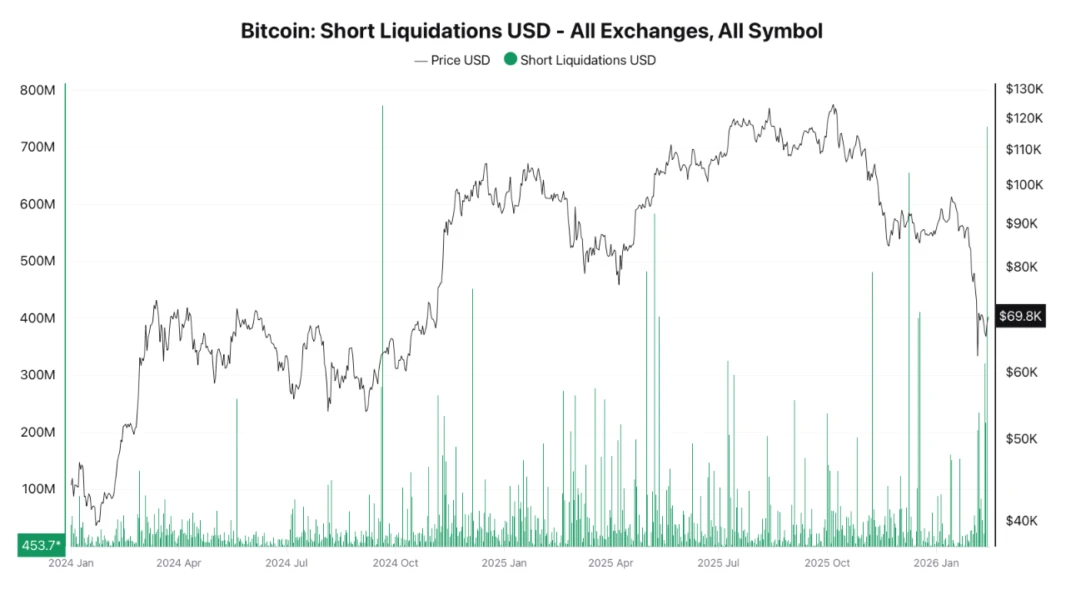

Darkfost, an anonymous on-chain analyst, recently disclosed in a QuickTake article on the CryptoQuant platform that the Bitcoin market has experienced its most significant short liquidation event since September 2024.

The total dollar amount of Bitcoin short positions that exchanges have forcibly terminated during a specific timeframe is a crucial metric to monitor. Darkfost pointed out that $773 million in positions were forced closed on September 20, 2024, making this liquidation event the second in importance.

A large number of sell positions before this occurrence, as seen by the extremely negative funding rates on Binance and other exchanges.

Source: Quicktake on CryptoQuant

Source: Quicktake on CryptoQuant

A short squeeze describes what happens when several short positions are suddenly closed. When there is a short squeeze, prices are driven higher by the significant impetus of sell-side liquidity being converted through liquidation dynamics.

According to Darkfost, speculation has reached a tipping point in the futures market, while the spot market is still struggling with a lack of liquidity.

This discrepancy creates a precarious market environment where aggressive short positions, if forced to cover, might heighten upward volatility.

But recognizing that the current upward trend led by the short squeeze may not last in an environment where demand stays continuously low.

That being said, Bitcoin is still in an unclear situation until there is a significant demand on the spot market that matches the present circumstances.

By examining a combination of market cycle indications, the anonymous market analyst known only as "CoinNiel" has offered some speculation about Bitcoin's future.

After successfully testing the $70,000 resistance level three times in February, the leading cryptocurrency now trades at around $68,000. The significant drop in Bitcoin's value from $60,000 in late January and early February appears to have levelled out.

By looking at important measures like distribution, capitulation, and accumulation, CoinNiel draws similarities between the present market cycle and the third halving cycle in a QuickTake article dated February 14.

Bear in mind that the on-chain expert has pointed to a declining trend in the Distribution Signal, which mirrors the selling behavior of knowledgeable investors.

At first glance, this trend – which is caused by less selling pressure –may seem good. However, it actually represents a vulnerable period of the market when big players are not very involved.

The third halving cycle following the development of a double top also displays this consistent decline in the Distribution Signal, as pointed out by CoinNiel.

The Capitulation Signal, which tracks panic-selling, and the Accumulation Signal, which tracks purchasing by knowledgeable investors, both increased throughout this cycle, which coincided with Bitcoin's continuing price decrease.

Source: Quicktake on CryptoQuant

Source: Quicktake on CryptoQuant

It's important to note that the Accumulation Signal only started to decline once Bitcoin hit $15,000, marking the lowest point of this cycle.

With the market stabilizing in expectation of a potential rebound, it became clear that the astute investors had successfully absorbed the wave of panic selling.

The price is still close to $69,000, while the Accumulation Signal is at about $54,000. Previous patterns suggest that the Accumulation Signal will coincide with the price at the cycle low. As a result, there are still chances to grow.

According to CoinNiel's Accumulation Signal and price predictions, the price is about to go beyond $60,000.

Still, we don't know when this junction will happen. Nevertheless, it is believed that this conference would bring stability to the Bitcoin market, which might lead to a reversal.

Source: Quicktake on CryptoQuant

Source: Quicktake on CryptoQuant

What Do Other Technicals Show?

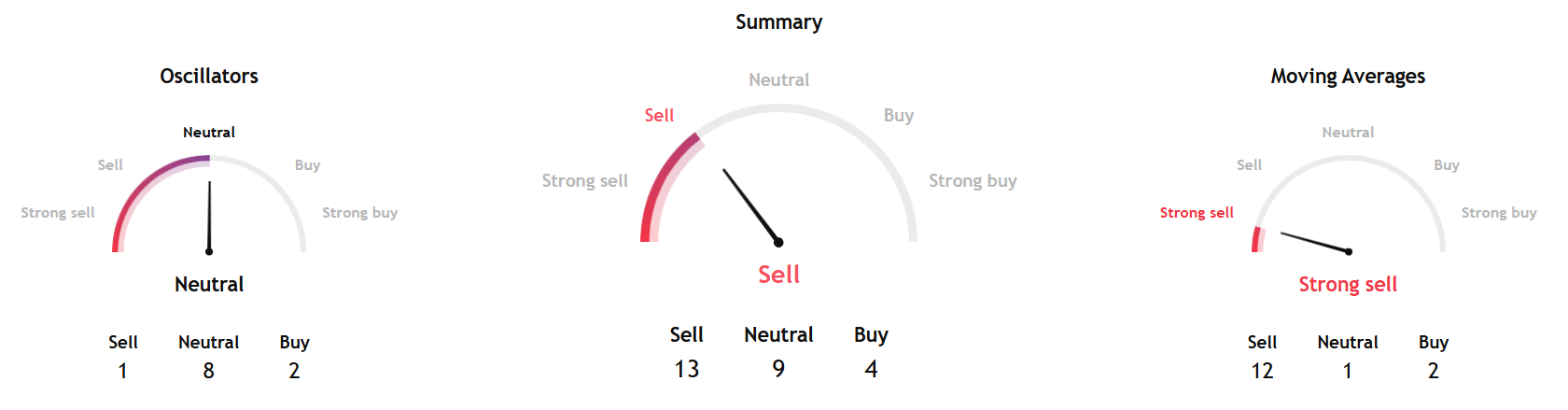

TradingView's technical analysis overview for the coming week, based on key data from moving averages, oscillators, and pivot points to a sell signal.

However, short-term sub-indicators signal a neutral reading.

Source: TradingView

Source: TradingView

TradingView's broader assessment also shows:

- Hourly MACD - The MACD is currently moving quickly into the negative zone.

- The relative strength index (RSI) for Bitcoin/USD on an hourly basis is now below 50.

- Two important support levels are $68,000 and $66,500.

- Levels of Significant Resistance - $69,500 and $70,000.

Separately, InvestTech's Algorithmic Overall Analysis and recommendation for one to six weeks showed a weak negative reading.

InvestTech said, "Bitcoin has broken through the ceiling of a falling trend channel in the short term. This indicates a slower falling rate initially, or the start of a more horizontal development. The token has support at $65,000 and resistance at points $88,000. Negative volume balance indicates that volume is high on days with falling prices and low on days with rising prices, which weakens the currency."

The Research added, "RSI diverges positively against the price, which indicates a possibility for a reaction up. The token is overall assessed as technically slightly negative for the short term."

Blockcast – Licensed to Shill: How Energy & Geopolitics Are Building a Bitcoin-Driven World, ft. Bitcoin Arabia's Lara Eggimann & Jeff Gorman

The Middle East is poised to become a pivotal hub in the global cryptocurrency ecosystem. Countries within the region are increasingly recognizing the strategic importance of integrating blockchain technology into their economic frameworks, energy markets, and geopolitical strategies, according to Lara Eggimann and Jeff Gorman, co-founders of Bitcoin Arabia, a strategic Bitcoin advisory and ecosystem builder that connects the global Bitcoin industry with the Middle East’s most powerful stakeholders.

Thanks for tuning in! If you enjoyed this episode, please like and subscribe to Blockcast on your favorite podcast platforms like Spotify and Apple.

Be at the heart of TradFi–DeFi collaboration at Money20/20 Asia 2026.

Are you looking to forge partnerships with banks and fintechs? To expand into new markets across Asia, or to secure funding from top-tier investors? This April, the world of digital assets, blockchain, and Web3 converges with the biggest players in APAC’s financial ecosystem at Money20/20 Asia 2026 and its brand new ‘Intersection’ zone, complete with a dedicated content stage, TradFi-Defi innovator showcase, and curated networking spaces. From traditional banking giants to decentralised innovators, private equity leaders, and cutting-edge fintech disruptors, this is where they meet to forge partnerships, spark dialogue, and shape the future of finance.

You May Also Like

Strive and Semler Scientific to Merge in All-Stock Deal, Creating Bitcoin Treasury Powerhouse

Milyar Dolarları Yöneten Şirket, Onchain Verilerine Göre Bu Altcoini Topluyor Olabilir!