Bitcoin Price Under Stress: Capitulation Or Just The First Leg Down?

Market participants are facing a sharp volatility spike as the Bitcoin price reacts to aggressive deleveraging across the crypto space.

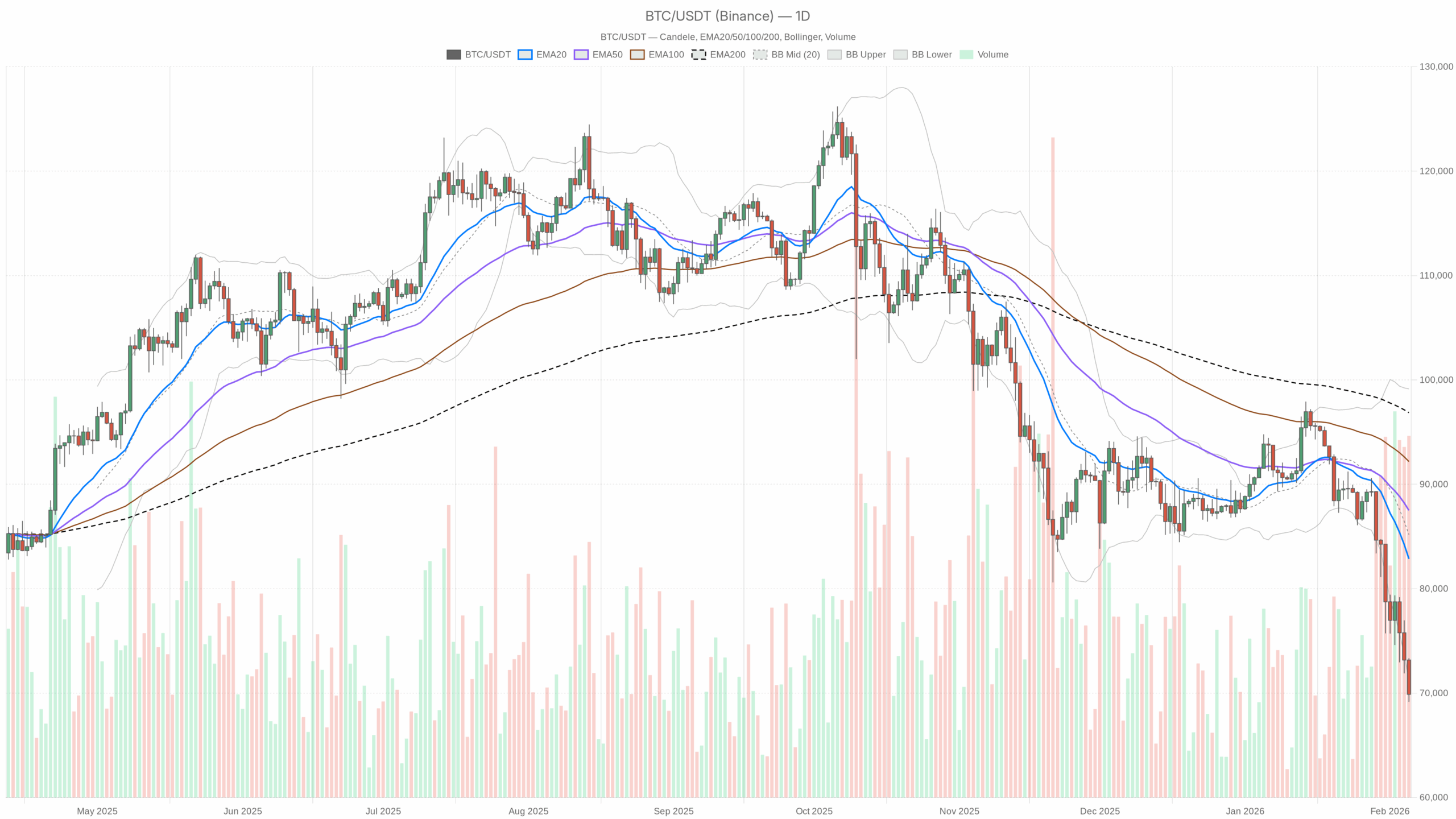

BTC/USDT daily chart with EMA20, EMA50 and volume”

BTC/USDT daily chart with EMA20, EMA50 and volume”

loading=”lazy” />BTC/USDT — daily chart with candlesticks, EMA20/EMA50 and volume.

Daily Structure: Clear Downtrend, Early Signs of Capitulation

Trend & EMAs (D1)

– Price: $69,882.91

– EMA 20: $82,859.92

– EMA 50: $87,498.27

– EMA 200: $96,861.46

Bitcoin is trading far below all key EMAs. The 20-day is more than $13k above spot, the 50-day almost $18k above, and the 200-day over $25k higher. That is not just a pullback; it is a full-blown bearish macro regime where momentum has broken and trend followers are exiting or shorting rallies. The distance from the 20-day EMA also means the market is stretched to the downside; sharp snapback rallies are entirely possible, but they would be corrections within a broader downtrend until at least the 20-day starts flattening and price reclaims it.

Main scenario from D1: Bearish. The higher-timeframe trend is down. Any bullish stance here is tactical and counter-trend, not a confirmed reversal.

RSI (D1)

– RSI 14: 20.03

Daily RSI around 20 is deeply oversold, in classic capitulation territory. This level of compression typically does not last long; it often marks either the tail end of a drop or the start of a volatile consolidation where bounces are violent but not necessarily durable. In plain terms, the market is heavily one-sided short or hedged, so it is vulnerable to a face-ripping squeeze, but from a structurally weak base.

MACD (D1)

– MACD line: -4,589.18

– Signal line: -2,780.01

– Histogram: -1,809.17

The MACD is deeply negative with the line well below the signal and a large negative histogram. Momentum remains decisively bearish; sellers are still in control on the daily chart. There is no visible sign yet of a momentum crossover or flattening, so while price is oversold, the underlying impulse of the move is still down.

Bollinger Bands (D1)

– Mid-band (20 SMA): $85,173.23

– Upper band: $99,138.17

– Lower band: $71,208.28

– Price: $69,882.91 (below lower band)

Bitcoin is trading below the lower daily Bollinger Band. That is classic overshoot behavior: price has broken out of the recent volatility envelope to the downside. Two implications:

1) The current move is statistically extreme relative to the last 20 days.

2) Mean reversion odds increase, not necessarily a full trend reversal, but at least a move back toward the band or the mid-line over time.

In practice, this setup often leads to one of two things: a fast bounce back inside the bands, or a “walking the band” phase where price grinds lower hugging the lower band. Given how far below the EMAs the market is, a short, sharp relief rally would not be surprising, but it would still be swimming against a strong current.

ATR & Volatility (D1)

– ATR 14: $3,938.39

An ATR near $4,000 on the daily means volatility is elevated. Day-to-day ranges of $4k or more are normal in this environment, which amplifies both downside air pockets and upside squeezes. Position sizing and leverage tolerance need to reflect this; a “normal” stop can easily be run in a single 4-hour candle.

Daily Pivot Levels (D1)

– Pivot point (PP): $70,795.70

– Resistance 1 (R1): $72,428.39

– Support 1 (S1): $68,250.21

Price is currently just below the daily pivot and hovering closer to S1. That sets up a very simple local battle: as long as BTC stays below $70.8k, intraday traders will treat bounces as opportunities to sell into. Moreover, a sustained reclaim of the pivot and a push toward $72k (R1) would be the first sign that selling pressure is relaxing. Conversely, a clean break below $68.2k opens the door to another leg down, with no strong daily support from this model until the market gets well into the mid-60s.

Hourly Context: Bearish, But Selling Pressure Is Easing

Trend & EMAs (H1)

– Price: $69,816.59

– EMA 20: $71,469.19

– EMA 50: $73,558.05

– EMA 200: $79,013.92

On the 1H chart, Bitcoin is below the 20, 50, and 200 EMA, so the intraday trend is in line with the daily: bearish. The gap to the 20 EMA (~$1.6k) is sizeable but not outrageous in this volatility regime, and it tells you short-term traders are still selling rallies rather than buying dips.

RSI (H1)

– RSI 14: 30.16

Hourly RSI sitting near 30 is weak but not yet fully washed out. The last leg of selling has eased; the market is no longer at sub-20 panic levels on this timeframe. That supports the idea that downside momentum is cooling short term, potentially setting up either a consolidation range or a corrective bounce back toward the 20 EMA around $71k and above.

MACD (H1)

– MACD line: -1,258.54

– Signal line: -1,222.34

– Histogram: -36.20

The MACD remains negative on the hour, but the histogram is only slightly below zero. Bearish momentum is still there but has largely flattened. Sellers are no longer accelerating; the trend is down, but the push lower is less aggressive than it was. If this histogram flips positive over the next few candles, that would confirm a short-term relief structure against the prevailing daily downtrend.

Bollinger Bands (H1)

– Mid-band: $71,504.77

– Upper band: $74,033.75

– Lower band: $68,975.80

– Price: $69,816.59

On the hourly, price has re-entered the bands and is sitting slightly above the lower band. That is a classic “stabilizing after a flush” posture: the market is no longer in full breakdown mode but has not reclaimed the middle of the range either. It supports the idea of a fragile base forming between roughly $69k and $72k where short-term bulls and bears can both play, but where the higher-timeframe bears still own the narrative.

ATR & Pivot (H1)

– ATR 14: $967.49

– Pivot point (PP): $69,939.38

– R1: $70,189.83

– S1: $69,566.14

The hourly ATR just under $1,000 lines up with the daily volatility picture: swings of $1k per hour are entirely normal here. Intraday, BTC is basically clinging to the hourly pivot area ($69.9k) with S1 just a few hundred dollars below. This marks a short-term decision zone: sustained trading above $70k tips the scale toward a bounce into $71–72k; repeated rejections here likely see another push toward and below $69.5k.

15-Minute Execution Layer: Micro Bearish, But Compressing

Trend & EMAs (M15)

– Price: $69,816.59

– EMA 20: $70,167.27

– EMA 50: $70,996.54

– EMA 200: $73,742.70

On the 15-minute chart, BTC is below the 20, 50, and 200 EMAs, so the microstructure is still bearish. However, the distance to the 20 EMA is now only a few hundred dollars. That is a sign of price compression, usually a prelude to a short-lived breakout move in either direction. Given the broader context, the default expectation is one of two things: a quick squeeze into $70.5–71k that sellers fade, or a minor breakdown toward $69k that either extends or gets bought for a scalp reversal.

RSI & MACD (M15)

– RSI 14: 41.41

– MACD line: -482.91

– Signal line: -445.72

– Histogram: -37.19

RSI on the 15-minute is around 41: weak, but not oversold. The short-term MACD remains negative with a small bearish histogram. This configuration usually appears in sideways-to-down consolidations, where bounces are shallow and sellers are patiently leaning in overhead. There is no clear intraday reversal signal on this timeframe yet.

Bollinger Bands & Pivot (M15)

– Mid-band: $70,402.36

– Upper band: $72,141.84

– Lower band: $68,662.89

– Price: $69,816.59

– Pivot point (PP): $69,939.38

– R1: $70,189.83

– S1: $69,566.14

On the 15-minute, price is inside the bands and sitting between the lower band and the mid-band. Combined with the nearby pivot cluster around $69.9–70.2k, this looks like a short-term equilibrium zone where liquidity is building. That is typically where larger players decide the next impulse: absorb remaining sell pressure and squeeze higher, or reload shorts and push for fresh lows.

Sentiment & Market Context

The broader crypto market has shed over 5% of its total market cap in a day, while volume is up more than 23%. That is classic high-volume liquidation behavior rather than a gentle rotation. BTC dominance near 57% reinforces that Bitcoin is leading the move; altcoins are passengers, not drivers.

The Extreme Fear reading on the fear and greed index (value: 12) tells you positioning has flipped from euphoria to panic. Historically, those readings are associated with attractive longer-term entries but are uncomfortable to live through, because they often coincide with headlines like “crisis of faith” and “freefall” – exactly what the news flow is saying now. It does not guarantee the low is in, but it does suggest most late buyers have either been shaken out or are seriously questioning their thesis.

Bullish Scenario for Bitcoin Price

For the bullish camp, the core idea is mean reversion after capitulation. The current Bitcoin price structure is stretched, but that alone does not confirm a durable bottom.

1. Hold and build above $68k (daily S1): As long as BTC defends the $68,000 region on daily closes, the market can argue the worst of the liquidation is done. A series of higher lows on intraday charts above this zone would reinforce that view.

2. Reclaim the $70.8k pivot and $72k area: On the daily, getting back above the pivot ($70,795) and then holding above $72k (R1 and recent breakdown area) would signal that sellers are running out of ammunition. Hourly RSI would likely drift back toward neutral, and the MACD histogram might flip positive on that push.

3. Drive back inside or toward the daily lower Bollinger Band: A daily close back inside the lower band (above roughly $71.2k) would mark the end of the Bollinger overshoot and confirm a short-term reversal attempt.

4. Target zone: In that case, a reasonable upside magnet would be the $75k–78k region, near the underside of short-term resistance zones and closer to the 20-day EMA, where the bigger-picture sellers are waiting.

What invalidates the bullish scenario?

A clean daily close below $68k with expanding volume and a still-negative MACD histogram would tell you the market is not done flushing. That would suggest the bounce was a bull trap and that the path of least resistance remains down toward the mid-60s or lower.

Bearish Scenario for Bitcoin Price

The bearish camp has the structural argument right now: trend is down, momentum is down, and rallies are for selling.

1. Fail to reclaim $72k–73k: As long as BTC remains pinned below the daily pivot zone and especially below $72k–73k, every push higher is just relief within a broader downtrend. Hourly and 15-minute EMAs overhead create a ceiling where short sellers can lean in.

2. Break $68k and “walk” the lower Bollinger Band down: A decisive move through $68k followed by price hugging the lower daily band would indicate ongoing distribution rather than capitulation. With RSI already at 20, this would be a “grind lower in pain” scenario rather than a waterfall, but it can still bleed out several thousand dollars.

3. Momentum stays negative: If the daily MACD line keeps diving away from the signal and the histogram remains strongly negative, you are looking at a persistent bearish impulse. Short-term bounces that fail to flip hourly MACD positive would be treated as reload points.

4. Target zone: Below $68k, the next logical zone is the mid-60ks, where prior consolidation took place. In more stressed conditions, a spike toward the low-60k area cannot be ruled out given current volatility.

What invalidates the bearish scenario?

The bear case weakens if BTC can reclaim and hold above the 20-day EMA (currently around $82.9k) on a closing basis, with daily RSI pushing back into the 40s and MACD flattening or crossing up. That would turn the recent move into a deep but successful retest rather than the start of a larger downtrend. More tactically, a series of higher highs and higher lows on the daily chart, closing back above $75k–78k, would already be a warning that the straightforward sell-the-rip playbook is failing.

How to Think About Positioning Here

The big picture is simple but uncomfortable: the daily trend is bearish, but the market is deeply oversold and highly emotional. That mix is where both sides regularly get punished, shorts by violent squeezes and dip-buyers by continuation selloffs.

Key points to keep in mind:

- Trend vs. mean reversion: The dominant structure (EMAs and MACD) says trend-followers still have the upper hand. Mean reversion signals (RSI, Bollinger overshoot, fear and greed) argue a counter-trend bounce is increasingly likely. Any bullish positioning here is inherently fighting the higher timeframe trend and should respect that risk.

- Timeframe alignment: All three timeframes, daily, hourly, and 15-minute, are technically bearish, but the shorter ones show slowing downside momentum. That supports short-term tactical trades in both directions, but it does not yet justify a confident long-term bullish stance.

- Volatility and risk: With daily ATR near $4k and hourly around $1k, position sizing and leverage are critical. Levels like $68k and $72k may be “near” in percentage terms, but they can be breached and reclaimed multiple times in a day. Planning around that noise is more important than trying to guess the exact bottom.

In summary, the Bitcoin price sits in a bearish regime with oversold conditions. The next few sessions will decide whether this was an exhaustive capitulation that sets up a larger bounce, or just the first meaningful leg of a deeper correction. Either way, this is an environment where discipline and volatility awareness matter more than conviction.

You May Also Like

Wormhole launches reserve tying protocol revenue to token

Kalshi debuts ecosystem hub with Solana and Base