Is Bitcoin’s Latest Bounce Real or Just a Temporary Rebound?

Bitcoin’s recent price surge has sparked debate over whether the market has finally found a bottom or is simply reacting to short-term exhaustion.

The critical issue is not how strong the bounce looks on price alone, but whether it reflects a real shift in underlying demand.

In Bitcoin markets, rebounds often occur during broader downtrends. These moves are typically driven by short-covering, position adjustments, and a brief easing of fear, rather than fresh spot buying. As a result, they can appear convincing while lacking the foundations needed for a sustained reversal.

What On-Chain Behavior Is Showing Right Now

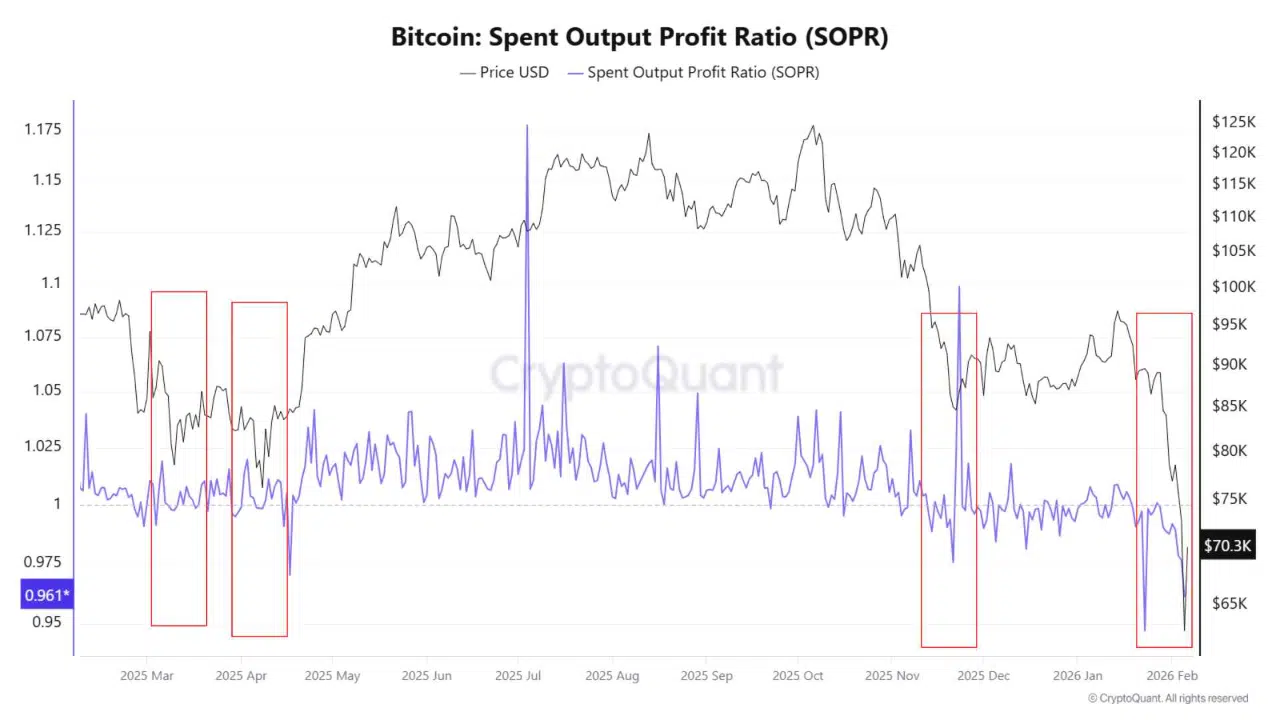

New report, shared by CryptoQuant focuses on the Spent Output Profit Ratio (SOPR), a metric that shows whether Bitcoin being moved on-chain is sold at a profit or at a loss.

Source: https://cryptoquant.com/insights/quicktake/69864ac

Source: https://cryptoquant.com/insights/quicktake/69864ac

According to the report when SOPR is below 1, it means market participants are selling at a loss. This behavior signals risk reduction and defensive positioning, not confidence. Historically, this condition has not marked final market bottoms. Instead, it has appeared repeatedly during early and mid bear-market phases.

Why This Matters for the Current Move

Current data fits that historical pattern. While Bitcoin’s price has rebounded, SOPR has not recovered and held above 1. This suggests that sellers are still accepting losses, and that the rally is not yet supported by strong, sustained spot demand.

In past cycles, true bottoms formed only after extended periods of SOPR weakness, multiple failed recoveries above 1, and widespread loss realization. Until those conditions were met, rebounds tended to fade rather than develop into new uptrends.

Structural Takeaway

Based strictly on the on-chain data shown in the chart, today’s Bitcoin rally looks more like a reflexive bounce than confirmation of a durable trend reversal. Price has reacted, but underlying behavior has not yet shifted. Without evidence that sellers have stopped exiting at a loss, caution remains warranted despite the strength of the short-term move.

The post Is Bitcoin’s Latest Bounce Real or Just a Temporary Rebound? appeared first on ETHNews.

You May Also Like

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release

Why Some Traders Say Bitcoin’s 21 Million Cap Is Being Diluted Off-Chain