The Rise of DATs: From Bitcoin Holding to Yield Management

By Sankalp Shangari

Compiled by Shaw Golden Finance

summary

Digital Asset Treasury (DAT) is a financial institution for "enthusiasts" on the chain, so what are these companies becoming?

- Not just treasury reserves, but also a programmable capital structure;

- It’s not just a balance sheet, it’s a liquidity engine;

- Not only a holder of cryptocurrency, but also a builder of the crypto-native financial ecosystem.

The corporate treasury department of the 2020s will look less like the traditional CFO’s office and more like a real-time, blockchain-powered hedge fund equipped with APIs, vaults, and validators.

They will process cross-border payments through stablecoins. They will invest capital in the ecosystems they help govern. They will issue tokens, establish special purpose vehicles (SPVs), and conduct macro hedging—all on-chain.

Yesterday’s DAT held Bitcoin. Today’s DAT spins the flywheel. Tomorrow’s DAT will operate the programmable capital machine.

They’ll issue equity to buy ETH. They’ll use nine-figure balance sheets to farm yield. They’ll stake governance tokens to shape the ecosystem, and do so while reporting quarterly to Wall Street. They’ll blur the lines between treasuries, venture capital funds, and protocol operators until all that’s left is self-printing the yield curve.

Welcome to a new era of capital formation fueled by cryptocurrency, represented by equity, and governed by a combination of spreadsheets and smart contracts.

In this summer of corporate showmanship, spreadsheets are gathering dust, balance sheets are getting a digital makeover, and the spectacle of public companies around the world jettisoning prosaic capital plans for bold cryptocurrency bets is almost operatic.

Forget R&D sprees or flashy product launches. This season's big story isn't new gadgets or services—it's fundraising, depositing proceeds directly into cryptocurrency wallets, and letting the market play out. From French chipmakers to Texas e-bike startups, the list of participants is diverse. Here's your front-row ticket to the corporate crypto craze.

Phase I - The Age of Accumulation

“A fallen cowboy once roamed the DeFi wilderness; now, Wall Street suits have entered the same space.”

what happened:

- Since June, nearly 100 public companies have launched token purchases, raising more than $43 billion, double the total amount raised in all U.S. initial public offerings (IPOs) through 2025.

- MicroStrategy tops the list with 607,770 bitcoins (about $43 billion) on paper; Trump Media has invested $2 billion in Bitcoin and its derivatives.

- Special purpose acquisition companies (SPACs) have evolved into "cryptocurrency vaults" (such as ReserveOne and Bitcoin Standard), providing retail investors with cutting-edge investment opportunities.

Why it matters:

- This is not just money management, it is also performance art performed using stock codes.

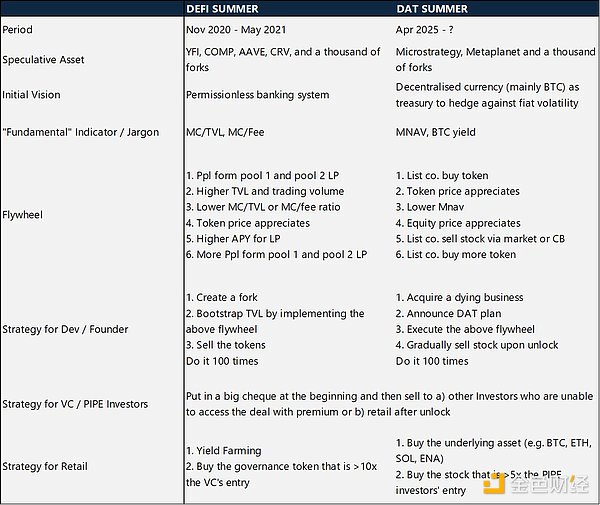

- What started as fringe experiments (think 2021’s “Summer of DeFi”) has now become mainstream finance in a tuxedo.

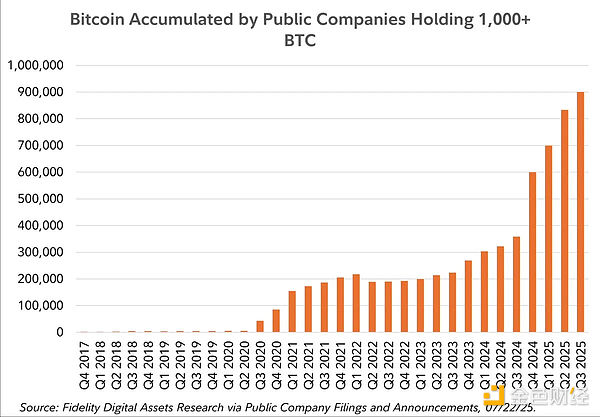

This chart vividly illustrates the institutionalization shift underway in the Bitcoin market, the core thesis of DAT Summer. Currently, over 11.17% of Bitcoin's market capitalization is held by institutions, with exchange-traded funds (ETFs) holding 6.52% and corporate treasuries holding 4.64%. What began as sporadic accumulation by a few bold corporates in the first phase has evolved into a full-blown flywheel, particularly after 2023, with a surge in ETF inflows and a rise in Bitcoin prices. This shift reflects the second phase of "activation," where structured capital raised by Wall Street through ETFs and financings is driving liquidity, momentum, and narrative. The substantial growth in ETF and corporate treasury holdings is more than just financial activity; it signals the institutionalization of Bitcoin as a balance sheet asset and capital markets tool. In short, this chart is the clearest evidence yet: Bitcoin has become a corporate asset class.

Phase 2 - Capturing Engineering Benefits from Dormant Reserves

“Buying Bitcoin is stage one. The real fun begins when you make it work.” — Steve Kurz, Galaxy Digital

Revenue Generation Strategies:

- Staking and DeFi Liquidity: Companies are staking ETH and other tokens into DeFi protocols.

- Structured products and options: Capital markets professionals are layering options overlays and basis trades on cryptocurrency holdings.

- Governance Playbook: Voting in a Decentralized Autonomous Organization (DAO) and staking governance tokens to influence the protocol roadmap.

- On-chain ecosystem: Create products that integrate enterprise fund management into practical application scenarios.

New flywheel:

- Public companies purchase tokens.

- Token prices rise.

- As the net asset value increased, the stock price soared.

- Issuance of new shares or convertible bonds.

- The proceeds are redistributed into more tokens.

- Repeat this process over and over again.

Why it's different:

- This is a marriage of traditional capital markets and crypto innovation, fully regulated and highly liquid.

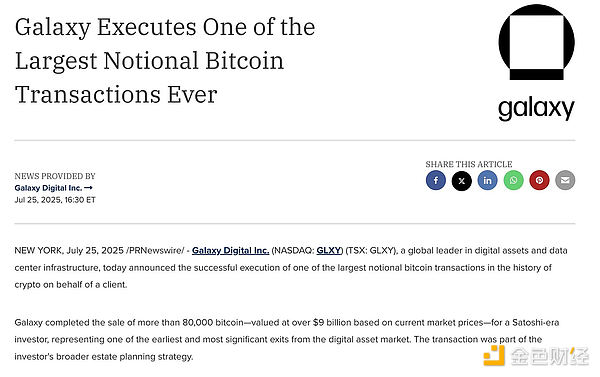

- Companies like Galaxy Digital have helped raise $4 billion for cryptocurrency acquisitions, including custody, risk management, and yield infrastructure.

Publicly listed companies currently hold nearly 900,000 Bitcoins, a 35% increase in just one quarter.

A sense of déjà vu of doubt, disbelief, and subversion

Some of the smartest people in the room were rolling their eyes:

- “This is a bubble.”

- “There’s no real demand for Ethereum (ETH) — why choose SBET?”

- “If the flywheel stops turning, these crypto vault companies are finished.”

But remember: prices change perceptions, and time will tell.

The same thing happens with DeFi tokens, NFTs, and even Bitcoin itself. If irrational enthusiasm creates real infrastructure, it won’t die—it will continue to grow.

Phase 3 - High-Quality Traps and High-Quality Rewards

“Not everyone gets the same premium. Act early and don’t be duplicated.” — Galaxy Digital

Quality phenomenon:

- Companies with large crypto reserve assets trade at an average premium of 73% to their on-chain assets.

- But the risk of saturation cuts into profits—if you’re the tenth person to enter the market, the market will just sit there and do nothing.

Regulatory and market changes:

The GENIUS & CLARITY Act: Stimulates stablecoin competition; impacts Circle’s valuation ahead of its Q2 earnings report on August 12.

Ethereum as a corporate strategy: SharpLink Gaming’s 360,807 ETH reserves, up 110% this month, signal a new on-chain treasury model.

While Circle declines, Galaxy rises

Analysts call it an "integrated provider" for institutions, surpassing single-service firms like FalconX and NYDIG.

The GENIUS Act and the CLARITY Act provide support for Galaxy's stablecoin custody, issuance, and artificial intelligence data center businesses.

Currently, more than two-thirds of Galaxy’s value comes from its infrastructure, such as the Helios facility (formerly Argo Blockchain), which currently hosts CoreWeave’s artificial intelligence and high-performance computing business.

DAT meets computing, a vertically integrated architecture.

A key driver behind this corporate cryptocurrency flywheel is the concept of mNAV, or market-based net asset value, which measures the real-time value of a company's cryptocurrency holdings relative to its stock market capitalization. When a publicly traded company accumulates a significant amount of cryptocurrency assets and that asset's price rises, its mNAV increases significantly. The difference between the actual token value and the stock value becomes a tradable narrative. The market begins to price the token not only in terms of operations but also in terms of potential future token appreciation, often at a premium. This causes stock valuations to surge, enabling companies to issue more shares or convertible bonds on favorable terms, which they can then reinvest into purchasing more cryptocurrency. It's a self-reinforcing cycle: cryptocurrency reserves → higher mNAV → higher stock price → more funds → larger reserves. In this cycle, mNAV is not only a valuation tool but also the fuel that fuels the next phase of growth.

Survival Manual:

- Be strategic: Don’t just buy tokens – tailor financial products.

- Stay flexible: Adjust incentives as regulations and earnings seasons change.

- Building infrastructure: moving beyond hoarding; launching APIs, vaults, and validators.

DAT summer or corporate casino?

What started as a trickle—a few adventurous companies testing the crypto waters—has now become a surging tide, awash in filings, financial disclosures, and cash flows. Welcome to "DAT Summer," where publicly traded companies aren't just hoarding digital gold; they're weaponizing it.

Yesterday's DAT held Bitcoin.

Today's DAT runs a self-reinforcing flywheel.

Tomorrow’s DATs will be programmable capital machines: issuing shares to purchase ETH, farming yield through nine-figure balance sheets, and shaping the ecosystem through governance.

We've entered an era where the question is no longer whether businesses will hold cryptocurrencies, but how much, where they'll be involved, and what new tricks they'll come up with next. Whether this evolves into a new financial architecture or just the fanciest game of corporate roulette ever remains to be seen. But one thing is certain: the casino doors are open, and the chips are digital.

This is either a brand new financial architecture built on digital gold, or the fanciest game of corporate roulette ever. Regardless, this summer on Wall Street has been less about strategy meetings and more about a casino filled with laser eyes and FOMO.

Welcome to DAT Summer, a time when public companies aren’t just buying digital assets, they’re weaponizing them.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End