Daily Market Update: Stock Futures Drop as Bitcoin Shows Bear Market Signals

TLDR

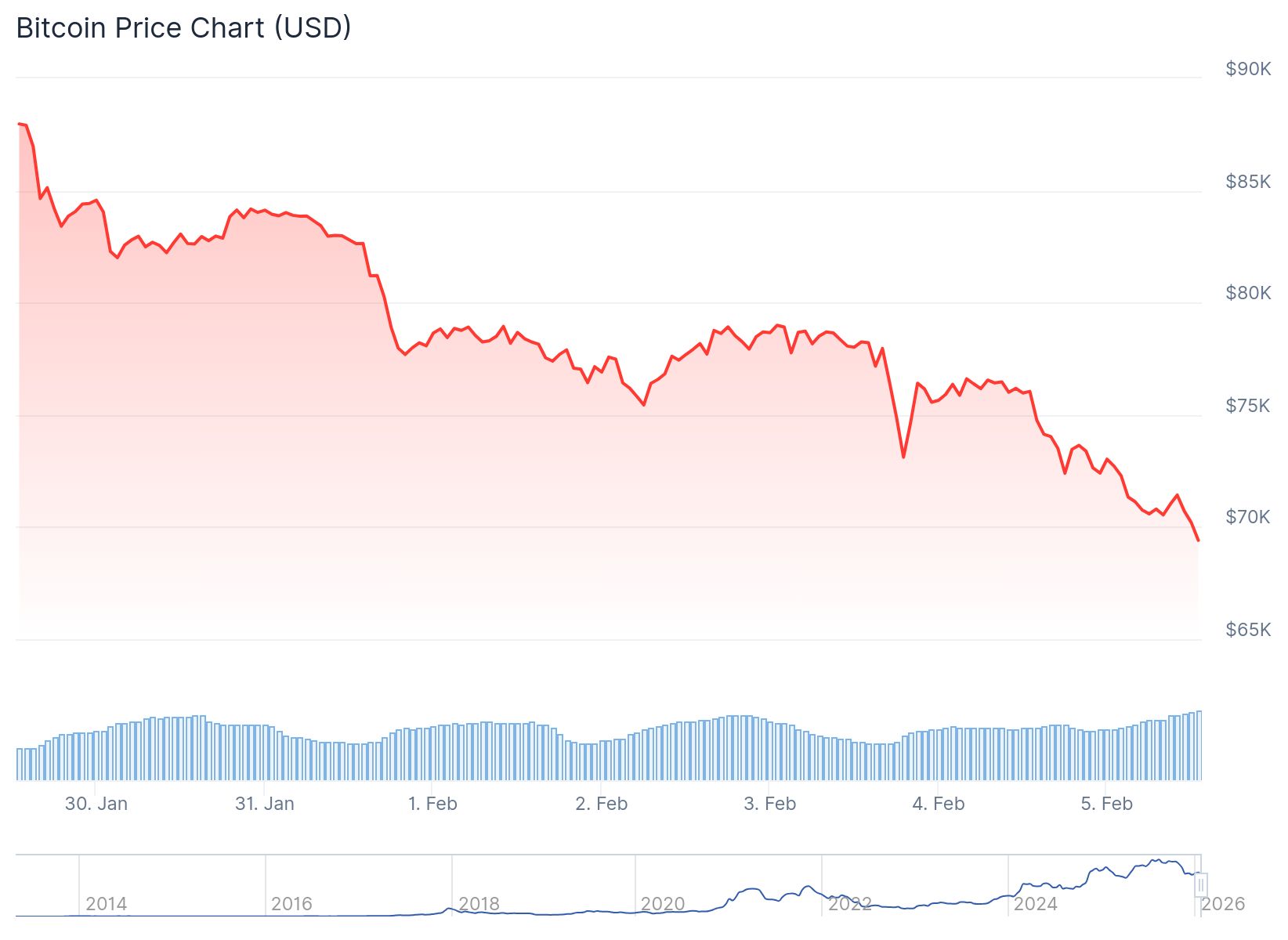

- Bitcoin fell to the mid-$70,000 range as CryptoQuant’s Bull Score Index hit zero and on-chain data revealed weakening market structure

- U.S. spot bitcoin ETFs reversed course from accumulation to net selling, removing tens of thousands of bitcoin from demand flows

- Stablecoin market cap declined for the first time since 2023 as USDT growth turned negative, signaling reduced liquidity

- S&P 500 futures climbed 0.2% and Nasdaq 100 futures gained 0.4% Thursday morning ahead of Amazon quarterly results

- Federal Reserve rate cut expectations remain low for April meeting as prediction markets show traders anticipating no policy changes

Bitcoin slipped toward $70,000 on Thursday as multiple on-chain indicators pointed to deteriorating market conditions. CryptoQuant’s Bull Score Index dropped to zero while prices remained well below October peaks.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The analytics platform characterized the weakness as structural in its latest report. Glassnode data confirmed the assessment with declining spot volumes across major exchanges.

Trading activity showed a lack of buyer participation rather than active selling pressure. The pattern suggested fading interest instead of panic-driven liquidations.

U.S. spot bitcoin exchange-traded funds changed from net accumulation to net distribution over the past year. The reversal created a demand shortfall measured in tens of thousands of bitcoin.

The Coinbase premium stayed negative since October. This pricing gap between U.S. and international exchanges typically reflects American investor sentiment.

Historical bitcoin rallies featured strong U.S. spot buying that drove price appreciation. Current market conditions lack that foundational demand despite lower entry points.

Stablecoin Market Cap Contracts

Stablecoin market capitalization growth turned negative for the first time in two years. USDT supply declined after sustained expansion that previously supported trading volumes.

Demand metrics fell from 2025 highs across longer timeframes. The data indicated reduced overall participation beyond standard leverage washouts.

Bitcoin traded below its 365-day moving average based on technical analysis. Valuation models positioned key support zones between $70,000 and $60,000.

Prediction markets assigned low probability to Federal Reserve rate cuts in April. Traders placed only modest odds on potential June policy adjustments.

President Trump discussed Fed chair nominee Kevin Warsh in a recent NBC News interview. He indicated candidates favoring rate increases would not receive consideration for the position.

Treasury Secretary Scott Bessent stated the government has no plans to intervene in bitcoin markets. His comments came as the cryptocurrency traded near $71,000.

Stock Index Futures Show Gains

Stock futures posted mixed results Thursday morning with technology benchmarks leading gains. S&P 500 futures advanced 0.2% while Nasdaq 100 futures climbed 0.4%.

E-Mini S&P 500 Mar 26 (ES=F)

E-Mini S&P 500 Mar 26 (ES=F)

Dow Jones Industrial Average futures traded slightly negative. The blue-chip index holds fewer technology names compared to growth-focused benchmarks.

Alphabet released quarterly earnings Wednesday evening announcing expanded AI infrastructure spending plans. The company projected potential capital expenditures reaching $185 billion in 2026.

Alphabet shares declined 1% in premarket trading despite beating earnings estimates. Market focus shifted to elevated spending requirements for AI development.

Semiconductor stocks displayed mixed premarket performance. Nvidia and Broadcom shares rose on data center demand optimism tied to AI growth.

Qualcomm shares fell after providing weaker guidance than analyst forecasts. Management cited global memory chip shortages affecting production schedules.

Amazon was scheduled to report quarterly results Thursday after market close. Weekly jobless claims data was also expected during morning trading hours.

Software sector stocks dropped Wednesday on news of Anthropic releasing new AI capabilities. Concerns emerged about competitive threats to established business software providers.

Ether hovered above $2,000 struggling to gain traction. The second-largest cryptocurrency mirrored bitcoin’s weakness as risk appetite remained subdued.

Gold rebounded toward $5,000-$5,100 on safe-haven flows. Prices climbed following geopolitical tensions and economic data that altered Fed policy expectations.

The post Daily Market Update: Stock Futures Drop as Bitcoin Shows Bear Market Signals appeared first on Blockonomi.

You May Also Like

Top Solana Treasury Firm Forward Industries Unveils $4 Billion Capital Raise To Buy More SOL ⋆ ZyCrypto

Market Records Largest Long-Term Bitcoin Supply Release In History, Here’s What It Means For BTC