Monero Gains Momentum After Recent Sell-Off, Faces Resistance at $363

- Monero rebounds ~5% today, trading around $357, finding short-term support near the 7-day SMA at $326.

- Key resistance remains at the 200-day SMA around $363, with stronger levels between $430–$470 for any sustained upside.

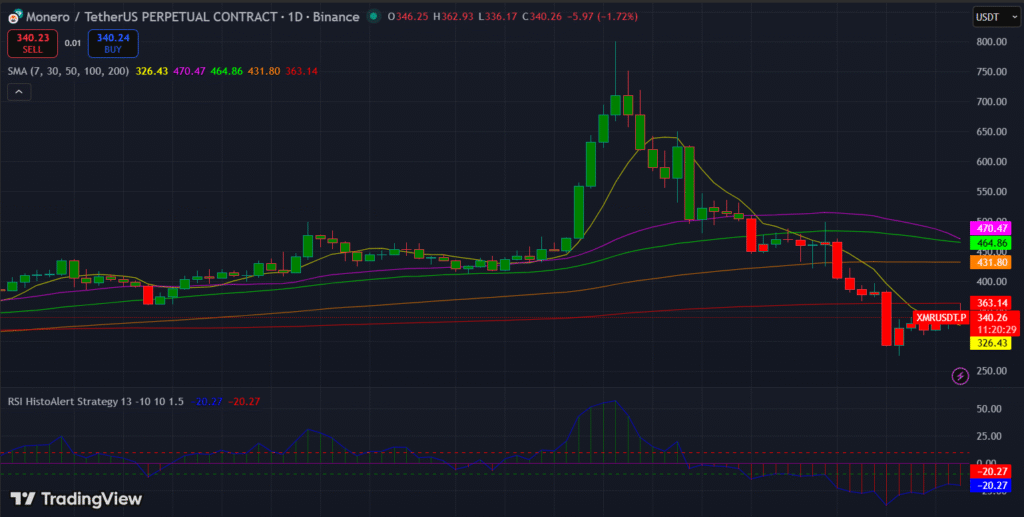

Monero (XMR), the privacy‑focused cryptocurrency, showing signs of stabilization on the daily chart after a significant sell-off from its January highs near $790. As of today, XMR trades around $340.26, consolidating in the $320 to $350 range following a sharp downtrend over the past week.

After being triggered by a technical break‑and‑fail pattern, the current pattern reflects a rebound from recent intra‑week lows. This move follows a surge earlier in the year and subsequent correction.

Monero Shows Bearish Trend, Key Levels in Focus

Technical indicators from Binance’s daily chart highlight a predominantly bearish trend. The XMR price remains below critical moving averages, including the 30-day SMA at $470.47, 50-day SMA at $464.86, 100-day SMA at $431.80, and 200-day SMA at $363.14. However, it is holding just above the short-term 7-day SMA at $326.43, which currently provides immediate support.

(Source: TradingView)

(Source: TradingView)

Zooming in, the Relative Strength Index (RSI) shows that momentum is still oversold, with a reading near -20.27, but recent RSI movements suggest a slight easing of bearish pressure, indicating a possible short-term recovery or consolidation phase.

If XMR continues the uptrend the Key resistance lies at the 200-day SMA around $363, with stronger resistance expected between $430 and $470, where it failed to boost the bull earlier. A break above these levels would be necessary to signal a sustained reversal from the current bearish trend.

If the price fails to maintain support near the 7-day SMA, it may retest recent lows near $270, marking another critical support zone.

Highlighted Crypto News:

Ethereum Slips Toward $1,900 as Selling Pressure Intensifies

You May Also Like

Knocking Bitcoin's lack of yield shows your ‘Western financial privilege’

Macro analyst Luke Gromen’s comments come amid an ongoing debate over whether Bitcoin or Ether is the more attractive long-term option for traditional investors. Macro analyst Luke Gromen says the fact that Bitcoin doesn’t natively earn yield isn’t a weakness; it’s what makes it a safer store of value.“If you’re earning a yield, you are taking a risk,” Gromen told Natalie Brunell on the Coin Stories podcast on Wednesday, responding to a question about critics who dismiss Bitcoin (BTC) because they prefer yield-earning assets.“Anyone who says that is showing their Western financial privilege,” he added.Read more

Ronin Price Prediction 2026-2030: A Strategic Deep Dive into RON’s Critical Juncture