Hit a Six and Earn Crypto: New Game Blends Cricket With Web3 Rewards

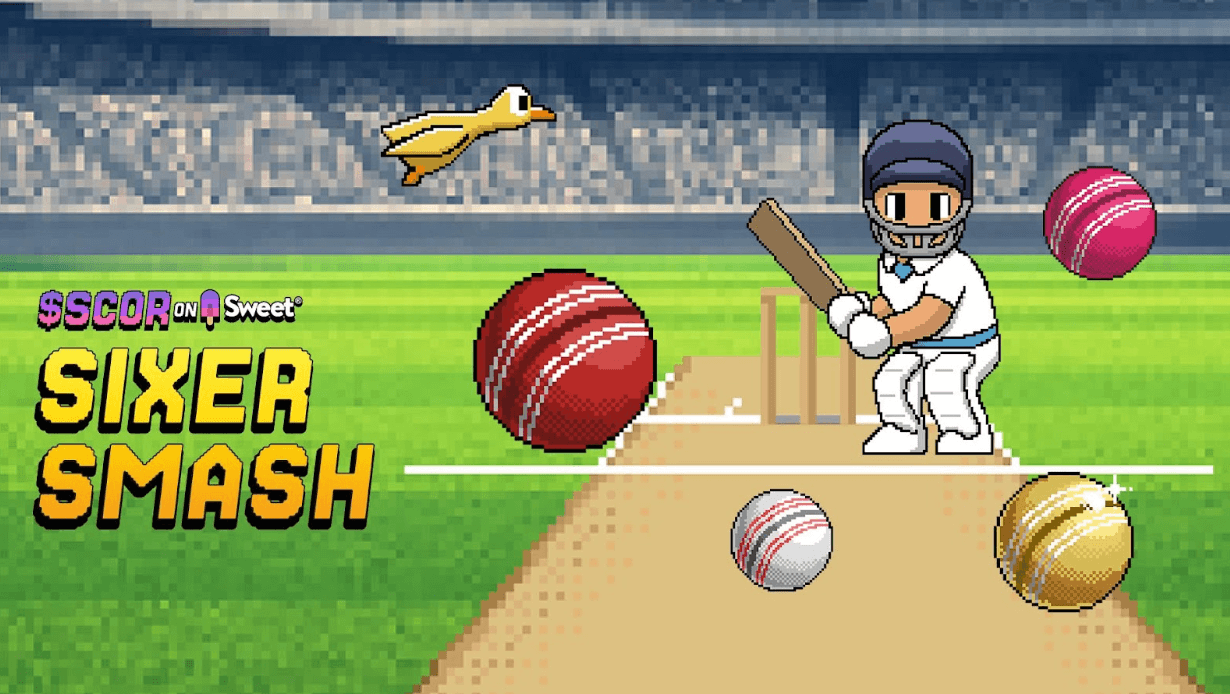

Scor on Sweet and Winners Alliance have partnered to launch a Web3 mini-game where users control avatar versions of famous cricket players to earn gems through gameplay.

In-Game Rewards

Scor on Sweet has partnered with Winners Alliance to launch a Web3 mini-game that allows players to step into the shoes of avatar versions of prominent cricket players and collect gems through skillful gameplay. Gems earned playing the game, known as Sixer Smash, can be converted into Scor, the platform’s native token. Using this token, players can redeem for exclusive sports-themed rewards, including signed cricket memorabilia.

According to a statement, Sixer Smash features an impressive roster of cricket legends, including Rashid Khan, Afghanistan’s leg-spin maestro, as well as Englishmen Jofra Archer and Ben Stokes. West Indies legend Chris Gayle and Andre Russell are also featured, as are Heinrich Klaasen, Pat Cummins, and Kieron Pollard.

To celebrate the debut, Scor on Sweet is hosting a competitive gameplay event. Top performers will earn whitelist access and guaranteed allocation for upcoming NFT Cricket Sticker Packs. These packs unlock exclusive access to professional player characters in the Scor Store and offer special in-game power-ups to boost performance in Sixer Smash.

Commenting on the game’s launch, Tom Mizzone, CEO of Sweet, said:

Manny Redruello, VP of Games at Winners Alliance, said the partnership demonstrates how far the global athlete-centric commercial solution is going to help athlete collectives reach fans worldwide “in new and meaningful ways.” Redruello added:

The game’s launch came nearly two months after the International Cricket Council (ICC) launched an Expression of Interest (EOI) process to identify potential partners to develop and publish a new, world-class mobile cricket game that reflects the global appeal and rich heritage of cricket. Gaming ventures were among the entities that were invited to express their interest in building a transformative cricket game.

At the time, ICC Chairman Jay Shah characterized the project as “a unique opportunity and step forward to reimagine how cricket is experienced and celebrated in the digital world.”

Meanwhile, Scor told Bitcoin.com News that in-app purchases of the game over the last 30 days have grown by a whopping 650%. It also reports that 15% of organic users return to play for five or more consecutive days, while 30% return to play at least two consecutive days.

You May Also Like

Cashing In On University Patents Means Giving Up On Our Innovation Future

VectorUSA Achieves Fortinet’s Engage Preferred Services Partner Designation