Hong Kong Virtual Asset Exchange has added 4 new members, a quick look at their backgrounds and latest regulatory routes

Author: Nancy, PANews

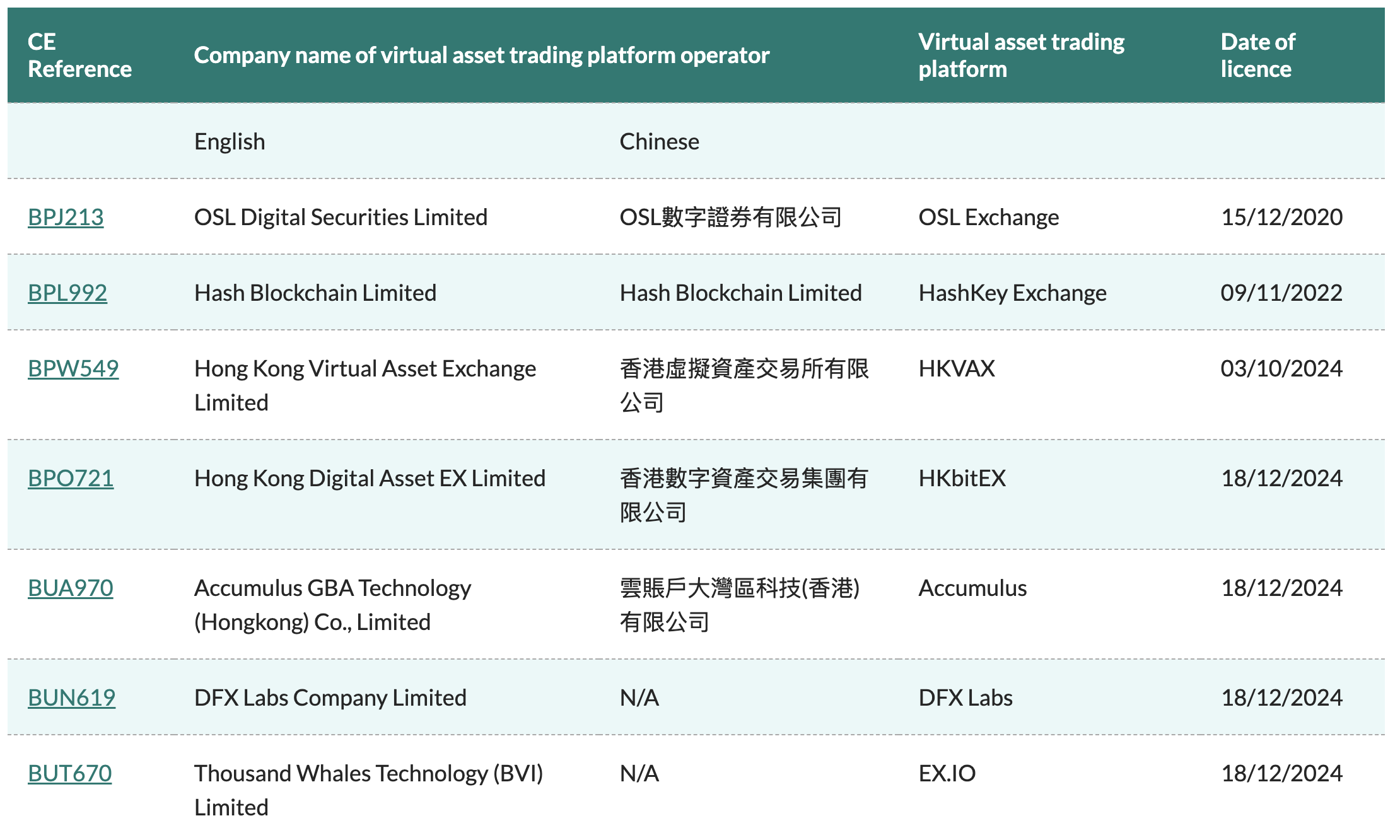

After OSL Exchange, HashKeyExchange and HKVAX, Hong Kong's licensed virtual asset trading platform (VATP) has welcomed four new members. On December 18, the Hong Kong Securities and Futures Commission announced that it would issue licenses to four virtual asset trading platforms in accordance with the fast-track licensing procedure, including Cloud Account Greater Bay Area Technology (Hong Kong), DFX Labs, Hong Kong Digital Asset Trading Group and Thousand Whales Technology.

At the same time, the Hong Kong Securities and Futures Commission is accelerating the approval process for virtual asset licenses and formulating a clear licensing procedure roadmap to further expand Hong Kong's presence in the Web3 field.

Four platforms were licensed by the Hong Kong Securities Regulatory Commission

This time, the Hong Kong Securities and Futures Commission approved four platforms at one time, bringing the number of licensed virtual asset trading platforms in Hong Kong to seven.

HKbitEX: Launched by a former senior executive of the Hong Kong Stock Exchange, it has received tens of millions of dollars in financing

HKbitEX was launched by Hong Kong Digital Asset Exchange Group Co., Ltd. and established in 2019. It is a company dedicated to providing compliant and regulated digital asset spot trading and over-the-counter (OTC) trading platforms for global professional investors.

It is reported that the parent company behind the Hong Kong Digital Asset Trading Group is Taiji Capital Group, which mainly provides tokenized asset services, including capital markets and wealth management, digital asset exchanges, and Web3 SaaS and technology research and development. In September 2023, Taiji Capital also announced the launch of Hong Kong's first real estate fund security token issuance (ST0). The closed-end fund managed by its subsidiary Pioneer Asset Management issued the token PRINCE, with the goal of raising about HK$100 million at the time. Gao Han, the founder of Taiji Capital, once worked for the Hong Kong Stock Exchange and was mainly responsible for promoting the Hong Kong Stock Exchange's products in the Mainland, including Hong Kong Stock Connect and Bond Connect. Taiji Capital also attracted a number of Hong Kong Stock Exchange executives to join.

As one of the first institutions to apply for a virtual asset trading platform license from the Hong Kong Securities and Futures Commission, HKbitEX has received multiple rounds of financing, including in December 20220, when HKbitEX announced the completion of a US$10 million A2 round of financing. This round of financing was led by Axion Global Investment Limited, a subsidiary of Hong Kong-listed company Edvance International, and Hanwha Asset Management. Other investors included De Ding Innovation Fund, Jianfeng Capital Management, Lenovo Capital and Lingfeng Capital; in November 2021, HKbitEX again announced the completion of a US$9 million Pre-B round of financing with US$300 million.

Accumulus: Backed by China's top 500 companies

The virtual asset trading platform Accumulus was launched by Cloud Account Greater Bay Area Technology (Hong Kong) Co., Ltd. and went online in Hong Kong in April 2023. At the end of the same year, it formally submitted an application for a virtual asset trading platform license to the Hong Kong Securities and Futures Commission.

Cloud Account Hong Kong is registered by Cloud Account and is also the only overseas business headquarters. The group has obtained a foreign direct investment quota of RMB 985 million approved by the National Development and Reform Commission and other departments in the Mainland, supporting Cloud Account Hong Kong to focus on Web 3.0 to expand its business. According to official introduction, Cloud Account is China's largest online human resources service company, serving 110 million new employment workers (freelancers) from 138 countries and regions. This year, it was selected as one of the "Top 500 Chinese Enterprises in 2024" with a revenue of RMB 108.4 billion.

DFX Labs : The team has many years of experience in blockchain

DFX Labs (DFX Labs Company Limited) was the last applicant for the Hong Kong virtual asset trading platform last year. The DFX Labs team has extensive experience in the blockchain and financial technology fields. For example, COO Simon Au Yeung was formerly the CEO of Blockchain Finance and virtual asset trading platform BGE, and Hong Kong IEEE Co-Chairman and CTO David H. worked for Morgan Stanley, Dell Technologies, and HashKey Group.

EX.IO : Sina's Internet brokerage is the main investor

EX.IO (formerly xWhale) launched by Thousand Whales Technology (BVI) Limited is the first and only licensed institution with a brokerage background in Hong Kong. It is invested by Huasheng Capital Group, an Internet brokerage under Sina, and Longling Capital and Weixin Jinke (HKG: 2003). EX.IO was originally called xWhale and was established after the original Web3 trading platform BusyWhale and Huasheng Securities reached a strategic agreement in May last year.

Release of a six-step roadmap for licensing procedures, with a consultation panel to be set up early next year

Although Hong Kong has shown its determination to vigorously develop Web3 and has attracted many crypto ecosystem projects/platforms to apply to join, the licenses have been continuously withdrawn during the transition period of license applications. By June, only 11 platforms were considered as licensed applicants. The challenges facing Hong Kong cannot be ignored.

In order to improve approval efficiency and ensure compliance, Hong Kong launched an inspection program in June this year and completed relevant on-site inspections of all licensed applicants, which achieved direct results. Therefore, the Hong Kong Securities and Futures Commission decided to continue this practice when commissioning external assessment experts to conduct the second phase of assessment of virtual asset trading platforms.

"The Commission has been actively communicating with senior management and ultimate controllers of virtual asset trading platforms. This will help us clarify the regulatory standards that should be met and accelerate the regulatory standards for virtual asset trading platforms," said Ye Zhiheng, executive director of the Intermediaries Department of the Hong Kong Securities and Futures Commission.

In the latest circular, the Hong Kong Securities and Futures Commission also formulated a clear roadmap for the licensing procedures for virtual asset trading platforms:

1. Conduct on-site inspections, provide opinions, and require the platform to submit a corrective action plan.

2. After reaching a consensus on the corrective plan, a conditional license will be granted to the platform. The platform will continue to complete the corrective measures according to the plan, conduct penetration testing and vulnerability assessment and obtain satisfactory results before it can operate within the restricted business scope;

3. Penetration testing and vulnerability assessments should be conducted by an independent third party, and the platform’s management should ensure that all important and critical corrective measures continue to be taken.

4. After completing corrective measures, vulnerability assessment and test license testing, the platform may be allowed to operate under a license within a restricted business scope.

5. The platform must engage external experts to evaluate the revised policies and procedures (including revised procedures and controls). The CSRC will oversee the entire second phase evaluation process, clarify regulatory requirements and provide opinions on the evaluation results.

6. The SFC will revoke the licensing conditions that restrict the scope of business after the completion of the second phase of the assessment. This phase of the assessment will focus on ensuring that the policies, procedures, systems and monitoring measures (policies and procedures) of the virtual asset trading platform are appropriately designed and implemented, and conducted in a direct attestation manner.

"We are trying hard to regulate this emerging market, but it is not easy because it is an existing huge market with advanced technology, no borders and imperfect regulation. The SFC will set up a formal advisory group for all licensed platforms in early 2025, and each licensed institution will appoint its senior staff as representatives. In this way, the SFC will be able to fully listen to and consider their views. This will enable us to brainstorm and systematically prioritize development matters based on investor protection." Ye Zhiheng previously revealed, and the SFC has also recently disclosed that it will provide more guidance on licensing schemes for new corporations applying for a second virtual asset trading platform license in early 2025.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Crucial Fed Rate Cut: October Probability Surges to 94%