Crypto Crash: Should You Buy the Dip or Wait for More Downside?

The post Crypto Crash: Should You Buy the Dip or Wait for More Downside? appeared first on Coinpedia Fintech News

Crypto markets extended the downside move today, slipping deeper into a high-volatility sell-off that has shaken both spot and derivatives traders. Bitcoin price dropped nearly 8.6%, hovering near the $65,000 level, while Ethereum and major altcoins followed with sharp intraday losses. The intensity of the move points to more than routine profit-taking. With liquidations accelerating and sentiment collapsing into extreme fear, the ongoing crypto crash creates a dilemma among investors, one that forces traders and investors to confront a familiar question: Is this a buy-the-dip moment, or is patience still required?

Liquidations Data Reveals Market Still Under Stress

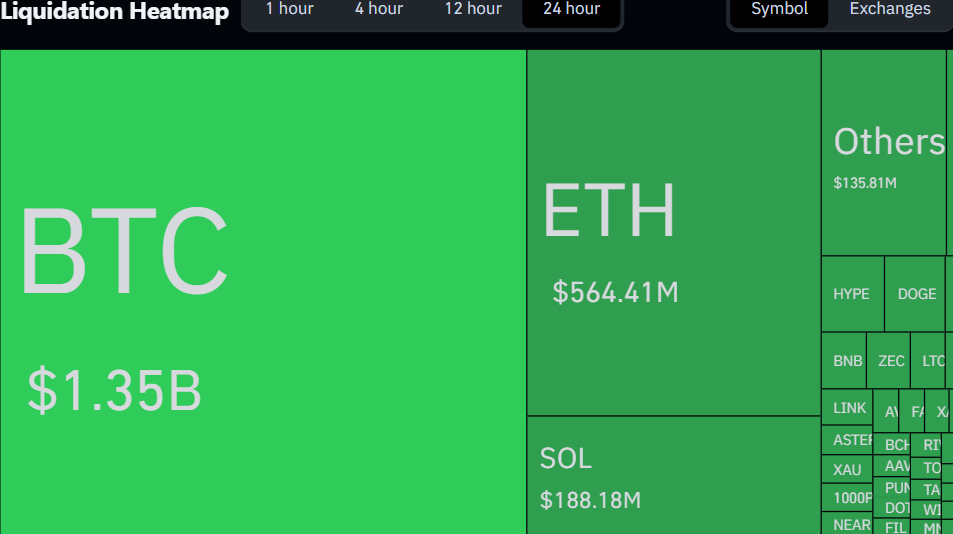

The key trigger of today’s crypto crash lies in derivatives data. More than $2.59 billion worth of crypto positions were liquidated in the last 24 hours, marking one of the most aggressive leverage flushes of the year.

Bitcoin and Ethereum accounted for the bulk of forced closures, while altcoins experienced cascading liquidations as price levels failed in quick succession. At the same time, total open interest fell 10.1% to $95.77 billion, confirming that leverage is being removed, not repositioned. Such conditions typically reflect instability rather than balance. Markets tend to struggle to form durable bottoms while liquidation velocity remains elevated.

Sentiment Hits Extreme Fear, But Capitulation Is Incomplete

The Crypto market Fear & Greed Index plunged to 10, placing sentiment deep into Extreme Fear, a zone that historically precedes medium-term recoveries. However, structural signals remain mixed. Bitcoin exchange balances increased by 13,800 BTC, suggesting that selling pressure has not fully exhausted itself. Coins are still moving toward exchanges rather than being locked away by long-term holders. In previous market cycles, sustainable bottoms emerged after extreme fear persisted alongside declining exchange inflows, a condition that has not yet fully materialized.

Bitcoin Price at $65K: A Decision Zone, Not a Confirmed Bottom

Bitcoin’s drop toward the $65,000 region is now colliding with a signal that long-term market participants rarely ignore. The monthly stochastic oscillator has slipped into extreme oversold territory, a condition that has appeared only three times over the past decade. Each prior occurrence aligned with major bear market bottoms and the start of prolonged accumulation phases. However, history also shows this signal is not a timing trigger. In previous cycles, Bitcoin did not immediately reverse higher. Instead, price often spent weeks sometimes months moving sideways or making marginal new lows as leverage flushed out and sentiment reset.

That dynamic matters today. While the long-term stochastic suggests downside may be structurally limited, short-term data still reflects stress. Open interest is falling, liquidations remain elevated, and exchange balances are rising, indicating that traders are still de-risking rather than rebuilding positions. In practical terms, this creates a split narrative. For long-horizon investors, conditions are beginning to resemble early accumulation zones. For short-term traders, volatility risk remains high until liquidation pressure eases and price stabilizes above key support. The signal argues that Bitcoin may be closer to a bottom than a top, but confirmation will require patience, not prediction.

Final Thoughts: Right Time to Buy or Wait?

The broader crypto market is showing classic stress signals, not clear bottoming behavior. Extreme fear readings, multi-billion-dollar liquidations, and declining open interest suggest forced deleveraging is still working its way through the system. While some assets are showing relative strength and selective accumulation, this looks more like rotation and positioning not a broad-based recovery.

Historically, durable market bottoms form after volatility compresses and sellers exhaust, not during peak liquidation phases. Right now, liquidity is thin and confidence remains fragile, leaving room for further downside or prolonged consolidation. This is not a clear “buy the dip” moment for the overall market. Caution and patience are still the better strategy, with selective accumulation only where strong fundamentals and on-chain support clearly justify it.

You May Also Like

XAU/USD picks up, nears $4,900 in risk-off markets

Sonic Holders Accumulate Millions as Price Tests Key Levels