Solana (SOL) Price: Institutions Buy as Token Tests $80 Support Level

TLDR

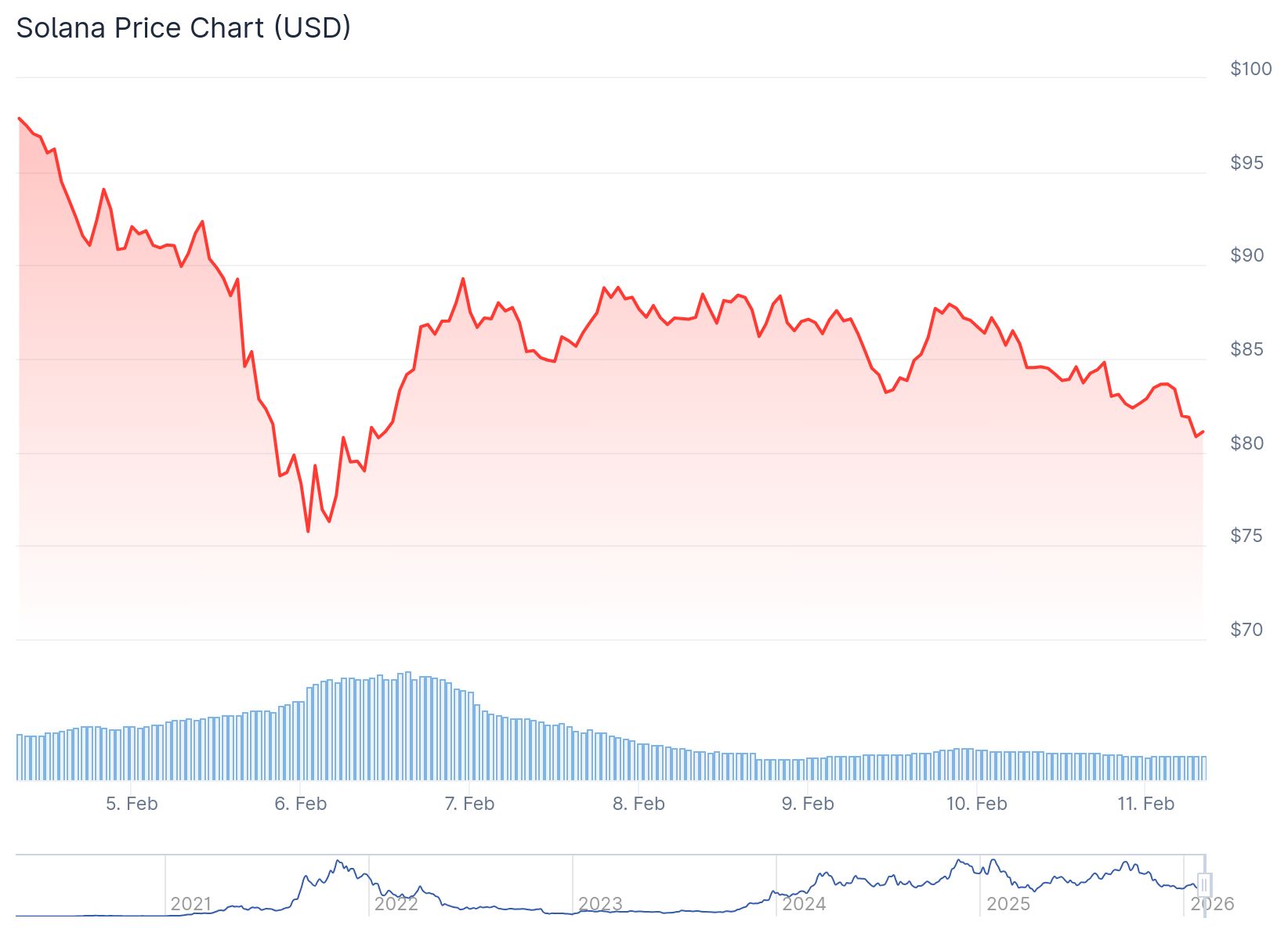

- Solana price hovers above $80 after dropping over 4% on Tuesday, struggling to recover from recent losses.

- Stablecoin supply on Solana grew 14% in the past seven days to $15.34 billion, indicating users are holding capital on-chain despite risk-off sentiment.

- SOL futures Open Interest dropped 2.74% to $5.08 billion, with long liquidations totaling $6.09 million compared to $2.01 million in short liquidations.

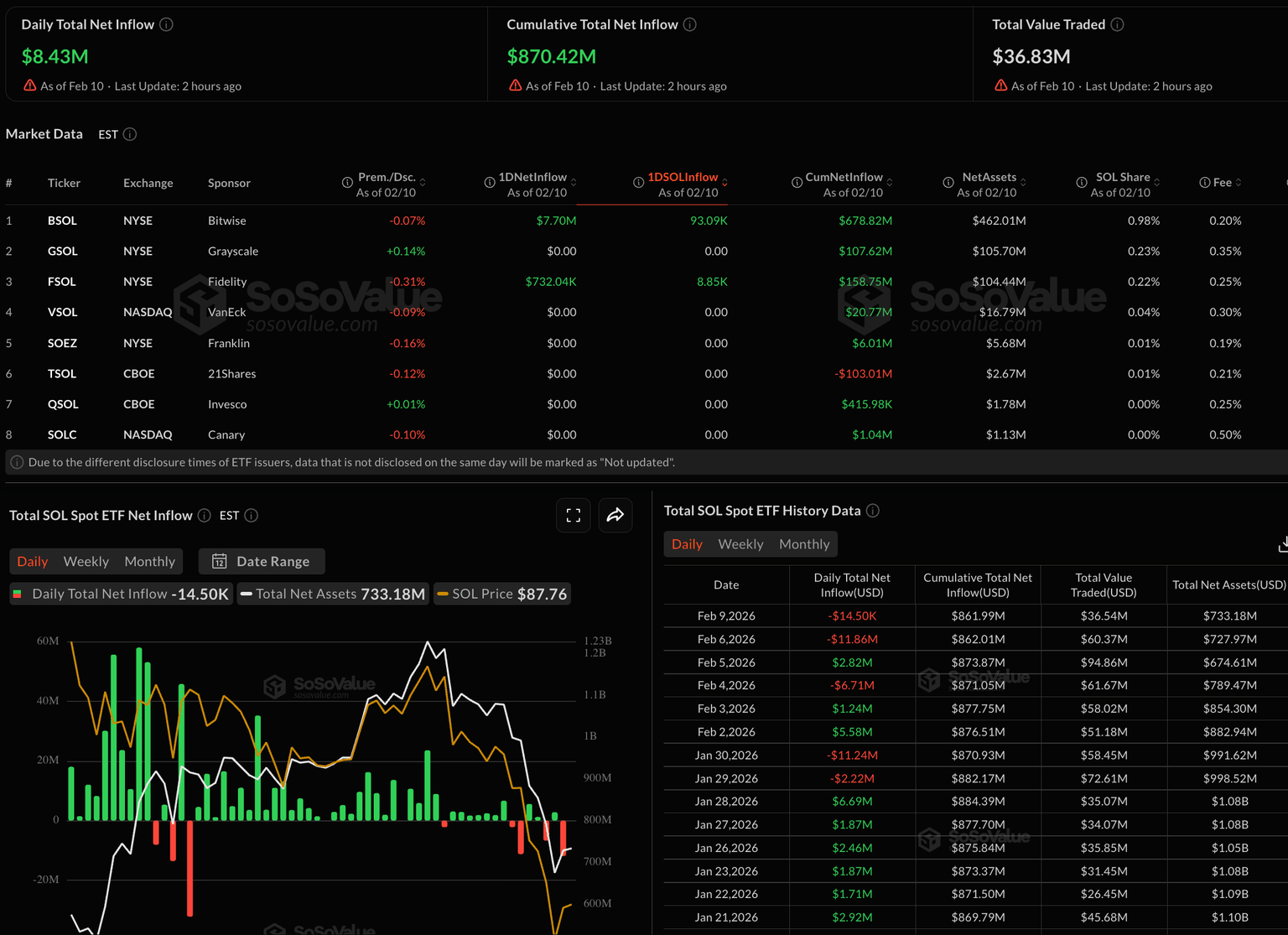

- US spot SOL ETFs recorded $8.43 million in inflows on Tuesday, showing continued institutional demand at lower price levels.

- Technical indicators show Solana trading below key moving averages at $116 and $148, with immediate support at $80 and resistance at $85.

Solana trades at $82 on Wednesday after losing more than 4% on Tuesday. The layer-1 blockchain faces pressure as it tries to maintain support above the $80 level.

Solana (SOL) Price

Solana (SOL) Price

The price dropped below $85 and now trades beneath the 100-hour simple moving average. A key bearish trend line has formed with resistance at $85 on the hourly chart.

Despite the price weakness, on-chain data shows mixed signals for Solana’s market structure. Stablecoin supply on the network increased roughly 14% over the past week.

The total stablecoin supply reached $15.34 billion according to DeFiLlama data. Traders appear to be swapping volatile tokens for stablecoins while keeping capital on the Solana blockchain.

Derivatives Data Shows Bearish Pressure

Futures market data reveals declining interest among traders. SOL futures Open Interest decreased 2.74% in the last 24 hours to $5.08 billion.

Long liquidations totaled $6.09 million during this period. Short liquidations came in at $2.01 million, showing a bearish bias among traders.

The funding rate stands at -0.0061%, confirming increased short-side interest. Traders are paying a premium to hold bearish positions on Solana.

Institutional Investors Continue Buying

US spot SOL ETFs recorded $8.43 million in inflows on Tuesday. This marks continued institutional demand despite the recent price decline.

Source; SoSoValue

Source; SoSoValue

Steady inflows at lower price levels could help Solana establish a bottom. Institutional buying may support a trend reversal if it continues.

The Relative Strength Index sits at 27 on the daily chart. This indicates oversold conditions and hints at a potential rebound.

The Moving Average Convergence Divergence shows contracting negative momentum. The bearish pressure appears to be fading based on this indicator.

Key Price Levels to Watch

Solana trades below the 50-day Exponential Moving Average at $116. The 200-day EMA sits at $148, both sloping lower and confirming bearish structure.

Immediate resistance appears at $85 where the bearish trend line sits. The next resistance levels are at $92 and $96.

A break above $96 could open the path toward $105 and $112. However, Solana must first clear the $85 resistance to gain upward momentum.

Support sits at $80 based on Fibonacci retracement levels. A break below this level could push the price toward $75.

Further downside could target $70 if the $75 support fails. The 61.8% Fibonacci extension level at $64 represents a deeper support zone.

Solana attempted recovery above $78 and $82 earlier this week. The price climbed above the 50% Fibonacci retracement level but failed to hold gains near $90.

The post Solana (SOL) Price: Institutions Buy as Token Tests $80 Support Level appeared first on CoinCentral.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

Unlocking Institutional OTC Trading For Tokenized Gold