Bitcoin Hits ‘Deep Value’ as RSI Plummets to 23: Is the High-Conviction Bottom In?

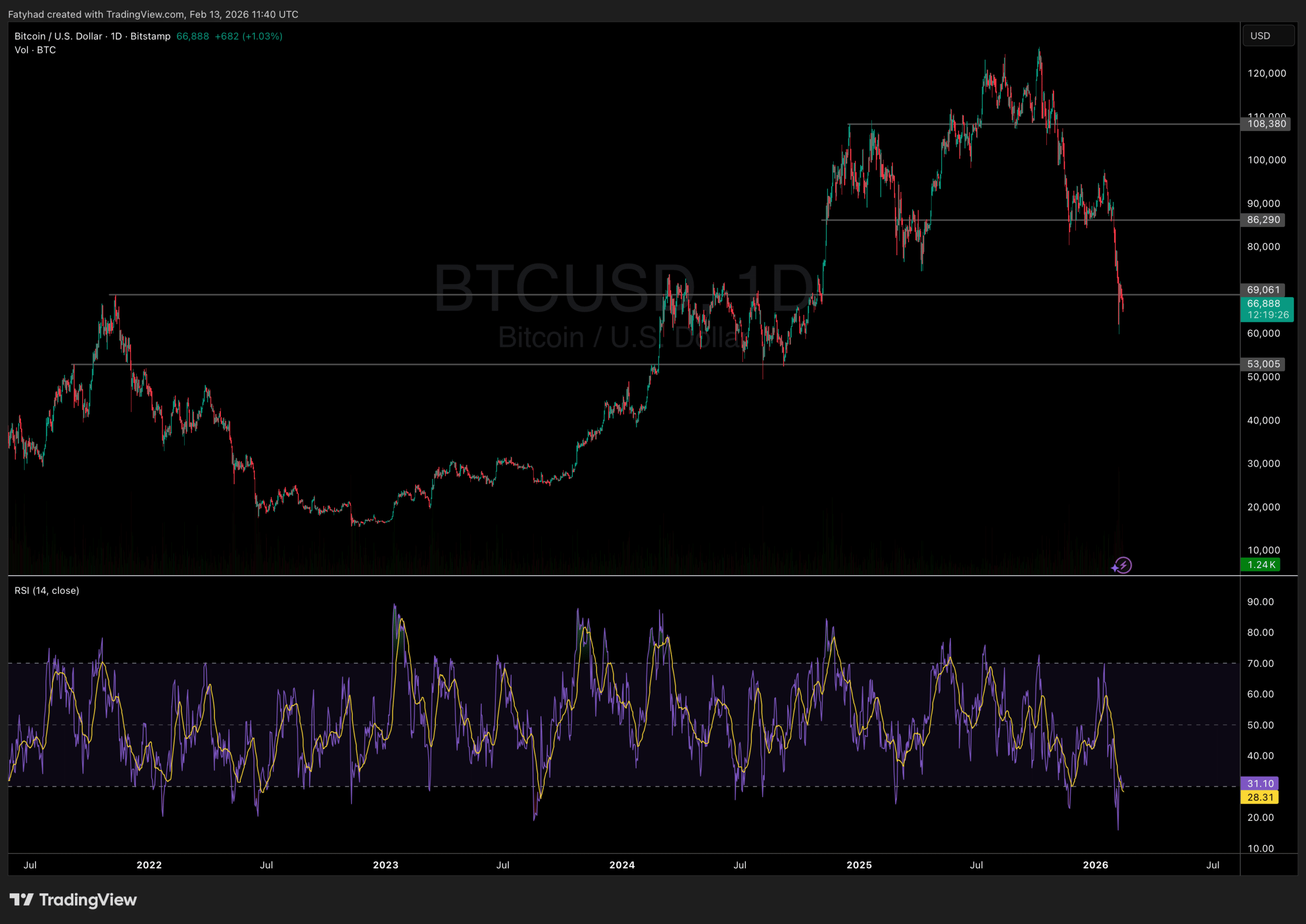

Bitcoin experienced a severe technical dislocation this week, with the Relative Strength Index (RSI) crashing to 23.3: its lowest level since August 2023.

This rare breach of the 200-day Simple Moving Average (SMA) pushed the asset into deep oversold territory, prompting analysts to flag a potential structural bottom despite immediate bearish pressure.

EXPLORE: What is the Next Crypto to Explode in 2026?

Understanding the ‘Deep Value’ Signal – Bitcoin RSI Drops To 23

In technical analysis, a Bitcoin RSI value reading below 30 typically signals oversold conditions, suggesting that sell-side momentum is exhausted. The drop to 23.37 mirrors historical capitulation events seen in late 2018 and August 2023, both of which preceded extended accumulation phases.

At the moment of writing, BTC $69 100 24h volatility: 4.8% Market cap: $1.38 T Vol. 24h: $47.36 B is trading near the $67,000 mark, significantly below its recent consolidation range.

The breach of the 200-day SMA, a critical trend separator, has historically acted as a watershed moment. While often interpreted as a bearish confirmation, some analysts argue that when this break coincides with such extreme RSI compression, it creates a “deep value” liquidity opportunity for long-term holders rather than a signal for further panic.

Traders are closely monitoring this setup as a high-conviction opportunity. While near-term sentiment remains fearful, some analysts view the alignment of the 200-day SMA breach and extreme RSI suppression as a rare buying signal.

Based on historical data analyzed by Binance, previous instances of such extreme oversold readings have often yielded positive returns for patient investors, though timing the exact reversal remains difficult.

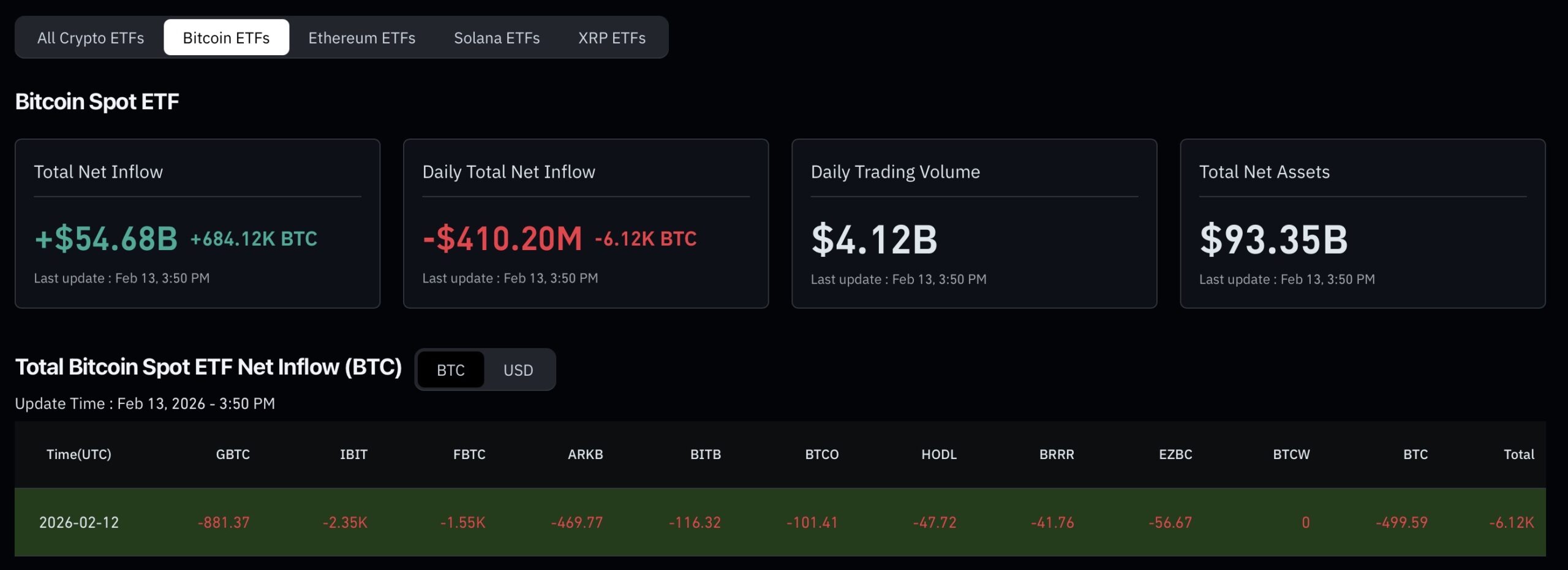

Institutional flows present a mixed picture. Bitcoin ETFs recorded $410 million in outflows on February 12 as Goldman Sachs recently disclosed holding $1.1 billion in Bitcoin ETFs.

Bitcoin Spot ETF Source: Coinglass

While the crypto market bottom may not be precisely in, the risk-reward ratio has shifted aggressively in favour of bulls.

DISCOVER: Best Solana Meme Coins By Market Cap 2026

Bitcoin Price Analysis – Possible Retest of the $60K Level

For now, traders are watching the $60,000 zone as immediate support. A failure to reclaim the 200-day SMA quickly could expose lower levels, potentially testing psychological support at $53,000.

Alternatively, a $70,000 reclamation could validate the bottoming thesis.

However, caution is warranted. RSI falling below historical averages can sometimes signal the start of a prolonged bear trend rather than an instant V-shape recovery.

Traders should wait for confirmation signals, such as volume spikes or a higher low structure, before declaring the correction over.

Bitcoin Price Analysis Source: TradingView

EXPLORE: 10 New Upcoming Binance Listings to Watch in February 2026

Bitcoin Hyper: Positioned as Bitcoin Tests Key Support

Historically, extreme RSI compression has marked late-stage capitulation rather than the start of prolonged collapses. If Bitcoin stabilizes near $60K and begins forming a higher low, it could confirm an accumulation phase.

Despite these periods of extreme market fear and traders’ attempts to identify the Bitcoin bottom, other projects are progressing, introducing innovation and potential opportunities.

As Bitcoin consolidates below major trend resistance, Bitcoin Hyper ($HYPER) is positioning itself as infrastructure for expanded BTC utility, offering faster execution and lower fees while remaining anchored to the Bitcoin network.

The project has raised over $31.4 million in its presale phase, with tokens currently priced at $0.0136755 ahead of the next increase.

If Bitcoin confirms a bottom and rebounds, infrastructure projects directly tied to network growth could benefit disproportionately.

The Bitcoin Hyper token is compatible with Best Wallet, widely considered the best crypto and Bitcoin wallet. HYPER is already featured in Best Wallet’s “Upcoming Tokens” section making it easy to buy track and claim once the token launches.

For now, traders are waiting for confirmation signals but some investors are positioning early, anticipating that extreme oversold conditions may signal opportunity rather than prolonged decline.

Be part of the Bitcoin Hyper community on Telegram and X.

Visit Bitcoin Hyper Here

DISCOVER: How to Buy Bitcoin Hyper – 2026 ICO Guide

nextThe post Bitcoin Hits ‘Deep Value’ as RSI Plummets to 23: Is the High-Conviction Bottom In? appeared first on Coinspeaker.

You May Also Like

Undeniable Synergy: How Guest Posting Fuels SEO, & Backlinks Power

BlackRock boosts AI and US equity exposure in $185 billion models